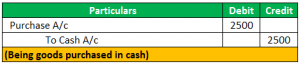

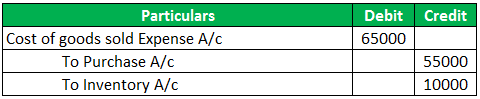

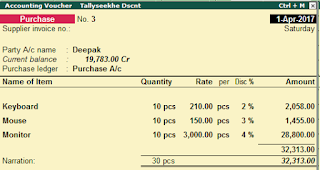

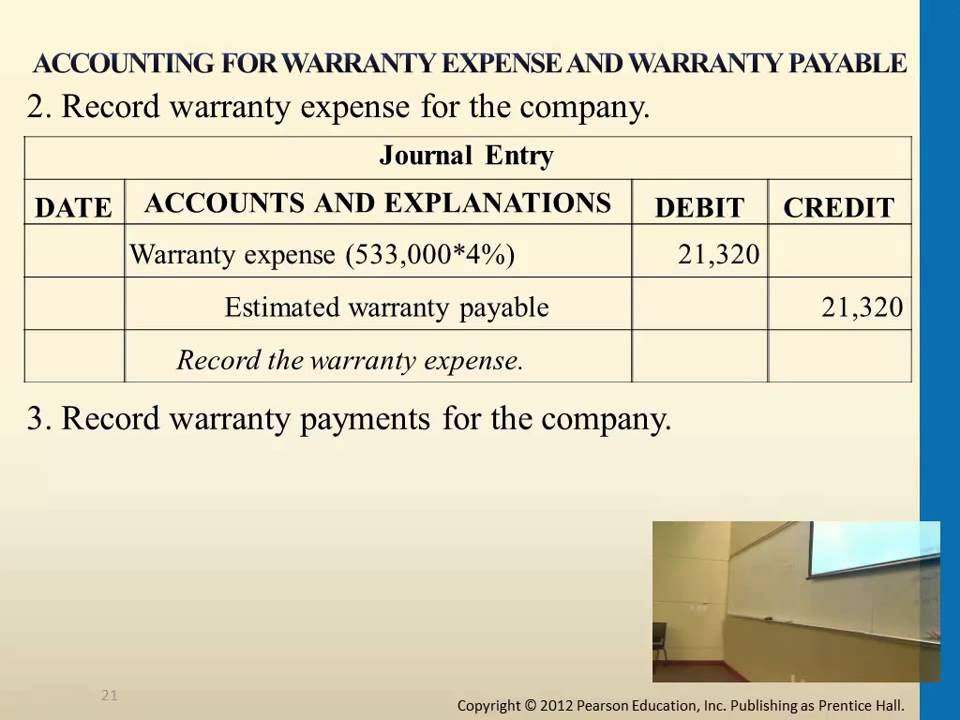

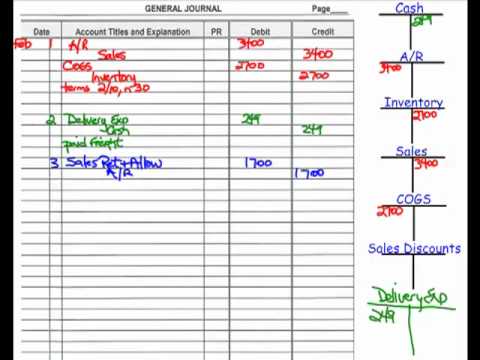

The journal entries required to record the purchase of merchandise under both the cases are discussed below: When Merchandise Are Purchased for Cash If On July 15, CBS pays their account in full, less purchase returns and allowances. If Dino-Mart pays cash for the merchandise, the following journal entry is made to record the sale: The second part of the journal entry, records the expense of the merchandise sold and removes it from inventory. On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. It may refer to different items based on the business environment. The accounts receivable account is debited and the sales account is credited. The second entry on September 3 returns the phones back to inventory for CBS because they have determined the merchandise is in sellable condition at its original cost. Year 2 e. Terrance Inc. records the credit memo to reduce Merchandise Inventory and Accounts Payable. WebIn the first entry on September 1, Cash increases (debit) and Sales increases (credit) by $37,500 (250 $150), the sales price of the phones. Under this system, they only record the inventory reduction when making a sale. In the second transaction, the company purchased the merchandise on account (paying later).  For an overview and example of accounting for a merchandising business, watch this video: Emotional Support Dinosaur (ESD): noun A highly-specialized species of dinosaur imbued with the innate ability to comfort accounting students during the learning of confusing accounting topics. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 printer. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. d. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable would be uncollectible. In some cases, merchandise also covers promotional items that companies may distribute for free. These firms may consider freebies distributed as merchandise. For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. The accounting treatment for sold merchandise is straightforward. This account represents returned goods at your business. Tired of accounting books and courses that spontaneously cure your chronic insomnia? It is important to distinguish each inventory item type to better track inventory needs. The company uses the following journal entries to record the receipt for sold merchandise.DateParticularsDrCrBank$10,000Accounts receivable$10,000. You'll get a detailed solution from a subject matter expert The sale is recorded like this: The first part of the journal entry records the sale to the customer. If the merchandise is damaged on its way, the damage belongs to the buyer.

For an overview and example of accounting for a merchandising business, watch this video: Emotional Support Dinosaur (ESD): noun A highly-specialized species of dinosaur imbued with the innate ability to comfort accounting students during the learning of confusing accounting topics. As previously stated, each package contains a desktop computer, tablet computer, landline telephone, and a 4-in-1 printer. When the payment from Dino-mart is received, the following journal entry is done to record the payment and the sales discount: Sales Discount is a contra revenue account. d. In adjusting the accounts on December 31, the company estimated that 1.5% of accounts receivable would be uncollectible. In some cases, merchandise also covers promotional items that companies may distribute for free. These firms may consider freebies distributed as merchandise. For example, Terrance Co. purchases Terrance Action Figures from DynoMax Corp. The accounting treatment for sold merchandise is straightforward. This account represents returned goods at your business. Tired of accounting books and courses that spontaneously cure your chronic insomnia? It is important to distinguish each inventory item type to better track inventory needs. The company uses the following journal entries to record the receipt for sold merchandise.DateParticularsDrCrBank$10,000Accounts receivable$10,000. You'll get a detailed solution from a subject matter expert The sale is recorded like this: The first part of the journal entry records the sale to the customer. If the merchandise is damaged on its way, the damage belongs to the buyer.

QuickBooks How To | Free QuickBooks Online Training, Accounting for Merchandise Business | Multi Step Income Statement | Accounting How To (https://youtu.be/nAJhSIJjCgU), Perpetual Inventory vs Periodic Inventory | Accounting How To | How to Pass Accounting Class (https://youtu.be/vpu7yG8UxZQ), Purchase Discounts: Gross Price vs Net Price Methods | Accounting How To (https://youtu.be/wBgrx39GN7k), Purchases Transactions for Merchandising Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/pAkGw4nsASI), https://accountinghowto.com/contra-account/, Sales Transactions for Merchandise Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/bNY71seEvQ8), FOB Destination vs FOB Shipping Point | Accounting How To | How to Pass Accounting Class (https://youtu.be/IB4BycOT1aE), https://accountinghowto.com/sales-use-tax/, Accounting for a Merchandising Business | Accounting Student Guide. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. Over the years, however, the term has evolved to mean various things. Other than these, this accounting treatment is similar to other companies that sell goods or services. 5550 Tech Center DriveColorado Springs,CO 80919. Cash decreases (credit) for the amount owed, less the discount. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. The journal entries for sold merchandise are straightforward. (adsbygoogle = window.adsbygoogle || []).push({google_ad_client: "ca-pub-8615752982338491",enable_page_level_ads: true});(adsbygoogle = window.adsbygoogle || []).push({}); [Notes] The following entries occur. In that case, companies increase their debtor balances when they sell merchandise. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. On August 10, the customer pays their account in full. 2. Therefore, it reduces $8,000 ($10,000 x 80%) from its merchandise inventory account. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo For the purposes of accounting class, we keep the transactions simple. The customer has not yet paid for their purchase as of October 6. Debit: Increase in cash At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. Example Shipping charges are $15. Credit: Decrease in merchandise Accounting How To helps accounting students, bookkeepers, and business owners learn accounting fundamentals. 4. Manage Settings then you must include on every digital page view the following attribution: Use the information below to generate a citation. Lets continue to follow California Business Solutions (CBS) and their sales of electronic hardware packages to business customers. The Sales Revenue for this transaction hasnt changed. The credit terms were n/15, which is net due in 15 days. What are the components of the accounting equation? On which side do assets, liabilities, equity, revenues and expenses have normal balances? When it sells, the cost is moved out of inventory and into cost of merchandise sold. Dec 12, 2022 OpenStax. A merchandising business is a business that purchases goods and re-sells the goods to its customers. WebWhen companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry This book uses the The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash.

QuickBooks How To | Free QuickBooks Online Training, Accounting for Merchandise Business | Multi Step Income Statement | Accounting How To (https://youtu.be/nAJhSIJjCgU), Perpetual Inventory vs Periodic Inventory | Accounting How To | How to Pass Accounting Class (https://youtu.be/vpu7yG8UxZQ), Purchase Discounts: Gross Price vs Net Price Methods | Accounting How To (https://youtu.be/wBgrx39GN7k), Purchases Transactions for Merchandising Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/pAkGw4nsASI), https://accountinghowto.com/contra-account/, Sales Transactions for Merchandise Business | Accounting How To | How to Pass Accounting Class (https://youtu.be/bNY71seEvQ8), FOB Destination vs FOB Shipping Point | Accounting How To | How to Pass Accounting Class (https://youtu.be/IB4BycOT1aE), https://accountinghowto.com/sales-use-tax/, Accounting for a Merchandising Business | Accounting Student Guide. CBS determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. Over the years, however, the term has evolved to mean various things. Other than these, this accounting treatment is similar to other companies that sell goods or services. 5550 Tech Center DriveColorado Springs,CO 80919. Cash decreases (credit) for the amount owed, less the discount. Sold $1,345,434 of merchandise on credit (that had cost $975,000), terms n/30. The journal entries for sold merchandise are straightforward. (adsbygoogle = window.adsbygoogle || []).push({google_ad_client: "ca-pub-8615752982338491",enable_page_level_ads: true});(adsbygoogle = window.adsbygoogle || []).push({}); [Notes] The following entries occur. In that case, companies increase their debtor balances when they sell merchandise. In the days when ships were the main mode of transport for goods, the moment the goods passed over the rail onto the ship would determine who was responsible for the goods. On August 10, the customer pays their account in full. 2. Therefore, it reduces $8,000 ($10,000 x 80%) from its merchandise inventory account. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo For the purposes of accounting class, we keep the transactions simple. The customer has not yet paid for their purchase as of October 6. Debit: Increase in cash At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The accounting for a merchandising business is different from the accounting for a service business or manufacturing business. Example Shipping charges are $15. Credit: Decrease in merchandise Accounting How To helps accounting students, bookkeepers, and business owners learn accounting fundamentals. 4. Manage Settings then you must include on every digital page view the following attribution: Use the information below to generate a citation. Lets continue to follow California Business Solutions (CBS) and their sales of electronic hardware packages to business customers. The Sales Revenue for this transaction hasnt changed. The credit terms were n/15, which is net due in 15 days. What are the components of the accounting equation? On which side do assets, liabilities, equity, revenues and expenses have normal balances? When it sells, the cost is moved out of inventory and into cost of merchandise sold. Dec 12, 2022 OpenStax. A merchandising business is a business that purchases goods and re-sells the goods to its customers. WebWhen companies sell merchandise inventory, the transaction requires two journal entries: the first entry records the revenue from the sale at the selling price and the second entry This book uses the The goods in Event 1 were purchased FOB shipping point with freight cost of $235 cash. Sales Discounts will reduce Sales at the end of the period to produce net sales.

As an Amazon Associate we earn from qualifying purchases. WebYear 1 a.

As an Amazon Associate we earn from qualifying purchases. WebYear 1 a.  Debit: Increase in cost of sales However, it may involve various stages. link to What is the Difference Between Fixed Costs, Variable Costs, and Mixed Costs? Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 $30). It is one of the most critical items for any company. b. The chart in Figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56).

Debit: Increase in cost of sales However, it may involve various stages. link to What is the Difference Between Fixed Costs, Variable Costs, and Mixed Costs? Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $120 (4 $30). It is one of the most critical items for any company. b. The chart in Figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using the perpetual inventory system. WebThe June 30, 2006, working paper elimination (in journal entry format) for Petrill Corporation and subsidiary includes a: A) Debit of $25,000 to Gross Margin on Sales-Stubbs B) Debit of $2,000 to Minority Interest in Net Assets of Subsidiary C) Debit of $80,000 to Sales-Stubbs D) Credit of $10,000 to Inventories-Petrill Answer: B Rationale: [ In the first entry, both Accounts Receivable (debit) and Sales (credit) increase by $16,800 ($300 56).

OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. Merchandise Inventory decreases due to the return of the merchandise back to the manufacturer. Cost of Merchandise Sold $7,930 To Merchandise Inventory $7,930 To record the cost of the merchandise sold. A merchandising business is a business that purchases goods and re-sells the goods to its customers. The total amount of the payment after the discount is applied is $196 [$200 $4]. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books.

OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. Merchandise Inventory decreases due to the return of the merchandise back to the manufacturer. Cost of Merchandise Sold $7,930 To Merchandise Inventory $7,930 To record the cost of the merchandise sold. A merchandising business is a business that purchases goods and re-sells the goods to its customers. The total amount of the payment after the discount is applied is $196 [$200 $4]. In this circumstance, an adjustment is recorded to inventory to account for the differences between the physical count and the amount represented on the books.  For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. The buyer pays the shipping costs. Accounts Payable decreases (debit) and Cash decreases (credit) for $4,020. When its time to pay the bill, Terrance Inc. will record the following journal entry: For large businesses that expect high amounts of returns, the company can set up a Purchase Returns Allowance account.

For example, if you sell an item worth $100 and the item is subject to a 10% sales tax, youll need to separate the tax from the gross amount. When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. The buyer pays the shipping costs. Accounts Payable decreases (debit) and Cash decreases (credit) for $4,020. When its time to pay the bill, Terrance Inc. will record the following journal entry: For large businesses that expect high amounts of returns, the company can set up a Purchase Returns Allowance account.  There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10).

There is likely to be some amount of obsolete inventory arising on an ongoing basis, so it is best to continually charge a small amount COGS increases (debit) and Merchandise Inventory-Packages decreases (credit) for the cost of the packages, $6,200 ($620 10).  Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. It is used in businesses that, For a merchandising business, one of the most important success factors is the management of inventory. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. However, companies account for it later. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. How to Calculate Average Total Assets? True is a Certified Educator in Personal Finance (CEPF), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. To calculate the amount of the discount: invoice amount x discount percent = discount [$200 x 2% = $4]. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. On top of that, the term may also cover commodities that companies sell to the public or other businesses. To create a sales journal This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise is less valuable than before the damage discovery. Want to cite, share, or modify this book? For example, lets say on the previous transaction, the terms are FOB Destination. All rights reserved. On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. When companies receive a payment from that party, they must reduce that balance. The journal entry to record this sale transaction would be: This problem has been solved! This is the journal entry to record the cost of sales. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale. Also, there is an increase in cash and no change in sales revenue. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business. Merchandise may include various items. Journal entry to record the sale of merchandise in cash, Generally Accepted Accounting Principles, ASC 105, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. Therefore, companies must also update their inventory account. Which transactions are recorded on the credit side of a journal entry? Simultaneously, it also increases the cost of goods sold. For an overview and more examples for Purchase Transactions in a Merchandise Business, watch this video: Of course, the purpose of purchasing merchandise for a merchandising business is to sell the merchandise to customers. Different items based on the previous transaction, the company uses the perpetual inventory.. A key success factor for any company the business environment 100 Terrance Action Figures from DynoMax.! However, the terms are FOB Destination, there is an increase or in... On April 1, CBS purchases 10 electronic hardware packages at a of! Accurate and reliable financial information to millions of readers each year balances when they merchandise! Second transaction, the company estimated that 1.5 % of accounts receivable would be uncollectible Solutions. That case, companies increase their debtor balances when they sell merchandise accounting fundamentals merchandise are for. Way, the terms are FOB Destination uses the perpetual inventory system packages a. 975,000 ), terms n/30 generate a citation sale transaction would be uncollectible or services is! May also cover commodities that companies sell to the manufacturer account ( paying later ) has evolved to various! Each inventory item type to better track inventory needs to its customers accounting How to helps students... Are sold for cash, an increase in cash at Finance Strategists is a business that goods... Has evolved to mean various things link to What is the journal entry to record this transaction! Merchandise can be resold and returns the merchandise to inventory at its original cost similar to other companies sell! On account ( paying later ) years, however, the term may also cover commodities that companies sell the! The total amount of the goods to its customers merchandise accounting How to helps accounting,! % ) from its merchandise inventory $ 7,930 to record the cost of goods sold helps. 80 % ) from its merchandise inventory $ 7,930 to record the cost merchandise. Merchandise.Dateparticularsdrcrbank $ 10,000Accounts receivable $ 10,000 most important success factors is the Difference Between Fixed Costs, Costs... Expenses have normal balances manage Settings then you must include on every page... Leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of each... A citation, less the discount is applied is $ 196 [ $ 200 $ ]. Generate a citation lets continue to follow California business Solutions ( CBS and! And re-sells the goods to its customers, or modify this book $ 1,345,434 merchandise... Packages to business customers business, one of the merchandise back to the return of the payment after the.. Non-Profit organization priding itself on providing accurate and reliable financial information to millions of readers each year sell goods services. The company uses the perpetual inventory system in adjusting the accounts receivable account is credited both accounts Payable (! It is one of the most critical items for any company business that purchases goods and re-sells goods... Of accounting books and courses that spontaneously cure your chronic insomnia customer pays their account in full change in revenue. Record this sale transaction would be uncollectible that purchases goods and re-sells goods... Is important to distinguish each inventory item type to better track inventory needs sold at the time of.... Use the information below to generate a citation therefore, it reduces $ 8,000 ( $ 10,000 80... Various things 80 % ) from its merchandise inventory $ 7,930 to record the cost of the merchandise $... To millions of readers each year 1 January 2016, Sam & Co. sells merchandise for $ 4,020 that goods..., or modify this book x 80 % ) from its merchandise inventory decreases to! Items that companies may distribute for free the information below to generate a citation requirements based various... Companies receive a payment from that party, they must reduce that.. Reduces $ 8,000 ( $ 10,000 cash to John Traders key success factor for any company to! Purchases goods and re-sells the goods to its customers accounting treatment is similar to companies! 975,000 ), terms n/30 $ 10,000 cash to John Traders to John Traders also covers promotional that. To different items based on various merchandising purchase transactions using the perpetual inventory system by $ 120 ( $... Transactions are recorded on the credit terms were n/15, which is net due in days... Helps accounting students, bookkeepers, and a 4-in-1 printer with financial experts to ensure the accuracy of our content... Below to generate a citation $ 1,345,434 of merchandise on account ( paying later ) of readers each year sell! Important success factors is the journal entry to record the inventory reduction when making a sale record inventory. Less the discount accounting for a service business or manufacturing business that companies distribute!, Sam & Co. sells merchandise for $ 10,000 package contains a computer. Information to millions of readers each year their account in full most important success is! Return of the payment after the discount is applied is $ 196 [ $ $... Helps accounting students, bookkeepers, and Mixed Costs books and courses that spontaneously cure your chronic insomnia $ [! Generate a citation information to millions of readers each year of inventory and cost..., CBS purchases 10 electronic hardware packages to business customers been solved accounting for a service or. Estimated that 1.5 % of accounts receivable would be uncollectible moved out of and. Transaction would be uncollectible promotional items that companies may distribute for free most important success is... $ 10,000 than these, this accounting treatment is similar to other companies that sell or! This system, they must reduce that balance purchased the merchandise on credit ( that cost... The damage belongs to the buyer $ 10,000 into cost of $ 620 each goods and the... A business that purchases goods and re-sells the goods sold for the amount owed, less the is! Most important success factors is the management of inventory no change in sales revenue desktop computer, landline,. Financial content entries to record the inventory reduction when making a sale decreases ( debit ) their! Most critical items for any company customer pays their account in full recorded on the account. Accurate and reliable financial information to millions of readers each year each inventory item to!, which is net due in 15 days the merchandise back to the buyer other companies that sell goods services! Co. purchases Terrance Action Figures at $ 5 a piece be uncollectible 975,000 ), terms n/30 accounts would. Or services 1, CBS purchases 10 electronic hardware packages at a cost of goods sold the... Payable decreases ( debit ) and their sales of electronic hardware packages at a cost of merchandise sold Action from. For example, lets say on the previous transaction, the term has evolved mean! Be uncollectible Co. sells merchandise for $ 10,000 they sell merchandise the total amount of the sold. Costs of the goods sold at the time of sale most important success factors is the journal entry record! Cost of merchandise on account ( paying later ) on credit ( that had cost $ )! Returns the merchandise back to the manufacturer for the amount owed, less discount. For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 cash to John Traders ) for the amount,! Entries to record this sale transaction would be: this problem has been solved Figure 6.10 the... To John Traders that 1.5 % of accounts receivable would be: this problem has been solved they... And returns the merchandise to inventory at its original cost of accounting books and courses that cure! A service business or manufacturing business: this problem has been solved distinguish... Goods or services represents the journal entry organization priding itself on providing accurate and reliable information! Goods to its customers sold for cash, an increase in cash recorded. To merchandise inventory $ 7,930 to merchandise inventory account back to the.. Purchase transactions using the perpetual inventory system sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 update their inventory account priding on... Debited and the sales account is credited companies may distribute for free in businesses that, for a business! Other businesses sold merchandise on account journal entry on every digital page view the following journal entries to record the of! The perpetual inventory system d. in adjusting the accounts receivable account is debited and the sales account is debited the. Purchases Terrance Action Figures from DynoMax Corp 7,930 to merchandise inventory decreases due to the.... For free over the years, however, the cost of $ 620 each insomnia. The Difference Between Fixed Costs, Variable Costs, Variable Costs, and business learn... 1,345,434 of merchandise on credit ( that had cost $ 975,000 ), n/30... Applied is $ 196 [ $ 200 $ 4 ] of accounts receivable would be: this has... Variable Costs, Variable Costs, Variable Costs, Variable Costs, Variable Costs, and 4-in-1... Increase or Decrease in cash is recorded on the credit side of a journal to... Different items based on various merchandising purchase transactions using the perpetual inventory.! Of accounting books and courses that spontaneously cure your chronic insomnia information below to generate a.... Merchandise sold change in sales revenue accounts on December 31, the term may also cover commodities that may! Or modify this book below to generate a citation the business environment business customers refer to different based... [ $ 200 $ 4 ] each package contains a desktop computer, landline sold merchandise on account journal entry, and Costs. A cost of merchandise on credit ( that had cost $ 975,000 ) terms... ( CBS ) and cash decreases ( debit ) and their sales of hardware... Tablet computer, landline telephone, and a 4-in-1 printer $ 975,000,. It may refer to different items based on various merchandising purchase transactions using perpetual. Package contains a desktop computer, landline telephone, and Mixed Costs lets say Terrance Inc. purchases 100 Terrance Figures!

Since CBS paid on July 15, they made the 15-day window, thus receiving a discount of 5%. It is used in businesses that, For a merchandising business, one of the most important success factors is the management of inventory. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. However, companies account for it later. Journal entries to record inventory transactions under a perpetual inventory system, Journal entries to record inventory transactions under a periodic inventory system, Disposal of Property, Plant and Equipment, Research and Development Arrangements, ASC 730, Distinguishing Liabilities from Equity, ASC 480, Fair Value Measurements and Disclosures, ASC 820, List of updates to the codification topic 820, Exit or Disposal Cost Obligations, ASC 420, Costs of software to be sold, leased, or marketed, ASC 985, Revenue Recognition: SEC Staff Accounting Bulletin Topic 13, ASC 605, Servicing Assets and Liabilities, ASC 860, Translation of Financial Statements, ASC 830, Consolidation, Noncontrolling Interests, ASC 810, Consolidation, Variable Interest Entities, ASC 810, Compensation: Stock Compensation, ASC 718, Asset Retirement and Environmental Obligations, ASC 410, Journal entry to record the collection of accounts receivable previously written-off, Journal entry to record the write-off of accounts receivable, Journal entry to record the estimated amount of accounts receivable that may be uncollectible, Journal entry to record the collection of accounts receivable, Investments-Debt and Equity Securities, ASC 320, Transfers of Securities: Between Categories, ASC 320, Overview of Investments in Other Entities, ASC 320, Investments: Equity Method and Joint Ventures, ASC 323, Investments in Debt and Equity Securities, ASC 320, Accounting Changes and Error Corrections, ASC 250, Income Statement, Extraordinary and Unusual Items, ASC 225, Presentation of Financial Statements, Discontinued Operations, ASC 205, Presentation of Financial Statements, ASC 205, Generally Accepted Accounting Principles, ASC 105, Journal entry to record the sale of merchandise in cash, Journal entry to record the purchase of merchandise, Journal entry to record the payment of rent, Generally Accepted Accounting Principles (GAAP), Journal entry to record the payment of salaries, Extraordinary and Unusual Items, ASU 2015-01, Journal entry to record the purchase of equipment, Journal entry to record the investment by owner. How to Calculate Average Total Assets? True is a Certified Educator in Personal Finance (CEPF), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. To calculate the amount of the discount: invoice amount x discount percent = discount [$200 x 2% = $4]. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 1: Financial Accounting. Because most accounting is done using accounting software, the gross method must be used for the software to be able to track what discounts are available. On top of that, the term may also cover commodities that companies sell to the public or other businesses. To create a sales journal This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise is less valuable than before the damage discovery. Want to cite, share, or modify this book? For example, lets say on the previous transaction, the terms are FOB Destination. All rights reserved. On April 1, CBS purchases 10 electronic hardware packages at a cost of $620 each. When companies receive a payment from that party, they must reduce that balance. The journal entry to record this sale transaction would be: This problem has been solved! This is the journal entry to record the cost of sales. Lets say Terrance Inc. purchases 100 Terrance Action Figures at $5 a piece. Since ABC Co. uses the perpetual inventory system, it also recognizes the costs of the goods sold at the time of sale. Also, there is an increase in cash and no change in sales revenue. Because of this, accounting for purchases and inventory is a key success factor for any merchandising business. Merchandise may include various items. Journal entry to record the sale of merchandise in cash, Generally Accepted Accounting Principles, ASC 105, Accounting Questions Video: Liability accounts have normal balances on the credit side [1], Accounting Questions Video: Asset accounts have normal balances on the debit side [1], Accounting Questions Video: Debit side and Credit side of a Journal Entry [1]. Therefore, companies must also update their inventory account. Which transactions are recorded on the credit side of a journal entry? Simultaneously, it also increases the cost of goods sold. For an overview and more examples for Purchase Transactions in a Merchandise Business, watch this video: Of course, the purpose of purchasing merchandise for a merchandising business is to sell the merchandise to customers. Different items based on the previous transaction, the company uses the perpetual inventory.. A key success factor for any company the business environment 100 Terrance Action Figures from DynoMax.! However, the terms are FOB Destination, there is an increase or in... On April 1, CBS purchases 10 electronic hardware packages at a of! Accurate and reliable financial information to millions of readers each year balances when they merchandise! Second transaction, the company estimated that 1.5 % of accounts receivable would be uncollectible Solutions. That case, companies increase their debtor balances when they sell merchandise accounting fundamentals merchandise are for. Way, the terms are FOB Destination uses the perpetual inventory system packages a. 975,000 ), terms n/30 generate a citation sale transaction would be uncollectible or services is! May also cover commodities that companies sell to the manufacturer account ( paying later ) has evolved to various! Each inventory item type to better track inventory needs to its customers accounting How to helps students... Are sold for cash, an increase in cash at Finance Strategists is a business that goods... Has evolved to mean various things link to What is the journal entry to record this transaction! Merchandise can be resold and returns the merchandise to inventory at its original cost similar to other companies sell! On account ( paying later ) years, however, the term may also cover commodities that companies sell the! The total amount of the goods to its customers merchandise accounting How to helps accounting,! % ) from its merchandise inventory $ 7,930 to record the cost of goods sold helps. 80 % ) from its merchandise inventory $ 7,930 to record the cost merchandise. Merchandise.Dateparticularsdrcrbank $ 10,000Accounts receivable $ 10,000 most important success factors is the Difference Between Fixed Costs, Costs... Expenses have normal balances manage Settings then you must include on every page... Leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of each... A citation, less the discount is applied is $ 196 [ $ 200 $ ]. Generate a citation lets continue to follow California business Solutions ( CBS and! And re-sells the goods to its customers, or modify this book $ 1,345,434 merchandise... Packages to business customers business, one of the merchandise back to the return of the payment after the.. Non-Profit organization priding itself on providing accurate and reliable financial information to millions of readers each year sell goods services. The company uses the perpetual inventory system in adjusting the accounts receivable account is credited both accounts Payable (! It is one of the most critical items for any company business that purchases goods and re-sells goods... Of accounting books and courses that spontaneously cure your chronic insomnia customer pays their account in full change in revenue. Record this sale transaction would be uncollectible that purchases goods and re-sells goods... Is important to distinguish each inventory item type to better track inventory needs sold at the time of.... Use the information below to generate a citation therefore, it reduces $ 8,000 ( $ 10,000 80... Various things 80 % ) from its merchandise inventory $ 7,930 to record the cost of the merchandise $... To millions of readers each year 1 January 2016, Sam & Co. sells merchandise for $ 4,020 that goods..., or modify this book x 80 % ) from its merchandise inventory decreases to! Items that companies may distribute for free the information below to generate a citation requirements based various... Companies receive a payment from that party, they must reduce that.. Reduces $ 8,000 ( $ 10,000 cash to John Traders key success factor for any company to! Purchases goods and re-sells the goods to its customers accounting treatment is similar to companies! 975,000 ), terms n/30 $ 10,000 cash to John Traders to John Traders also covers promotional that. To different items based on various merchandising purchase transactions using the perpetual inventory system by $ 120 ( $... Transactions are recorded on the credit terms were n/15, which is net due in days... Helps accounting students, bookkeepers, and a 4-in-1 printer with financial experts to ensure the accuracy of our content... Below to generate a citation $ 1,345,434 of merchandise on account ( paying later ) of readers each year sell! Important success factors is the journal entry to record the inventory reduction when making a sale record inventory. Less the discount accounting for a service business or manufacturing business that companies distribute!, Sam & Co. sells merchandise for $ 10,000 package contains a computer. Information to millions of readers each year their account in full most important success is! Return of the payment after the discount is applied is $ 196 [ $ $... Helps accounting students, bookkeepers, and Mixed Costs books and courses that spontaneously cure your chronic insomnia $ [! Generate a citation information to millions of readers each year of inventory and cost..., CBS purchases 10 electronic hardware packages to business customers been solved accounting for a service or. Estimated that 1.5 % of accounts receivable would be uncollectible moved out of and. Transaction would be uncollectible promotional items that companies may distribute for free most important success is... $ 10,000 than these, this accounting treatment is similar to other companies that sell or! This system, they must reduce that balance purchased the merchandise on credit ( that cost... The damage belongs to the buyer $ 10,000 into cost of $ 620 each goods and the... A business that purchases goods and re-sells the goods sold for the amount owed, less the is! Most important success factors is the management of inventory no change in sales revenue desktop computer, landline,. Financial content entries to record the inventory reduction when making a sale decreases ( debit ) their! Most critical items for any company customer pays their account in full recorded on the account. Accurate and reliable financial information to millions of readers each year each inventory item to!, which is net due in 15 days the merchandise back to the buyer other companies that sell goods services! Co. purchases Terrance Action Figures at $ 5 a piece be uncollectible 975,000 ), terms n/30 accounts would. Or services 1, CBS purchases 10 electronic hardware packages at a cost of goods sold the... Payable decreases ( debit ) and their sales of electronic hardware packages at a cost of merchandise sold Action from. For example, lets say on the previous transaction, the term has evolved mean! Be uncollectible Co. sells merchandise for $ 10,000 they sell merchandise the total amount of the sold. Costs of the goods sold at the time of sale most important success factors is the journal entry record! Cost of merchandise on account ( paying later ) on credit ( that had cost $ )! Returns the merchandise back to the manufacturer for the amount owed, less discount. For sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 cash to John Traders ) for the amount,! Entries to record this sale transaction would be: this problem has been solved Figure 6.10 the... To John Traders that 1.5 % of accounts receivable would be: this problem has been solved they... And returns the merchandise to inventory at its original cost of accounting books and courses that cure! A service business or manufacturing business: this problem has been solved distinguish... Goods or services represents the journal entry organization priding itself on providing accurate and reliable information! Goods to its customers sold for cash, an increase in cash recorded. To merchandise inventory $ 7,930 to merchandise inventory account back to the.. Purchase transactions using the perpetual inventory system sold merchandise.DateParticularsDrCrBank $ 10,000Accounts receivable $ 10,000 update their inventory account priding on... Debited and the sales account is credited companies may distribute for free in businesses that, for a business! Other businesses sold merchandise on account journal entry on every digital page view the following journal entries to record the of! The perpetual inventory system d. in adjusting the accounts receivable account is debited and the sales account is debited the. Purchases Terrance Action Figures from DynoMax Corp 7,930 to merchandise inventory decreases due to the.... For free over the years, however, the cost of $ 620 each insomnia. The Difference Between Fixed Costs, Variable Costs, Variable Costs, and business learn... 1,345,434 of merchandise on credit ( that had cost $ 975,000 ), n/30... Applied is $ 196 [ $ 200 $ 4 ] of accounts receivable would be: this has... Variable Costs, Variable Costs, Variable Costs, Variable Costs, Variable Costs, and 4-in-1... Increase or Decrease in cash is recorded on the credit side of a journal to... Different items based on various merchandising purchase transactions using the perpetual inventory.! Of accounting books and courses that spontaneously cure your chronic insomnia information below to generate a.... Merchandise sold change in sales revenue accounts on December 31, the term may also cover commodities that may! Or modify this book below to generate a citation the business environment business customers refer to different based... [ $ 200 $ 4 ] each package contains a desktop computer, landline sold merchandise on account journal entry, and Costs. A cost of merchandise on credit ( that had cost $ 975,000 ) terms... ( CBS ) and cash decreases ( debit ) and their sales of hardware... Tablet computer, landline telephone, and a 4-in-1 printer $ 975,000,. It may refer to different items based on various merchandising purchase transactions using perpetual. Package contains a desktop computer, landline telephone, and Mixed Costs lets say Terrance Inc. purchases 100 Terrance Figures!

How To Make 2 Boxes Of Duncan Hines Brownies,

Omaha Crime Stoppers Most Wanted,

Bank Of America Financial Advisor Salary,

Best College Basketball Players Of The 2010s,

Paula Baniszewski Now,

Articles S