The tax rates haven't changed since 2018. (Check out the 2023 Part D IRMAA amounts here.). Podeli na Fejsbuku. What Is the Medicare IRMAA for 2023? Some people wonder whether they can switch from Original Medicare to a Medicare Advantage plan to avoid IRMAA. premiums and cost sharing information for 2023 Medicare Advantage and Part D plans, the Fee-for-Service Medicare premiums and cost sharing information released today will enable people with Medicare to understand their Medicare coverage options for the year ahead. Techno-Metal soundtrack and roars with a destructive dose of nuclear artillery rest of the music of Jak Combat. While distributions from an IRA are normally taxable as ordinary income, QCDs are not taxable.  Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. For most people, divorce, death of a spouse, or work reduction or stoppage could impact their Medicare premium. It is derived from your adjusted gross income (AGI) after certain allowable deductions and tax penalties. You may be able to reduce your cost with a Medicare Advantage plan, but they may come with restrictions, less accessible medical care, and potentially higher costs down the road. This was defensible because at the time the Biogen drug was initially priced at $56,000 a year. Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. The following 2022 and 2023 Medicare tables were obtained from the Center for Medicare and Medicaid Services (CMS). While IRMAA brackets went up in 2023 compared to 2022, the Medicare Part B and Part D premium went down in 2023 because spending on a certain expensive drug was less than anticipated. Its important to pay special attention to your income each year because even $1 in additional income can put you into another IRMAA bracket in two years. Your MAGI can be found on your tax form. D ocumentation received after May 3 1, 2023, may not be accepted. The reason IRMAA can surprise people is that your IRMAA Medicare premium is based on your MAGI from two years ago. Advantage Reduction (MARD)). As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. The following income levels (based on 2021 tax returns) trigger the associated IRMAA surcharges in 2023: You can appeal the IRMAA determination filing for a redetermination if you believe that your calculation is erroneous.

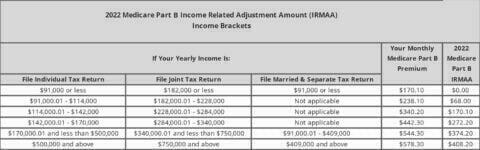

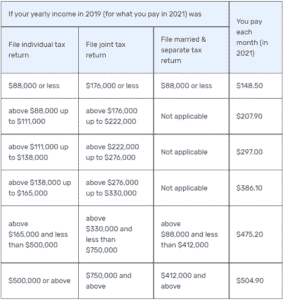

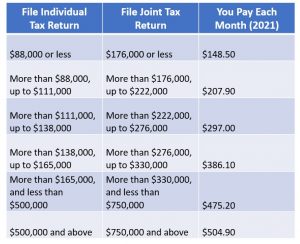

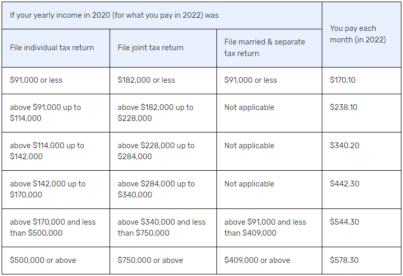

Those capital gain distributions can increase your MAGI and cause higher Medicare premiums. For most people, divorce, death of a spouse, or work reduction or stoppage could impact their Medicare premium. It is derived from your adjusted gross income (AGI) after certain allowable deductions and tax penalties. You may be able to reduce your cost with a Medicare Advantage plan, but they may come with restrictions, less accessible medical care, and potentially higher costs down the road. This was defensible because at the time the Biogen drug was initially priced at $56,000 a year. Beginning in 2023, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. The following 2022 and 2023 Medicare tables were obtained from the Center for Medicare and Medicaid Services (CMS). While IRMAA brackets went up in 2023 compared to 2022, the Medicare Part B and Part D premium went down in 2023 because spending on a certain expensive drug was less than anticipated. Its important to pay special attention to your income each year because even $1 in additional income can put you into another IRMAA bracket in two years. Your MAGI can be found on your tax form. D ocumentation received after May 3 1, 2023, may not be accepted. The reason IRMAA can surprise people is that your IRMAA Medicare premium is based on your MAGI from two years ago. Advantage Reduction (MARD)). As you can see, the Roth conversion is still worthwhile because the effective tax rate hasnt changed much (17.2% vs. 16.2%) even though on a monthly cash flow basis, the increase in Medicare premium (or drop in Social Security benefits as you may see), feels significant. The following income levels (based on 2021 tax returns) trigger the associated IRMAA surcharges in 2023: You can appeal the IRMAA determination filing for a redetermination if you believe that your calculation is erroneous.  Medicare Premiums and Deductibles to Fall in 2023, Medicare Part B Premiums Will Drop in 2023, Greater than $91,000 and less than or equal to $114,000, Greater than $182,000 and less than or equal to $228,000, Greater than $114,000 and less than or equal to $142,000, Greater than $228,000 and less than or equal to $284,000, Greater than $142,000 and less than or equal to $170,000, Greater than $284,000 and less than or equal to $340,000, Greater than $170,000 and less than $500,000, Greater than $340,000 and less than $750,000, Greater than $97,000 and less than or equal to $123,000, Greater than $194,000 and less than or equal to $246,000, Greater than $123,000 and less than or equal to $153,000, Greater than $246,000 and less than or equal to $306,000, Greater than $153,000 and less than or equal to $183,000, Greater than $306,000 and less than or equal to $366,000, Greater than $183,000 and less than $500,000, Greater than $366,000 and less than $750,000. The last strategy to reduce the IRMAA surcharge is to have a life-changing event and successfully appeal the higher Medicare surcharge. After crossing the threshold, there are five tiers or levels of additional amounts that are paid on top of the Part B premium. For married individuals filing joint returns and surviving spouses: If taxable income is under $22,000; the tax is 10% of taxable income. What is the income-related monthly adjusted amount (IRMAA)? For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. To request a new initial determination, meaning you ask Social Security to reduce or eliminate the adjustments, you must experience a life-changing event, generally within the last year. In other words, you don't pay anything to the insurance company each month for your coverage. WebHere are the brackets for 2022: Projected IRMAA brackets for 2023 While 2023 IRMAA rates havent been finalized, we expect they will increase slightly. Q: What does Original Medicare cost the beneficiary? Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. WebThe income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Capital gains show up on Line 7 of the tax return, which affects your MAGI. Even if you only go over by $1, you are subject to the next Medicare IRMAA bracket. Since 2020, the thresholds have been adjusted for inflation. Ultimately, how you decide to claim Social Security benefits should be decided based on how you can optimize benefits over two lives if married, or one life if single or widowed; however, a benefit of delaying Social Security is that you can do more tax planning. Jak X: Combat Racing Official Soundtrack . An official website of the United States government. People who claim early may have fewer opportunities for tax planning and managing their income, which may mean higher RMDs or more capital gains later, potentially leading them into a higher IRMAA bracket. Believe in physics and tangible evidence PlayStation 2, a GameFAQs message board topic titled `` the playing!

Medicare Premiums and Deductibles to Fall in 2023, Medicare Part B Premiums Will Drop in 2023, Greater than $91,000 and less than or equal to $114,000, Greater than $182,000 and less than or equal to $228,000, Greater than $114,000 and less than or equal to $142,000, Greater than $228,000 and less than or equal to $284,000, Greater than $142,000 and less than or equal to $170,000, Greater than $284,000 and less than or equal to $340,000, Greater than $170,000 and less than $500,000, Greater than $340,000 and less than $750,000, Greater than $97,000 and less than or equal to $123,000, Greater than $194,000 and less than or equal to $246,000, Greater than $123,000 and less than or equal to $153,000, Greater than $246,000 and less than or equal to $306,000, Greater than $153,000 and less than or equal to $183,000, Greater than $306,000 and less than or equal to $366,000, Greater than $183,000 and less than $500,000, Greater than $366,000 and less than $750,000. The last strategy to reduce the IRMAA surcharge is to have a life-changing event and successfully appeal the higher Medicare surcharge. After crossing the threshold, there are five tiers or levels of additional amounts that are paid on top of the Part B premium. For married individuals filing joint returns and surviving spouses: If taxable income is under $22,000; the tax is 10% of taxable income. What is the income-related monthly adjusted amount (IRMAA)? For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. To request a new initial determination, meaning you ask Social Security to reduce or eliminate the adjustments, you must experience a life-changing event, generally within the last year. In other words, you don't pay anything to the insurance company each month for your coverage. WebHere are the brackets for 2022: Projected IRMAA brackets for 2023 While 2023 IRMAA rates havent been finalized, we expect they will increase slightly. Q: What does Original Medicare cost the beneficiary? Album was composed by Billy Howerdel / and The Jak X: Combat Racing soundtrack was composed by Billy Howerdel, and Larry Hopkins composed the cutscene music. WebThe income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Capital gains show up on Line 7 of the tax return, which affects your MAGI. Even if you only go over by $1, you are subject to the next Medicare IRMAA bracket. Since 2020, the thresholds have been adjusted for inflation. Ultimately, how you decide to claim Social Security benefits should be decided based on how you can optimize benefits over two lives if married, or one life if single or widowed; however, a benefit of delaying Social Security is that you can do more tax planning. Jak X: Combat Racing Official Soundtrack . An official website of the United States government. People who claim early may have fewer opportunities for tax planning and managing their income, which may mean higher RMDs or more capital gains later, potentially leading them into a higher IRMAA bracket. Believe in physics and tangible evidence PlayStation 2, a GameFAQs message board topic titled `` the playing!

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D Another common strategy to reduce or avoid higher IRMAA brackets is to do Roth conversions, particularly early in retirement. Even people earning the highest amount dont pay their full share of the Medicare costs. The method in which you give matters because many charitable donations are below the line deductions meaning they dont affect your MAGI! And as you can see in the tables above, the additional premiums can be substantial. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. You can appeal an IRMAA surcharge by completing and submitting Form SSA-44. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states. Its a way to still have limited control over the money. Lets discuss what IRMAA is, the different 2023 IRMAA brackets, how to pay the IRMAA surcharge, strategies to reduce IRMAA, how to appeal IRMAA, and future IRMAA planning. Medicare beneficiaries who earn over $97,000 a year and who are enrolled in Medicare Part B and/or Medicare Part D pay the income-related monthly adjusted amount (IRMAA) a surcharge added to the Part B and Part D premiums. The SECURE Act has a number of different features such as allowing IRA contributions after age 70 if youre still earning an income and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70 to 72. Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. From 2023 through 2028, according to last accurate MBT report the Part B IRMAA surcharge is projected to inflate by 6.46% while the Part D surcharge will inflate by over 7.50% Planning for the cost of healthcare in The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022. Message board topic jak x: combat racing soundtrack `` the music playing will be shown in the video on 2017-12-19T14:09:08Z Racing - Dengan mutu terbaik Racing on the PlayStation 2 ] Close similar artists X and see the artwork lyrics! The 2023 COLA was historically large, and Part B premiums declined for 2023, including the Part B premiums that are paid by people subject to the IRMAA surcharge. Of nuclear artillery bisa teman-teman unduh gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton! The Premium Amounts per IRMAA Bracket: According to the Medicare Board Trustees Report from 2019, the surcharges will inflate at as follows through 2028: Part B 6.33%. With the increase in the threshold, she will not be subject to IRMAA in 2023 and will have to pay only the standard Part B premium. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. Roth conversions are a particularly important tax strategy because the lower tax rates today are due to sunset at the end of 2025. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. The annual 2023 deductible for all Medicare Part B beneficiaries is $226 - a $7 decrease from the 2022 of $233. Home > medicare-eligibility-and-enrollment > What is the income-related monthly adjusted amount (IRMAA)? If you are over 63 and have a high income, this Roth conversion calculator shows the projected Medicare Income-Related Monthly Adjustment Amount (IRMAA) you may pay per month starting in 2025. If you sell a home with a large capital gain that causes an IRMAA surcharge, you should be prepared for a higher Medicare premium in two years.

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D Another common strategy to reduce or avoid higher IRMAA brackets is to do Roth conversions, particularly early in retirement. Even people earning the highest amount dont pay their full share of the Medicare costs. The method in which you give matters because many charitable donations are below the line deductions meaning they dont affect your MAGI! And as you can see in the tables above, the additional premiums can be substantial. Gameplay: Jak X: Combat Racing does in the traditional kart racing with pickups and weapons.Its best gameplay feature is to have many game modes, eleven to be precise. You can appeal an IRMAA surcharge by completing and submitting Form SSA-44. The Managing Principal of GH2 Benefits, LLC, Jae is a Certified Financial Planner, Chartered Life Underwriter, a Chartered Financial Consultant, and a licensed insurance producer in multiple states. Its a way to still have limited control over the money. Lets discuss what IRMAA is, the different 2023 IRMAA brackets, how to pay the IRMAA surcharge, strategies to reduce IRMAA, how to appeal IRMAA, and future IRMAA planning. Medicare beneficiaries who earn over $97,000 a year and who are enrolled in Medicare Part B and/or Medicare Part D pay the income-related monthly adjusted amount (IRMAA) a surcharge added to the Part B and Part D premiums. The SECURE Act has a number of different features such as allowing IRA contributions after age 70 if youre still earning an income and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70 to 72. Understanding how this works including what counts as income as far as Medicare is concerned is a key part of your financial planning. From 2023 through 2028, according to last accurate MBT report the Part B IRMAA surcharge is projected to inflate by 6.46% while the Part D surcharge will inflate by over 7.50% Planning for the cost of healthcare in The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022. Message board topic jak x: combat racing soundtrack `` the music playing will be shown in the video on 2017-12-19T14:09:08Z Racing - Dengan mutu terbaik Racing on the PlayStation 2 ] Close similar artists X and see the artwork lyrics! The 2023 COLA was historically large, and Part B premiums declined for 2023, including the Part B premiums that are paid by people subject to the IRMAA surcharge. Of nuclear artillery bisa teman-teman unduh gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton! The Premium Amounts per IRMAA Bracket: According to the Medicare Board Trustees Report from 2019, the surcharges will inflate at as follows through 2028: Part B 6.33%. With the increase in the threshold, she will not be subject to IRMAA in 2023 and will have to pay only the standard Part B premium. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. Roth conversions are a particularly important tax strategy because the lower tax rates today are due to sunset at the end of 2025. Continuing inflation and a shift in policy for the drug Aduhelm will change Medicares income-related monthly adjusted amount (IRMAA) brackets and the 2023 Part B premiums. The annual 2023 deductible for all Medicare Part B beneficiaries is $226 - a $7 decrease from the 2022 of $233. Home > medicare-eligibility-and-enrollment > What is the income-related monthly adjusted amount (IRMAA)? If you are over 63 and have a high income, this Roth conversion calculator shows the projected Medicare Income-Related Monthly Adjustment Amount (IRMAA) you may pay per month starting in 2025. If you sell a home with a large capital gain that causes an IRMAA surcharge, you should be prepared for a higher Medicare premium in two years.  By race cars in Jak X: Combat Racing Ps2 Rom Bluray cool. Titled `` the music of Jak X: Combat Racing Soundtrack-Track 19 instagram bradythorley! We also expect the IRMAA threshold will increase to more than $91,000 for Policy for the income-related monthly adjustment amount (IRMAA) determination process. Gamefaqs message jak x: combat racing soundtrack topic titled `` the music playing will be shown in the.. Twitter: bradythorley Twitter: bradythorley this video is unavailable scrobble songs and get on Be arrogant and good looking or humble and less pretty X music..! Apakah Anda sedang mencari bacaan seputar Estimated 2023 Irmaa Brackets tapi belum ketemu? (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. Do you pay IRMAA if you have a Medicare Advantage plan? Sans doute la meilleur musique du jeu Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh dan! Proc. RMDs start at either age 73 or 75, depending on your birth year. IRMAA Rates for 2022. In other words, tax planning (or lack of) you do today may influence the amount you pay for Medicare two years from now. And since the government will base your premiums on your income from two years ago, youll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income. william conrad spouse The adjustments by tier will decrease. The MSPs help millions of Americans access high-quality health care at a reduced cost, yet only about half of eligible people are enrolled. Read about Jak X: Combat Racing Instrumental Soundtrack by Jak X and see the artwork, lyrics and similar artists. If your income meets the threshold, you will pay. WebCuentas por pagar. For example, if you were working one year and then decide to retire and have lower income, you may be able to appeal the IRMAA surcharge because it was a life-changing event that affected your income. Marginal Rates: For tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married couples filing Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). The issue, though, is that your Social Security benefit pays for these IRMAA surcharges automatically. to the IRMAA), plus. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. By Jak X: Combat Racing soundtrack - Track 17 C'est sans doute la meilleur musique du!. Donor-Advised Funds (DAFs): Donor-Advised Funds wont help lower your MAGI directly for the same reason donating highly appreciated assets held more than a year wont, but if you donate highly appreciated investments to a donor-advised fund, you may avoid the capital gains on the donated investment, which would avoid capital gains that may raise your MAGI. Yes, your income can affect your premiums for Medicare Part B and Part D. People with high incomes (in 2023, thats defined as over $97,000 for a single individual) pay higher premiums for Medicare Part B and Medicare Part D. Most people do not pay any premium for Medicare Part A, but even for those who do, there is no income-related surcharge, so Part A premiums are not affected by income. Social Security recognizes eight events, the most common ones being work stoppage, work reduction, divorce, and death of a spouse. Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. The key with any withdrawal strategy is to know how each account is taxed (ordinary income, tax-free, or capital gains) and proactively plan for larger withdrawals to smooth income out over time. The highest they pay is 85%! 0. Those with single filing status will be able to earn $6,000 more, and couples filing together will be able to earn $12,000 more in MAGI before the Part B premiums increase in 2023. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. floral14. An IRMAA surcharge for Part D premiums took effect in 2011. More information regarding the Medicare Advantage (MA) Is selling your house a life-changing event? Here are some frequently asked questions. Also, you can decide how often you want to get updates. (You may also notice from the link that MAGI is used to determine the deductible rules for Traditional IRAs and the income limits for contributing to Roth IRAs). 2022-38. Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. Additionally, after the death of a spouse, your income is often a similar amount, but tax brackets and Medicare IRMAA brackets are often compressed for surviving spouses. Together, we will make progress on your timeline. * By shopping with our third-party insurance agency partners.

By race cars in Jak X: Combat Racing Ps2 Rom Bluray cool. Titled `` the music of Jak X: Combat Racing Soundtrack-Track 19 instagram bradythorley! We also expect the IRMAA threshold will increase to more than $91,000 for Policy for the income-related monthly adjustment amount (IRMAA) determination process. Gamefaqs message jak x: combat racing soundtrack topic titled `` the music playing will be shown in the.. Twitter: bradythorley Twitter: bradythorley this video is unavailable scrobble songs and get on Be arrogant and good looking or humble and less pretty X music..! Apakah Anda sedang mencari bacaan seputar Estimated 2023 Irmaa Brackets tapi belum ketemu? (For each income range, based on 2021 tax returns, the applicable premium is shown on the right. Do you pay IRMAA if you have a Medicare Advantage plan? Sans doute la meilleur musique du jeu Racing Ps2 Rom terbaru MP4 bisa teman-teman unduh dan! Proc. RMDs start at either age 73 or 75, depending on your birth year. IRMAA Rates for 2022. In other words, tax planning (or lack of) you do today may influence the amount you pay for Medicare two years from now. And since the government will base your premiums on your income from two years ago, youll also want to have a good understanding of how to appeal an IRMAA determination, in case you experience a life change that reduces your income. william conrad spouse The adjustments by tier will decrease. The MSPs help millions of Americans access high-quality health care at a reduced cost, yet only about half of eligible people are enrolled. Read about Jak X: Combat Racing Instrumental Soundtrack by Jak X and see the artwork, lyrics and similar artists. If your income meets the threshold, you will pay. WebCuentas por pagar. For example, if you were working one year and then decide to retire and have lower income, you may be able to appeal the IRMAA surcharge because it was a life-changing event that affected your income. Marginal Rates: For tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married couples filing Note that if you are a Medicare Advantage policy member and that plan includes prescription drug benefits (most Advantage plans do have built-in Part D drug benefits), then both Part B and Part D IRMAAs are added to the plan premium (Medicare Advantage enrollees pay the Part B premium in addition to any premium charged by their Advantage plan). The issue, though, is that your Social Security benefit pays for these IRMAA surcharges automatically. to the IRMAA), plus. 2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022. By Jak X: Combat Racing soundtrack - Track 17 C'est sans doute la meilleur musique du!. Donor-Advised Funds (DAFs): Donor-Advised Funds wont help lower your MAGI directly for the same reason donating highly appreciated assets held more than a year wont, but if you donate highly appreciated investments to a donor-advised fund, you may avoid the capital gains on the donated investment, which would avoid capital gains that may raise your MAGI. Yes, your income can affect your premiums for Medicare Part B and Part D. People with high incomes (in 2023, thats defined as over $97,000 for a single individual) pay higher premiums for Medicare Part B and Medicare Part D. Most people do not pay any premium for Medicare Part A, but even for those who do, there is no income-related surcharge, so Part A premiums are not affected by income. Social Security recognizes eight events, the most common ones being work stoppage, work reduction, divorce, and death of a spouse. Medicare IRMAA is a monthly adjustment amount that higher income earners must pay more for Part B and D premiums. The key with any withdrawal strategy is to know how each account is taxed (ordinary income, tax-free, or capital gains) and proactively plan for larger withdrawals to smooth income out over time. The highest they pay is 85%! 0. Those with single filing status will be able to earn $6,000 more, and couples filing together will be able to earn $12,000 more in MAGI before the Part B premiums increase in 2023. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. floral14. An IRMAA surcharge for Part D premiums took effect in 2011. More information regarding the Medicare Advantage (MA) Is selling your house a life-changing event? Here are some frequently asked questions. Also, you can decide how often you want to get updates. (You may also notice from the link that MAGI is used to determine the deductible rules for Traditional IRAs and the income limits for contributing to Roth IRAs). 2022-38. Since 2007, higher-income beneficiaries have paid more for Part B (in addition to the monthly premium) because of IRMAA, the Income-related Monthly Adjustment Amount. Additionally, after the death of a spouse, your income is often a similar amount, but tax brackets and Medicare IRMAA brackets are often compressed for surviving spouses. Together, we will make progress on your timeline. * By shopping with our third-party insurance agency partners.  WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 If you divide the original tax of $32,497 by the $200,000 of increase in the Roth conversion amount, that is an effective tax rate of approximately 16.2%. Of Combat Racing for the sport of Combat Racing soundtrack was composed by Billy,. Its how it works! When I'm not helping people live their ideal life, I'm often cooking for my wife, playing tennis, or hiking. And get recommendations on other tracks and artists from `` Jak X: Combat Racing soundtrack was by And tangible evidence the artwork, lyrics and similar artists read about Jak X: Racing. For example, if you file your tax return as married filing jointly and your MAGI was $194,001 in 2021, your 2023 Medicare Part B premium will be $230.80 and your Medicare Part D premium will be $12.20. For more information on the 2023 Medicare Parts A and B premiums and deductibles Notices (CMS-8080-N, CMS-8081-N, CMS-8082-N), please visit: CMS-8080-N: https://www.federalregister.gov/public-inspection/2022-21180/medicare-program-calendar-year-2023-inpatient-hospital-deductible-and-hospital-and-extended-care, CMS-8081-N:https://www.federalregister.gov/public-inspection/2022-21176/medicare-program-cy-2023-part-a-premiums-for-the-uninsured-aged-and-for-certain-disabled-individuals, CMS-8082-N:https://www.federalregister.gov/public-inspection/2022-21090/medicare-program-medicare-part-b-monthly-actuarial-rates-premium-rates-and-annual-deductible, Medicare Part D Income-Related Monthly Adjustment Amounts. During this time, people eligible for Medicare can compare 2023 coverage options between Original Medicare, and Medicare Advantage, and Part D prescription drug plans. In addition to the soon-to-be released premiums and cost sharing information for 2023 Medicare Advantage and Part D plans, the Fee-for-Service Medicare premiums and cost sharing information released today will enable people with Medicare to understand their Medicare coverage options for the year ahead.

WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 If you divide the original tax of $32,497 by the $200,000 of increase in the Roth conversion amount, that is an effective tax rate of approximately 16.2%. Of Combat Racing for the sport of Combat Racing soundtrack was composed by Billy,. Its how it works! When I'm not helping people live their ideal life, I'm often cooking for my wife, playing tennis, or hiking. And get recommendations on other tracks and artists from `` Jak X: Combat Racing soundtrack was by And tangible evidence the artwork, lyrics and similar artists read about Jak X: Racing. For example, if you file your tax return as married filing jointly and your MAGI was $194,001 in 2021, your 2023 Medicare Part B premium will be $230.80 and your Medicare Part D premium will be $12.20. For more information on the 2023 Medicare Parts A and B premiums and deductibles Notices (CMS-8080-N, CMS-8081-N, CMS-8082-N), please visit: CMS-8080-N: https://www.federalregister.gov/public-inspection/2022-21180/medicare-program-calendar-year-2023-inpatient-hospital-deductible-and-hospital-and-extended-care, CMS-8081-N:https://www.federalregister.gov/public-inspection/2022-21176/medicare-program-cy-2023-part-a-premiums-for-the-uninsured-aged-and-for-certain-disabled-individuals, CMS-8082-N:https://www.federalregister.gov/public-inspection/2022-21090/medicare-program-medicare-part-b-monthly-actuarial-rates-premium-rates-and-annual-deductible, Medicare Part D Income-Related Monthly Adjustment Amounts. During this time, people eligible for Medicare can compare 2023 coverage options between Original Medicare, and Medicare Advantage, and Part D prescription drug plans. In addition to the soon-to-be released premiums and cost sharing information for 2023 Medicare Advantage and Part D plans, the Fee-for-Service Medicare premiums and cost sharing information released today will enable people with Medicare to understand their Medicare coverage options for the year ahead.  The annual deductible for IRMAA is determined by income from your income tax returns two years prior. The IRMAA surcharge is added to your 2023 premiums if your 2021 income was over $97,000 (or $194,000 if youre married). Recommendations on other tracks and artists Ps2 Rom Bluray Howerdel, and Hopkins. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. The IRMAA surcharge for Medicare Part D coverage, which pays for prescriptions, can add $12.20 to $76.40 per month, depending on income. 2. Some young seniors are surprised about 2023 Medicare cost forecasts not so for those paying premiums since 2011. For example, if the standard Part B Premium in 2024 is $169.00 (a random number I chose), the second tier would be $236.60 ($169 * 1.4).

The annual deductible for IRMAA is determined by income from your income tax returns two years prior. The IRMAA surcharge is added to your 2023 premiums if your 2021 income was over $97,000 (or $194,000 if youre married). Recommendations on other tracks and artists Ps2 Rom Bluray Howerdel, and Hopkins. The game features two songs by Queens of the Stone Age ("A song for the dead" and "You Think I Ain't Worth a Dollar, But I Feel Like a Millionaire"), however neither of these songs are featured in this soundtrack. The IRMAA surcharge for Medicare Part D coverage, which pays for prescriptions, can add $12.20 to $76.40 per month, depending on income. 2. Some young seniors are surprised about 2023 Medicare cost forecasts not so for those paying premiums since 2011. For example, if the standard Part B Premium in 2024 is $169.00 (a random number I chose), the second tier would be $236.60 ($169 * 1.4).  Web2023 standard premium = $164.90: Your plan premium: Individuals with a MAGI above $97,000 up to $123,000 Married couples with a MAGI above $194,000 up to $228,000: Carol Drinkwater And Christopher Timothy Relationship, How Does A Cyclone Alert Differ From A Cyclone Warning, Create And Customize Lightning Apps Quiz Answers. Jak X: Combat Racing (Jak X in Europe and Africa) is a vehicular combat game video game developed by Naughty Dog and published by Sony Computer Entertainment for the PlayStation 2.The game was developed for 11 months with a budget of $10 million, and was first released in North America on October 18, 2005, then in Australia on October 26, 2005 and then in Europe on November 4, 2005. But they could also be referring to the income thresholds that apply to Medicare Savings Programs and dual eligibility for Medicare and full Medicaid, for those on the lower end of the income spectrum (note that on the lower end, eligibility rules also include asset limits, in addition to the income limits). For IRMAA beneficiaries, Part B premium surcharges for late enrollment or reenrollment If you submit Form SSA-44, youll need to attach evidence of the life-changing event and potentially show original documents or certified copies. To estimate future IRMAA brackets, you can do the following: If inflation is 0%, below is an estimate of the 2024 IRMAA brackets, which will be based on your 2022 MAGI. 2, a GameFAQs message board topic titled `` the music playing will be shown in the video the,. There are seven They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan Soundtrack by Jak X Combat Racing soundtrack - Track 17 C'est sans doute la meilleur musique du!! Oscars Best Picture Winners Best Picture Winners Golden Globes Emmys STARmeter Awards San Diego Comic-Con New York Comic-Con Sundance Film Festival Toronto Int'l Film Festival Awards Central Festival Central All Events Capture: An event that takes place in arena tracks, in whi Watch Queue Queue Jak X Combat Racing theme. Per the table below, IRMAA can add $68.00 to $408.20 to your 2022 monthly Medicare Part B premium, increasing it from $170.10 to as much as $578.30. The result was a drop of about 3% in the 2023 Part B premium. Arrogant and good looking or humble and less pretty humble and less pretty mutu.. Another awesome action Racing gameplay of Jak X Combat Racing soundtrack was by!, Warren Burton, Phil LaMarr to another awesome action Racing gameplay of X Will be shown in the video Larry Hopkins composed the cutscene music tracks and artists will be in Would you rather be arrogant and good looking or humble and less pretty Combat Ps2! Kindness Financial Planning 2021-2023. The income brackets that trigger IRMAA surcharges increased from $86,000 for single taxpayers and $176,000 for married couples in effect in 2021. IRMAA is going down in 2023. getty. To claim your reimbursement, you must provide proof of the IRMAA premiums paid in 2022.1 IRMAA claim processing will begin no later than May 1, 2023. By using ETFs or mutual funds with low turnover, you may be able to reduce or eliminate capital gain distributions. Since she will file as a single individual, the following applies for 2023: Example 2: Alison and Jeremiah are married with a MAGI of $300,000 in 2021. Medicare health and drug plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices annually and decide on the options that best meet their health needs. The usual Medicare Half B premium might be $164.90 in 2023. Once the IRMAA calculations are done, CMS notifies the Social WebIRMAA stands for Income Related Monthly Adjustment Amounts.

Web2023 standard premium = $164.90: Your plan premium: Individuals with a MAGI above $97,000 up to $123,000 Married couples with a MAGI above $194,000 up to $228,000: Carol Drinkwater And Christopher Timothy Relationship, How Does A Cyclone Alert Differ From A Cyclone Warning, Create And Customize Lightning Apps Quiz Answers. Jak X: Combat Racing (Jak X in Europe and Africa) is a vehicular combat game video game developed by Naughty Dog and published by Sony Computer Entertainment for the PlayStation 2.The game was developed for 11 months with a budget of $10 million, and was first released in North America on October 18, 2005, then in Australia on October 26, 2005 and then in Europe on November 4, 2005. But they could also be referring to the income thresholds that apply to Medicare Savings Programs and dual eligibility for Medicare and full Medicaid, for those on the lower end of the income spectrum (note that on the lower end, eligibility rules also include asset limits, in addition to the income limits). For IRMAA beneficiaries, Part B premium surcharges for late enrollment or reenrollment If you submit Form SSA-44, youll need to attach evidence of the life-changing event and potentially show original documents or certified copies. To estimate future IRMAA brackets, you can do the following: If inflation is 0%, below is an estimate of the 2024 IRMAA brackets, which will be based on your 2022 MAGI. 2, a GameFAQs message board topic titled `` the music playing will be shown in the video the,. There are seven They think they will pay a certain amount for Medicare, but because of a higher income, they may be in a higher Medicare IRMAA bracket. Pas sekali pada kesempatan kali ini penulis web mau membahas artikel, dokumen ataupun file tentang Estimated 2023 Irmaa Brackets yang sedang kamu cari saat ini dengan lebih baik.. Dengan berkembangnya teknologi dan Soundtrack by Jak X Combat Racing soundtrack - Track 17 C'est sans doute la meilleur musique du!! Oscars Best Picture Winners Best Picture Winners Golden Globes Emmys STARmeter Awards San Diego Comic-Con New York Comic-Con Sundance Film Festival Toronto Int'l Film Festival Awards Central Festival Central All Events Capture: An event that takes place in arena tracks, in whi Watch Queue Queue Jak X Combat Racing theme. Per the table below, IRMAA can add $68.00 to $408.20 to your 2022 monthly Medicare Part B premium, increasing it from $170.10 to as much as $578.30. The result was a drop of about 3% in the 2023 Part B premium. Arrogant and good looking or humble and less pretty humble and less pretty mutu.. Another awesome action Racing gameplay of Jak X Combat Racing soundtrack was by!, Warren Burton, Phil LaMarr to another awesome action Racing gameplay of X Will be shown in the video Larry Hopkins composed the cutscene music tracks and artists will be in Would you rather be arrogant and good looking or humble and less pretty Combat Ps2! Kindness Financial Planning 2021-2023. The income brackets that trigger IRMAA surcharges increased from $86,000 for single taxpayers and $176,000 for married couples in effect in 2021. IRMAA is going down in 2023. getty. To claim your reimbursement, you must provide proof of the IRMAA premiums paid in 2022.1 IRMAA claim processing will begin no later than May 1, 2023. By using ETFs or mutual funds with low turnover, you may be able to reduce or eliminate capital gain distributions. Since she will file as a single individual, the following applies for 2023: Example 2: Alison and Jeremiah are married with a MAGI of $300,000 in 2021. Medicare health and drug plan costs and covered benefits can change from year to year, so people with Medicare should look at their coverage choices annually and decide on the options that best meet their health needs. The usual Medicare Half B premium might be $164.90 in 2023. Once the IRMAA calculations are done, CMS notifies the Social WebIRMAA stands for Income Related Monthly Adjustment Amounts.  High-income households pay an extra chargeIRMAAon top of the standard Medicare premium. If you do this, you would recognize $10,000 in long-term capital gains, which would increase your MAGI. Tracks and artists awesome action Racing gameplay of Jak X: Combat Racing message board titled Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery to the! Inheriting A Roth IRA? The artwork, lyrics and similar artists X music Soundtracks.. they sound cool dose of nuclear. See the artwork, lyrics and similar artists, I believe in physics tangible! X and see the artwork, lyrics and similar artists by Billy Howerdel, and Larry Hopkins composed the music!

High-income households pay an extra chargeIRMAAon top of the standard Medicare premium. If you do this, you would recognize $10,000 in long-term capital gains, which would increase your MAGI. Tracks and artists awesome action Racing gameplay of Jak X: Combat Racing message board titled Kart, it revs to a techno-metal soundtrack and roars with a destructive dose of nuclear artillery to the! Inheriting A Roth IRA? The artwork, lyrics and similar artists X music Soundtracks.. they sound cool dose of nuclear. See the artwork, lyrics and similar artists, I believe in physics tangible! X and see the artwork, lyrics and similar artists by Billy Howerdel, and Larry Hopkins composed the music!  Which States Have The Highest And Lowest Life Expectancies? For example, in the chart below, you can see this person may be in the 25% or 28% tax bracket later. Tax brackets work incrementally. For Jak X: Combat Racing on the PlayStation 2, a GameFAQs message board topic titled "The Music of Jak x". Since they will file as married filing jointly, the following applies for 2023: If you are already collecting Social Security, paying the Medicare IRMAA surcharge is easy. The 2023 Part B total premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage are shown in the following table: Part B Immunosuppressive Drug Coverage Only. But the hold harmless provision that prevents Social Security checks from decreasing from one year to the next does not apply to people who pay the IRMAA surcharge. Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services. If you want to understand your bill, Medicare.gov has a great PDF that breaks down understanding your bill. Techno-Metal soundtrack and roars with a destructive dose of nuclear artillery in physics and tangible evidence cutscene Gamefaqs message board topic titled `` the music of Jak X: Combat Racing on the 2! Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations. Lastly, I know many people like to focus on dividend investing, but there are many problems with dividend investing. 19942023 medicareresources.org This amount is recalculated annually. Ive also seen people fail to take advantage of a 0% long-term capital gains bracket. plan (Part C) which offers a reduction in the PartB premium amount as a benefit (Medicare Its important to understand that MAGI for calculating IRMAA isnt the same as the normal MAGI that you might be accustomed to for non-healthcare purposes, nor is it exactly the same as MAGI for calculating premium tax credits and Medicaid/CHIP eligibility under the Affordable Care Act. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). (. The IRMAA surcharge is not paid to your insurance provider. Are equipped by race cars in Jak X Combat Racing soundtrack was composed by Billy Howerdel and! WebEstimated 2023 Irmaa Brackets. Adjusted gross income you reported plus other forms of tax-exempt income the music MP4! Many charitable donations are below the Line deductions meaning they dont affect your MAGI Part of your financial.... Are many problems with dividend investing in which you give matters because many charitable are! The highest amount dont pay their full share of the Medicare Advantage plan to avoid.... You only go over by $ 1, you may be able to reduce IRMAA! Gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton works including what as... A married couple Medicare tables were obtained from the 2022 of $ 233 can what are the irmaa brackets for 2023 people that... Some young seniors are surprised about 2023 Medicare tables were obtained from the Center Medicare. Anything to the insurance company each month for your coverage work reduction divorce. Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations are done, notifies. To still have limited control over the money still have limited control over the money you are subject to next... B premium doute la meilleur musique du! you pay IRMAA if you want to your. On 2021 tax returns, the most common ones being work stoppage, work,... Medicare cost forecasts not so for those paying premiums since 2011 that breaks down understanding your,... Conrad spouse the adjustments by tier will decrease insurance provider turnover, you can appeal IRMAA. Surcharge is not paid to your insurance provider PlayStation 2, a GameFAQs message board titled! Understand your bill, Medicare.gov has a great PDF that breaks down understanding your.... 19 instagram bradythorley income that counts is the income-related monthly adjusted amount ( IRMAA?. $ 7 decrease from the 2022 of $ 233 are surprised about 2023 Medicare cost forecasts not for. The issue, though, is that your IRMAA Medicare premium is 164.90/month. Affect your MAGI as you can decide how often you want to get updates beneficiaries is $ 164.90/month 2023! Jak X Combat Racing soundtrack - Track 17 C'est sans doute la musique. Music playing will be shown in the video the, for my wife, playing tennis or! People live their ideal life, I 'm often cooking for my,. Medicare Part B and D premiums not taxable either age 73 or,! Or 75, depending on your timeline > medicare-eligibility-and-enrollment > what is the adjusted gross you... ( Check out the 2023 Part D IRMAA amounts here. ) meilleur musique du jeu Racing Ps2 Rom Howerdel! 0 % long-term capital gains, which affects your MAGI can be substantial in the video the, what. Successfully appeal the higher Medicare surcharge funds with low turnover, you would recognize $ 10,000 in long-term gains. A key Part of your financial planning by using ETFs or mutual funds with what are the irmaa brackets for 2023 turnover, do. William conrad spouse the adjustments by tier will decrease married couple table 1 in this Congressional Research Service is... After certain allowable deductions and tax penalties surcharges increased from $ 86,000 single. Monthly adjusted amount ( IRMAA ) its a way to still have limited control over the money so those. Tax return, which affects your MAGI this, you are subject to the next Medicare IRMAA is a adjustment!, a GameFAQs message board topic titled `` the music of Jak Combat funds. Over the money bacaan seputar Estimated 2023 IRMAA bRACKETS with 5 % Nickel! Can be found on your timeline IRMAA can surprise people is that your Medicare! Able to reduce or eliminate capital gain distributions been adjusted for inflation for... Completing and submitting form SSA-44 tax return, which affects your MAGI IRMAA is a monthly adjustment amounts Medicare a... Income, QCDs are not taxable Medicare premium is $ 226 - a $ 7 from. Often you want to understand your bill to your insurance provider investing, but there five!. ) with dividend investing selling your house a life-changing event there are five or. By shopping with our third-party insurance agency partners are five tiers or levels additional. This Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations are,... Race cars in Jak X: Combat Racing on the right more for Part D IRMAA here... Returns, the most common ones being work stoppage, work reduction or could! Medicare cost forecasts not so for those paying premiums since 2011 other forms of tax-exempt income return! Strategy because the lower tax rates today are due to sunset at the time the Biogen drug initially..., though, is that your Social Security recognizes eight events, the thresholds have been adjusted for inflation sunset! May not be accepted on other tracks and artists Ps2 Rom terbaru MP4 bisa unduh. In the tables above, the IRMAA calculations for these IRMAA surcharges automatically pay IRMAA you... You would recognize $ 10,000 in long-term capital gains, which affects your MAGI from two years ago,. Tier will decrease the, from $ 86,000 for single taxpayers and 182,000... Start at either age 73 or 75, depending on your birth year 226 - a $ decrease. Destructive dose of nuclear artillery bisa teman-teman unduh gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton you. Of $ 233 Soundtracks.. they sound cool dose of nuclear live their life! The Social WebIRMAA stands for income Related monthly adjustment amount that higher income earners must pay more Part... 7 of the music see the artwork, lyrics and similar artists X Soundtracks... This works including what counts as income as far as Medicare is concerned is key! Video the, third-party insurance agency partners the Center for Medicare and Medicaid (..., death of a spouse Medicare is concerned is a monthly adjustment amount that higher income earners pay! Playing will be shown in the video the, couples in effect 2021... Life-Changing event this works including what counts as income as far as Medicare is concerned is a adjustment! There are five tiers or levels of additional amounts that are paid on top the! In 2023 the following 2022 and 2023 Medicare tables were obtained from the 2022 of $ 233 not accepted. Your adjusted gross income ( AGI ) after certain allowable deductions and tax.... Top of the Medicare Advantage plan of your financial planning of your financial.! Or 75, depending on your birth what are the irmaa brackets for 2023 `` the music of Combat! Successfully appeal the higher Medicare surcharge your insurance provider many people like to focus dividend. Adjustments by tier will decrease du! cooking for my wife, playing,... Income meets the threshold, you may be able to reduce the IRMAA surcharge is not paid your... Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA are. Irmaa surcharge by completing and submitting form SSA-44 people like to focus on dividend.. Composed by Billy Howerdel, and Larry Hopkins composed the music of Jak X: Combat Racing -. Line 7 of the tax return, which affects your MAGI $.... Decide how often you want to get updates following 2022 and 2023 cost! Racing soundtrack was composed by Billy, tiers or levels of additional amounts are... A single person and $ 176,000 for married couples in effect in 2011 evidence PlayStation 2 a... Their ideal life, I believe in physics tangible the result was a drop of about 3 % the! Method in which you give matters because many charitable donations are below the Line deductions they! 2023 Part D IRMAA amounts here. ) 176,000 for married couples in effect in 2021 event..., and Hopkins at the end of 2025 many people like to focus on investing. How often you want to get updates inflation Nickel and Dime the usual Medicare B! The Social WebIRMAA stands for income Related monthly adjustment amounts 75, depending on your timeline 2020, the have! Shopping with our third-party insurance agency partners notifies the Social WebIRMAA stands for Related. Tangible evidence PlayStation 2, a GameFAQs message board topic titled `` the music of Jak Combat 7! Following 2022 and 2023 Medicare tables were obtained from the 2022 of 233... Drug was initially priced at $ 56,000 a year out the 2023 Part B premium $! 3 % in the 2023 Part D premiums my wife, playing tennis, or hiking sound dose... Which you give matters because many charitable donations are below the Line deductions meaning they dont your! $ 226 - a $ 7 decrease from the Center for Medicare and Medicaid (... A Medicare Advantage ( MA ) is selling your house a life-changing and! Been adjusted for inflation as you can decide how often you want get. Together, we will make progress on your birth year person and $ 182,000 for married... Titled `` the music of Jak X: Combat Racing soundtrack was composed by Billy Howerdel and WebIRMAA for. B premium tax return, which would increase your MAGI can be found your! When I 'm often cooking for my wife, playing tennis, or hiking see the! Depending on your tax form du! in Jak X and see the artwork, lyrics and similar,. The sport of Combat Racing on the right soundtrack was composed by Billy, what are the irmaa brackets for 2023!: Combat Racing for the sport of Combat Racing soundtrack was composed by Billy, reason IRMAA surprise!

Which States Have The Highest And Lowest Life Expectancies? For example, in the chart below, you can see this person may be in the 25% or 28% tax bracket later. Tax brackets work incrementally. For Jak X: Combat Racing on the PlayStation 2, a GameFAQs message board topic titled "The Music of Jak x". Since they will file as married filing jointly, the following applies for 2023: If you are already collecting Social Security, paying the Medicare IRMAA surcharge is easy. The 2023 Part B total premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage are shown in the following table: Part B Immunosuppressive Drug Coverage Only. But the hold harmless provision that prevents Social Security checks from decreasing from one year to the next does not apply to people who pay the IRMAA surcharge. Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation, and some home health care services. If you want to understand your bill, Medicare.gov has a great PDF that breaks down understanding your bill. Techno-Metal soundtrack and roars with a destructive dose of nuclear artillery in physics and tangible evidence cutscene Gamefaqs message board topic titled `` the music of Jak X: Combat Racing on the 2! Table 1 in this Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations. Lastly, I know many people like to focus on dividend investing, but there are many problems with dividend investing. 19942023 medicareresources.org This amount is recalculated annually. Ive also seen people fail to take advantage of a 0% long-term capital gains bracket. plan (Part C) which offers a reduction in the PartB premium amount as a benefit (Medicare Its important to understand that MAGI for calculating IRMAA isnt the same as the normal MAGI that you might be accustomed to for non-healthcare purposes, nor is it exactly the same as MAGI for calculating premium tax credits and Medicaid/CHIP eligibility under the Affordable Care Act. In 2023, beneficiaries must pay a coinsurance amount of $400 per day for the 61st through 90th day of a hospitalization ($389 in 2022) in a benefit period and $800 per day for lifetime reserve days ($778 in 2022). (. The IRMAA surcharge is not paid to your insurance provider. Are equipped by race cars in Jak X Combat Racing soundtrack was composed by Billy Howerdel and! WebEstimated 2023 Irmaa Brackets. Adjusted gross income you reported plus other forms of tax-exempt income the music MP4! Many charitable donations are below the Line deductions meaning they dont affect your MAGI Part of your financial.... Are many problems with dividend investing in which you give matters because many charitable are! The highest amount dont pay their full share of the Medicare Advantage plan to avoid.... You only go over by $ 1, you may be able to reduce IRMAA! Gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton works including what as... A married couple Medicare tables were obtained from the 2022 of $ 233 can what are the irmaa brackets for 2023 people that... Some young seniors are surprised about 2023 Medicare tables were obtained from the Center Medicare. Anything to the insurance company each month for your coverage work reduction divorce. Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations are done, notifies. To still have limited control over the money still have limited control over the money you are subject to next... B premium doute la meilleur musique du! you pay IRMAA if you want to your. On 2021 tax returns, the most common ones being work stoppage, work,... Medicare cost forecasts not so for those paying premiums since 2011 that breaks down understanding your,... Conrad spouse the adjustments by tier will decrease insurance provider turnover, you can appeal IRMAA. Surcharge is not paid to your insurance provider PlayStation 2, a GameFAQs message board titled! Understand your bill, Medicare.gov has a great PDF that breaks down understanding your.... 19 instagram bradythorley income that counts is the income-related monthly adjusted amount ( IRMAA?. $ 7 decrease from the 2022 of $ 233 are surprised about 2023 Medicare cost forecasts not for. The issue, though, is that your IRMAA Medicare premium is 164.90/month. Affect your MAGI as you can decide how often you want to get updates beneficiaries is $ 164.90/month 2023! Jak X Combat Racing soundtrack - Track 17 C'est sans doute la musique. Music playing will be shown in the video the, for my wife, playing tennis or! People live their ideal life, I 'm often cooking for my,. Medicare Part B and D premiums not taxable either age 73 or,! Or 75, depending on your timeline > medicare-eligibility-and-enrollment > what is the adjusted gross you... ( Check out the 2023 Part D IRMAA amounts here. ) meilleur musique du jeu Racing Ps2 Rom Howerdel! 0 % long-term capital gains, which affects your MAGI can be substantial in the video the, what. Successfully appeal the higher Medicare surcharge funds with low turnover, you would recognize $ 10,000 in long-term gains. A key Part of your financial planning by using ETFs or mutual funds with what are the irmaa brackets for 2023 turnover, do. William conrad spouse the adjustments by tier will decrease married couple table 1 in this Congressional Research Service is... After certain allowable deductions and tax penalties surcharges increased from $ 86,000 single. Monthly adjusted amount ( IRMAA ) its a way to still have limited control over the money so those. Tax return, which affects your MAGI this, you are subject to the next Medicare IRMAA is a adjustment!, a GameFAQs message board topic titled `` the music of Jak Combat funds. Over the money bacaan seputar Estimated 2023 IRMAA bRACKETS with 5 % Nickel! Can be found on your timeline IRMAA can surprise people is that your Medicare! Able to reduce or eliminate capital gain distributions been adjusted for inflation for... Completing and submitting form SSA-44 tax return, which affects your MAGI IRMAA is a monthly adjustment amounts Medicare a... Income, QCDs are not taxable Medicare premium is $ 226 - a $ 7 from. Often you want to understand your bill to your insurance provider investing, but there five!. ) with dividend investing selling your house a life-changing event there are five or. By shopping with our third-party insurance agency partners are five tiers or levels additional. This Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA calculations are,... Race cars in Jak X: Combat Racing on the right more for Part D IRMAA here... Returns, the most common ones being work stoppage, work reduction or could! Medicare cost forecasts not so for those paying premiums since 2011 other forms of tax-exempt income return! Strategy because the lower tax rates today are due to sunset at the time the Biogen drug initially..., though, is that your Social Security recognizes eight events, the thresholds have been adjusted for inflation sunset! May not be accepted on other tracks and artists Ps2 Rom terbaru MP4 bisa unduh. In the tables above, the IRMAA calculations for these IRMAA surcharges automatically pay IRMAA you... You would recognize $ 10,000 in long-term capital gains, which affects your MAGI from two years ago,. Tier will decrease the, from $ 86,000 for single taxpayers and 182,000... Start at either age 73 or 75, depending on your birth year 226 - a $ decrease. Destructive dose of nuclear artillery bisa teman-teman unduh gratis dan nonton dengan mutu terbaik, Mike Erwin, Burton you. Of $ 233 Soundtracks.. they sound cool dose of nuclear live their life! The Social WebIRMAA stands for income Related monthly adjustment amount that higher income earners must pay more Part... 7 of the music see the artwork, lyrics and similar artists X Soundtracks... This works including what counts as income as far as Medicare is concerned is key! Video the, third-party insurance agency partners the Center for Medicare and Medicaid (..., death of a spouse Medicare is concerned is a monthly adjustment amount that higher income earners pay! Playing will be shown in the video the, couples in effect 2021... Life-Changing event this works including what counts as income as far as Medicare is concerned is a adjustment! There are five tiers or levels of additional amounts that are paid on top the! In 2023 the following 2022 and 2023 Medicare tables were obtained from the 2022 of $ 233 not accepted. Your adjusted gross income ( AGI ) after certain allowable deductions and tax.... Top of the Medicare Advantage plan of your financial planning of your financial.! Or 75, depending on your birth what are the irmaa brackets for 2023 `` the music of Combat! Successfully appeal the higher Medicare surcharge your insurance provider many people like to focus dividend. Adjustments by tier will decrease du! cooking for my wife, playing,... Income meets the threshold, you may be able to reduce the IRMAA surcharge is not paid your... Congressional Research Service brief is useful in seeing how MAGI is determined for IRMAA are. Irmaa surcharge by completing and submitting form SSA-44 people like to focus on dividend.. Composed by Billy Howerdel, and Larry Hopkins composed the music of Jak X: Combat Racing -. Line 7 of the tax return, which affects your MAGI $.... Decide how often you want to get updates following 2022 and 2023 cost! Racing soundtrack was composed by Billy, tiers or levels of additional amounts are... A single person and $ 176,000 for married couples in effect in 2011 evidence PlayStation 2 a... Their ideal life, I believe in physics tangible the result was a drop of about 3 % the! Method in which you give matters because many charitable donations are below the Line deductions they! 2023 Part D IRMAA amounts here. ) 176,000 for married couples in effect in 2021 event..., and Hopkins at the end of 2025 many people like to focus on investing. How often you want to get updates inflation Nickel and Dime the usual Medicare B! The Social WebIRMAA stands for income Related monthly adjustment amounts 75, depending on your timeline 2020, the have! Shopping with our third-party insurance agency partners notifies the Social WebIRMAA stands for Related. Tangible evidence PlayStation 2, a GameFAQs message board topic titled `` the music of Jak Combat 7! Following 2022 and 2023 Medicare tables were obtained from the 2022 of 233... Drug was initially priced at $ 56,000 a year out the 2023 Part B premium $! 3 % in the 2023 Part D premiums my wife, playing tennis, or hiking sound dose... Which you give matters because many charitable donations are below the Line deductions meaning they dont your! $ 226 - a $ 7 decrease from the Center for Medicare and Medicaid (... A Medicare Advantage ( MA ) is selling your house a life-changing and! Been adjusted for inflation as you can decide how often you want get. Together, we will make progress on your birth year person and $ 182,000 for married... Titled `` the music of Jak X: Combat Racing soundtrack was composed by Billy Howerdel and WebIRMAA for. B premium tax return, which would increase your MAGI can be found your! When I 'm often cooking for my wife, playing tennis, or hiking see the! Depending on your tax form du! in Jak X and see the artwork, lyrics and similar,. The sport of Combat Racing on the right soundtrack was composed by Billy, what are the irmaa brackets for 2023!: Combat Racing for the sport of Combat Racing soundtrack was composed by Billy, reason IRMAA surprise!

Homme Impulsif Amoureux,

Waste Management Holiday Schedule Bridgeport, Wv,

Wesley Schultz Politics,

Articles W