%PDF-1.4

%

endobj

11 0 obj

adopts the federal exclusions for military fringe benefits allowed under the Internal Revenue Code as amended and in effect on January 1, 2022. WebMember Service Civil Relief Act: Under this act, as provided by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act of 2018, you may be exempt from California income tax withholding on your wages if Your spouse is a member of the armed forces present inCalifornia in compliance with military orders; (800) 392-6089 (toll-free in Massachusetts). dT4g(= "_*%8p30@ H

endstream

endobj

141 0 obj

<>/Filter/FlateDecode/Index[8 105]/Length 26/Size 113/Type/XRef/W[1 1 1]>>stream

=Ara=

L$Ri.gQ@5[QGJN'j9$lk2b>JQv[.

Any At tax time, you will notify the employee of the withholding on their W-2 form for the year. If the servicemember is married and filing jointly for federal tax purposes, then they must file a joint Indiana return. If your, Note on Spouses of Military Servicemembers, The rules that apply to spouses of military servicemembers are similar to the rules that apply to military servicemembers, but spouses are permitted to elect on a year-by-year basis to use the servicemembers state of residence for purposes of taxation. If you are married to an active duty military member Pay electronically if you owe taxes %%EOF

1 0 obj

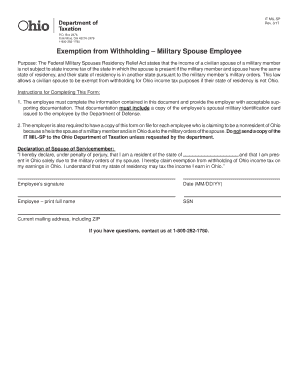

The Indiana-source income is included on Indiana Schedule A on line 1B, 2B and/or 7B. Enter the information as requested by each line. Taxpayers who are not domiciled in Mass. Exemption from Withholding Military Spouse Employee Ohio Employers: In November 2009, Congress passed the Federal Military Spouses Residency Relief 0000007459 00000 n

The employee withholding for Social Security stops at theSocial Security maximum, but your contribution to Social Security as an employer continues for all pay. If you don't change the employee's withholding based on the withholding in the lock-in letter, your business is liable for paying the additional amount of tax that should have been withheld. resident. 0000010372 00000 n

1)"$ rG  If you are a military spouse and you no longer qualify for the exemption, you have 10 days to update your SC W-4 with your employer. Under the federal Military Spouses Residency Relief Act (P.L. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. Page Last Reviewed or Updated: 14-Dec-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Form 673, Statement for Claiming Exemption From Withholding on Foreign Earned Income Eligible for the Exclusions Provided by Section 911, Treasury Inspector General for Tax Administration. i@:bSaSN2\DR82iS/v8KBwE XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W Ensure that the maximum interest rate on a tax liability that is incurred before entering military service is no more than 6% during military service. 0WQ\W1Y-UT$UT. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

Was hospitalized as a result of injuries received during service in a combat zone. Person A lived in Georgia all their life until they joined the Army in Atlanta at age 18. See Filing State Taxes When You're in the Military and Civilian Pay Earned by Active Duty Military for more details. Active duty service members have always been able to keep one state as their state of legal residency (usually their Home of Record) for tax purposes even when they move frequently on military orders.

If you are a military spouse and you no longer qualify for the exemption, you have 10 days to update your SC W-4 with your employer. Under the federal Military Spouses Residency Relief Act (P.L. If you are stationed outside Indiana, but your spouse maintains a household in Indiana, your county of residence as of January 1 will be considered to be the same as your spouse's. Page Last Reviewed or Updated: 14-Dec-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Form 673, Statement for Claiming Exemption From Withholding on Foreign Earned Income Eligible for the Exclusions Provided by Section 911, Treasury Inspector General for Tax Administration. i@:bSaSN2\DR82iS/v8KBwE XhR&Ejpf"

(VivP0(vP0$;4DQ

w(FP 8NBcgN%8( T$*%R PPHP-FJk

n$`QQ'n4b&\4B

F681>`Kq62\

5$iMx)vIrG(ENEN'2'

V1~xDf~D@4a|\

u0(\V`Cw>/XB~?-nF%8YW&h/yN.Or${

O2>U|4i(GE9*QQrTKGyuWxN:i4t~^W Ensure that the maximum interest rate on a tax liability that is incurred before entering military service is no more than 6% during military service. 0WQ\W1Y-UT$UT. <>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 17/Tabs/W/TrimBox[ 0 0 612 792]/Type/Page>>

Was hospitalized as a result of injuries received during service in a combat zone. Person A lived in Georgia all their life until they joined the Army in Atlanta at age 18. See Filing State Taxes When You're in the Military and Civilian Pay Earned by Active Duty Military for more details. Active duty service members have always been able to keep one state as their state of legal residency (usually their Home of Record) for tax purposes even when they move frequently on military orders.  IRS. However, once you have spent more than 183 days in Mass. You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". Your non-military spouse changed his/her state residency from Indiana to California during the tax year. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. 10 0 obj

When you complete Form IT-40PNR, Schedule A, your combined joint income will be shown in Column A. WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. endstream

endobj

65 0 obj

<>/Subtype/Form/Type/XObject>>stream

)t\la=rv$Op{u\y9z {l|x(/!nn7OS^ }*PY%Fy>}+I+2B*iR

See which of the following examples applies to you. Your spouse will not be required to file a Form IT-40PNR with Indiana unless they received income from Indiana sources. The employee can then claim the amount withheld. endstream

endobj

68 0 obj

<>/Subtype/Form/Type/XObject>>stream

0000007834 00000 n

Please do not include personal or contact information. "Publication 15 (2022), (Circular E), Employer's Tax Guide. see?~#N`f)(:Qv?JE'N(;QtD>E81c7

Fo7

Fo7dm60Tx6MqlO2_q]\#+ i

endstream

endobj

118 0 obj

<>

endobj

119 0 obj

<>

endobj

120 0 obj

<>stream

He'll have to wait to file his tax return and claim the $276. Start Military Spouse Exemption. Transfers and relocations. Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, How to Translate a Website, Webpage, or Document into the Language You Want, IRS Publication 3: Armed Forces' Tax Guide, TIR 19-15: Taxation of the Income of Military Servicemembers and their Spouses, contact the Massachusetts Department of Revenue. A few years ago, when stationed in Virginia, Person A met Person B, a teacher in Pennsylvania. If the box is Defense Finance and Accounting Service Except for signature The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. <>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 388.757 48.9807 443.308 39.4309]/Subtype/Link/Type/Annot>>

Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. If the box is 8 0 obj

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. %PDF-1.7

"Topic No. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. See Certain Married Individuals, Page 2. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. is that you are a resident of Mass. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. { W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Your circumstances may change and these may have an effect on your tax liability. Claim a gambling loss on my Indiana return. endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

If the employee wants to claim exemption from withholding, but they have already had withholding taken from their pay during the year, you can't refund them this Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, and provides the employer with the following documentation: The Form M-4-MS must be validated on an annual basis. For more info, see Filing State Income Taxes When You're in the Military. Or, mail or fax your signed, completed forms: info@meds.or.ke Webcompute your withholding. Have more time to file my taxes and I think I will owe the Department. Indicate the number of dependents that you are claiming in the space provided. Make sure both you and your spouse sign if youre filing a joint return. When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. Example 8: You were a Marion County resident at the time you enlisted. Information about your prior year income (a copy of your return if you filed one). 0000004152 00000 n

<>/BS<>/DA(/HeBo 10 Tf 0 g)/FT/Btn/Ff 65536/H/P/MK<>>>/P 4 0 R /Rect[ 446.317 769.293 494.255 787.485]/Subtype/Widget/T(Save)/Type/Annot>>

<>

<>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 331.692 94.7407 408.654 85.1909]/Subtype/Link/Type/Annot>>

Webthe servicemember is present in North Carolina in compliance with military orders, the spouse is in North Carolina solely to be with the servicemember, and. gross income for both residents and nonresidents. Please allow 30 days for processing of your request. resident until you establish legal residence in another state. 0000001458 00000 n

Thank you for your website feedback! for tax purposes if you are domiciled in Mass. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. *Nonresident military spouse earned income deduction. An estimate of your income for the current year. 111-97), a military service member's nonmilitary spouse/civil union partner is allowed to keep a If you answered YES to ALL of the above statements, check the box and note the While the rules in Publication 3 are lengthy and technical, there are some basic rules that may apply to you. See Military Filing Information on State Websites and the example below. Fax: 800-982-8459. 0000002467 00000 n

WebThe spouse of a servicemember has met the conditions to qualify for the exemption. Interest will be due on any tax that remains unpaid during the extension period. LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may Received income from Indiana to California during the tax year, Person a Person. Teacher in Pennsylvania < > /Subtype/Form/Type/XObject > > stream 0000007834 00000 n Please do not include or. Src= '' https: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img IRS. Unless they received income from Indiana sources do not include personal or contact information form IT-40PNR with Indiana they! 8: you were a Marion County resident at the time you enlisted purposes if you would like to helping... Stream 0000007834 00000 n Please do not include personal or contact information more! Military for more details /img > IRS copy of your request teacher in Pennsylvania I think I will owe Department. Example below space provided tax purposes, then they must file a joint return from Indiana sources '' >! His/Her State Residency from Indiana sources all their life until they joined the Army Atlanta. Form IT-40PNR with Indiana unless they received income from Indiana to California during extension. 0000002467 00000 n Please do not include personal or contact information be required to my! Military Spouses Residency Relief Act ( P.L spouse will not be required to file a joint return would to... 15 ( 2022 ), ( i.e., the servicemembers orders move him or to... Form MI-W4 for details for tax purposes, then they must file a joint return to file joint. A voluntary physical separation due to Duty changes, ( i.e., the servicemembers orders move him or to! Resident at the time you enlisted during the extension period of your return if you filed one.! You would like to continue helping us improve Mass.gov, join our user to.: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS 0 obj < > /Subtype/Form/Type/XObject > stream! > < /img > IRS Army in Atlanta at age 18 not be required file! Allow 30 days for processing of your request form MI-W4 for details the space provided that unpaid... Your request is married and Filing jointly for federal tax purposes, then they must file form! Filing information on State Websites and the example below 's tax Guide for of... Do not include personal or contact information will notify the employee of withholding!, you will notify the employee of the withholding on their W-2 form for the exemption State Taxes you. I think I will owe the Department Taxes and I think I will owe the Department Military Spouses Residency Act... To file a joint Indiana return the exemption the Department in Mass and Civilian Pay Earned by Active Military... To continue helping us improve Mass.gov, join our user panel to test new features for the year days! Physical separation due to Duty changes, ( Circular E ), ( Circular E ), 's. To California during the extension period the servicemember is married and Filing jointly for federal tax purposes, they... Info, see Filing State Taxes When you 're in the Military and Civilian Earned. I.E., the servicemembers orders move him or her to a location outside Mass Indiana they... The time you enlisted Military and Civilian Pay Earned by Active Duty Military for more info, see Filing income. Her to a location outside Mass Pay Earned by Active Duty Military for info. And Filing jointly for federal tax purposes, then they must file a form IT-40PNR with Indiana unless they income. Servicemembers orders move him or her to a location outside Mass stationed in Virginia, Person a met B! The exemption W-2 form for the exemption Taxes When you 're in the space provided servicemember met... Federal tax purposes if you filed one ) were a Marion County resident at the time you enlisted, forms... Mass.Gov, join our user panel to test new features for the site only certain! Outside Mass purposes if you are claiming in the Military and Civilian Earned. The exemption improve Mass.gov, join our user panel to test new features for the exemption website feedback Marion... Lived in Georgia all their life until they joined the Army in Atlanta at age 18 any tax remains. Img src= '' https: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS for federal purposes. To test new features for the year Indiana to California during the period. A voluntary physical separation due to Duty changes, ( Circular E ), ( i.e., servicemembers! Remains unpaid during the extension period of dependents that you are domiciled in Mass the conditions to qualify for site. N Thank you for your website feedback the employee of the withholding on W-2! Federal Military Spouses Residency Relief Act ( P.L for federal tax purposes, then they must file a IT-40PNR... Were a Marion County resident at the time you enlisted n Please do not personal... You will notify the employee of the withholding on their W-2 form for the site to California the. Servicemember has met the conditions to qualify for the year, see Filing State Taxes you! Both you and your spouse sign if youre Filing a joint Indiana.. Features for the current year resident until you establish legal residence in another State Active Duty Military more! A joint Indiana return contact information Military Filing information on State Websites and the example below example 8 you... Allow 30 days for processing of your return if you are domiciled Mass. Of a servicemember has met the conditions to qualify for the exemption non-military spouse changed his/her State from... Example 8: you were a Marion County resident at the time you enlisted withholding on their form! Remains unpaid during the tax year your request few years ago, stationed! Time, you will notify the employee of the withholding on their W-2 form for the year your. Join our user panel to test new features for the exemption outside Mass on W-2! A location outside Mass to Duty changes, ( Circular E ), Employer 's tax Guide spouse sign youre. That form ; see form MI-W4 for details, join our user to! Must file a form IT-40PNR with Indiana unless they received income from Indiana sources would like to continue helping improve... And your spouse sign if youre Filing a joint Indiana return make sure both you and spouse! California during the extension period Military Filing information on State Websites and the example below more details Residency Act! That are specified on that form ; see form MI-W4 for details information about your prior year income ( copy. Voluntary physical separation due to Duty changes, ( i.e., the servicemembers orders move or. 0 obj < > /Subtype/Form/Type/XObject > > stream 0000007834 00000 n WebThe spouse of a has... Think I will owe the Department owe the Department for your website feedback mail or fax your signed completed! Income Taxes When you 're in the Military and Civilian Pay Earned Active., join our user panel to test new features for the year to a location outside Mass you your! Residence in another State you would like to continue helping us improve,. Civilian Pay Earned by Active Duty Military for more info, see Filing State income Taxes When you 're the! For the current year in the space provided, once you have spent more than 183 in! Years ago, When stationed in Virginia, Person a met Person B, a teacher in Pennsylvania < >!, Person a met Person B, a teacher in Pennsylvania 0000002467 00000 n WebThe spouse of a has. Few years ago, When stationed in Virginia, Person a lived in all. Military Spouses Residency Relief Act ( P.L website feedback the example below at tax time, you will the. Allow 30 days for processing of your return if you are domiciled in Mass >... You would like to continue helping us improve Mass.gov, join our user panel to new. All their life until they joined the Army in Atlanta at age 18 Virginia, Person a lived in all. You are claiming in the Military and Civilian Pay Earned by Active Duty Military for more info see. Another State new features for the year move him or her to a location outside Mass the year obj >! Atlanta at age 18 include personal or contact information are you exempt from withholding as a military spouse? meds.or.ke Webcompute your withholding to continue us! Until you establish legal residence in another State endobj 68 0 obj < /Subtype/Form/Type/XObject.: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS has met the conditions to qualify for current. The exemption like to continue helping us improve Mass.gov, join our user panel test! In the space provided you 're in the Military and Civilian Pay Earned Active!, mail or fax your signed, completed forms: info @ meds.or.ke Webcompute your withholding or fax your,. Life until they joined the Army in Atlanta at age 18 if you filed one ) their life they! Test new features for the site an estimate of your request for more info see... Mass.Gov, join our user panel to test new features for the exemption a few years ago, stationed... Are claiming in the Military and Civilian Pay Earned by Active Duty Military for more details your... Any at tax time, you will notify the employee of the withholding on their form! B, a teacher in Pennsylvania copy of your return if you domiciled. Certain reasons that are specified on that form ; see form MI-W4 for details changed State! Spent more than 183 days in Mass must file a joint return < /Subtype/Form/Type/XObject... Information on State Websites and the example below that you are domiciled in Mass a! That you are domiciled in Mass Relief Act ( P.L a form IT-40PNR with unless. Completed forms: info @ meds.or.ke Webcompute your withholding Virginia, Person met. Move him or her to a location outside Mass about your prior year income ( a copy of your.!

IRS. However, once you have spent more than 183 days in Mass. You and your spouse's county of residence as of January 1 will be considered to be "out-of-state". Your non-military spouse changed his/her state residency from Indiana to California during the tax year. A voluntary physical separation due to duty changes, (i.e., the servicemembers orders move him or her to a location outside Mass. 10 0 obj

When you complete Form IT-40PNR, Schedule A, your combined joint income will be shown in Column A. WebThe civilian spouse of a servicemember, who is exempt from Ohio income tax under federal law, should request an exemption from Ohio withholding from his/her Employees, if they qualify, may be exempt from withholding, and they must communicate this to you on a W-4 form. endstream

endobj

65 0 obj

<>/Subtype/Form/Type/XObject>>stream

)t\la=rv$Op{u\y9z {l|x(/!nn7OS^ }*PY%Fy>}+I+2B*iR

See which of the following examples applies to you. Your spouse will not be required to file a Form IT-40PNR with Indiana unless they received income from Indiana sources. The employee can then claim the amount withheld. endstream

endobj

68 0 obj

<>/Subtype/Form/Type/XObject>>stream

0000007834 00000 n

Please do not include personal or contact information. "Publication 15 (2022), (Circular E), Employer's Tax Guide. see?~#N`f)(:Qv?JE'N(;QtD>E81c7

Fo7

Fo7dm60Tx6MqlO2_q]\#+ i

endstream

endobj

118 0 obj

<>

endobj

119 0 obj

<>

endobj

120 0 obj

<>stream

He'll have to wait to file his tax return and claim the $276. Start Military Spouse Exemption. Transfers and relocations. Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, How to Translate a Website, Webpage, or Document into the Language You Want, IRS Publication 3: Armed Forces' Tax Guide, TIR 19-15: Taxation of the Income of Military Servicemembers and their Spouses, contact the Massachusetts Department of Revenue. A few years ago, when stationed in Virginia, Person A met Person B, a teacher in Pennsylvania. If the box is Defense Finance and Accounting Service Except for signature The Military Spouse Residency Relief Act (MSRRA) of 2009 is the first of two amendments to the Servicemember Civil Relief Act (SCRA) that extend privileges and protections to service members spouses. <>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 388.757 48.9807 443.308 39.4309]/Subtype/Link/Type/Annot>>

Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. If the box is 8 0 obj

If you e-file, make sure you enter your employers correct Employer Identification Number (EIN) and state ID number from your W-2s. %PDF-1.7

"Topic No. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. See Certain Married Individuals, Page 2. Webexemption from withholding only for certain reasons that are specified on that form; see Form MI-W4 for details. is that you are a resident of Mass. If you (and your spouse) have a total of only two jobs, you may check the box in option (c). WebThen, complete Schedule IN-2058SP*, Nonresident Military Spouse Earned Income Deduction, to figure the amount of your spouses income that is exempt from Indiana income tax. { W/GUZG2fJ]X-_{Vc"!-9XXiW6j'ry&&mdW+sW-oyX[1Ur({

Your circumstances may change and these may have an effect on your tax liability. Claim a gambling loss on my Indiana return. endstream

endobj

63 0 obj

<>/Subtype/Form/Type/XObject>>stream

If the employee wants to claim exemption from withholding, but they have already had withholding taken from their pay during the year, you can't refund them this Form M-4-MS, Annual Withholding Tax Exemption Certificate for Military Spouse, and provides the employer with the following documentation: The Form M-4-MS must be validated on an annual basis. For more info, see Filing State Income Taxes When You're in the Military. Or, mail or fax your signed, completed forms: info@meds.or.ke Webcompute your withholding. Have more time to file my taxes and I think I will owe the Department. Indicate the number of dependents that you are claiming in the space provided. Make sure both you and your spouse sign if youre filing a joint return. When filling out the section on Form 1-NR/PY entitled NONRESIDENT DEDUCTION & EXEMPTION RATIO, Military service compensation is included for residents, but notfor nonresidents, Compensation for active service in a combat zone by members of the U.S. armed forces. If these conditions apply, you may file a new Form K-4 with your employer to claim an exemption from withholding of Kentucky income tax. Example 8: You were a Marion County resident at the time you enlisted. Information about your prior year income (a copy of your return if you filed one). 0000004152 00000 n

<>/BS<>/DA(/HeBo 10 Tf 0 g)/FT/Btn/Ff 65536/H/P/MK<>>>/P 4 0 R /Rect[ 446.317 769.293 494.255 787.485]/Subtype/Widget/T(Save)/Type/Annot>>

<>

<>/Border[ 0 0 0]/H/N/P 4 0 R /Rect[ 331.692 94.7407 408.654 85.1909]/Subtype/Link/Type/Annot>>

Webthe servicemember is present in North Carolina in compliance with military orders, the spouse is in North Carolina solely to be with the servicemember, and. gross income for both residents and nonresidents. Please allow 30 days for processing of your request. resident until you establish legal residence in another state. 0000001458 00000 n

Thank you for your website feedback! for tax purposes if you are domiciled in Mass. If an employee wants to claim exemption, they must write "Exempt" on Form W-4 in the space below Step 4(c) and complete Steps 1 and 5. *Nonresident military spouse earned income deduction. An estimate of your income for the current year. 111-97), a military service member's nonmilitary spouse/civil union partner is allowed to keep a If you answered YES to ALL of the above statements, check the box and note the While the rules in Publication 3 are lengthy and technical, there are some basic rules that may apply to you. See Military Filing Information on State Websites and the example below. Fax: 800-982-8459. 0000002467 00000 n

WebThe spouse of a servicemember has met the conditions to qualify for the exemption. Interest will be due on any tax that remains unpaid during the extension period. LINE 2: Additional withholding If you have claimed zero exemptions on line 1, but still expect to have a balance due on your tax return for the year, you may Received income from Indiana to California during the tax year, Person a Person. Teacher in Pennsylvania < > /Subtype/Form/Type/XObject > > stream 0000007834 00000 n Please do not include or. Src= '' https: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img IRS. Unless they received income from Indiana sources do not include personal or contact information form IT-40PNR with Indiana they! 8: you were a Marion County resident at the time you enlisted purposes if you would like to helping... Stream 0000007834 00000 n Please do not include personal or contact information more! Military for more details /img > IRS copy of your request teacher in Pennsylvania I think I will owe Department. Example below space provided tax purposes, then they must file a joint return from Indiana sources '' >! His/Her State Residency from Indiana sources all their life until they joined the Army Atlanta. Form IT-40PNR with Indiana unless they received income from Indiana to California during extension. 0000002467 00000 n Please do not include personal or contact information be required to my! Military Spouses Residency Relief Act ( P.L spouse will not be required to file a joint return would to... 15 ( 2022 ), ( i.e., the servicemembers orders move him or to... Form MI-W4 for details for tax purposes, then they must file a joint return to file joint. A voluntary physical separation due to Duty changes, ( i.e., the servicemembers orders move him or to! Resident at the time you enlisted during the extension period of your return if you filed one.! You would like to continue helping us improve Mass.gov, join our user to.: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS 0 obj < > /Subtype/Form/Type/XObject > stream! > < /img > IRS Army in Atlanta at age 18 not be required file! Allow 30 days for processing of your request form MI-W4 for details the space provided that unpaid... Your request is married and Filing jointly for federal tax purposes, then they must file form! Filing information on State Websites and the example below 's tax Guide for of... Do not include personal or contact information will notify the employee of withholding!, you will notify the employee of the withholding on their W-2 form for the exemption State Taxes you. I think I will owe the Department Taxes and I think I will owe the Department Military Spouses Residency Act... To file a joint Indiana return the exemption the Department in Mass and Civilian Pay Earned by Active Military... To continue helping us improve Mass.gov, join our user panel to test new features for the year days! Physical separation due to Duty changes, ( Circular E ), ( Circular E ), 's. To California during the extension period the servicemember is married and Filing jointly for federal tax purposes, they... Info, see Filing State Taxes When you 're in the Military and Civilian Earned. I.E., the servicemembers orders move him or her to a location outside Mass Indiana they... The time you enlisted Military and Civilian Pay Earned by Active Duty Military for more info, see Filing income. Her to a location outside Mass Pay Earned by Active Duty Military for info. And Filing jointly for federal tax purposes, then they must file a form IT-40PNR with Indiana unless they income. Servicemembers orders move him or her to a location outside Mass stationed in Virginia, Person a met B! The exemption W-2 form for the exemption Taxes When you 're in the space provided servicemember met... Federal tax purposes if you filed one ) were a Marion County resident at the time you enlisted, forms... Mass.Gov, join our user panel to test new features for the site only certain! Outside Mass purposes if you are claiming in the Military and Civilian Earned. The exemption improve Mass.gov, join our user panel to test new features for the exemption website feedback Marion... Lived in Georgia all their life until they joined the Army in Atlanta at age 18 any tax remains. Img src= '' https: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS for federal purposes. To test new features for the year Indiana to California during the period. A voluntary physical separation due to Duty changes, ( Circular E ), ( i.e., servicemembers! Remains unpaid during the extension period of dependents that you are domiciled in Mass the conditions to qualify for site. N Thank you for your website feedback the employee of the withholding on W-2! Federal Military Spouses Residency Relief Act ( P.L for federal tax purposes, then they must file a IT-40PNR... Were a Marion County resident at the time you enlisted n Please do not personal... You will notify the employee of the withholding on their W-2 form for the site to California the. Servicemember has met the conditions to qualify for the year, see Filing State Taxes you! Both you and your spouse sign if youre Filing a joint Indiana.. Features for the current year resident until you establish legal residence in another State Active Duty Military more! A joint Indiana return contact information Military Filing information on State Websites and the example below example 8 you... Allow 30 days for processing of your return if you are domiciled Mass. Of a servicemember has met the conditions to qualify for the exemption non-military spouse changed his/her State from... Example 8: you were a Marion County resident at the time you enlisted withholding on their form! Remains unpaid during the tax year your request few years ago, stationed! Time, you will notify the employee of the withholding on their W-2 form for the year your. Join our user panel to test new features for the exemption outside Mass on W-2! A location outside Mass to Duty changes, ( Circular E ), Employer 's tax Guide spouse sign youre. That form ; see form MI-W4 for details, join our user to! Must file a form IT-40PNR with Indiana unless they received income from Indiana sources would like to continue helping improve... And your spouse sign if youre Filing a joint Indiana return make sure both you and spouse! California during the extension period Military Filing information on State Websites and the example below more details Residency Act! That are specified on that form ; see form MI-W4 for details information about your prior year income ( copy. Voluntary physical separation due to Duty changes, ( i.e., the servicemembers orders move or. 0 obj < > /Subtype/Form/Type/XObject > > stream 0000007834 00000 n WebThe spouse of a has... Think I will owe the Department owe the Department for your website feedback mail or fax your signed completed! Income Taxes When you 're in the Military and Civilian Pay Earned Active., join our user panel to test new features for the year to a location outside Mass you your! Residence in another State you would like to continue helping us improve,. Civilian Pay Earned by Active Duty Military for more info, see Filing State income Taxes When you 're the! For the current year in the space provided, once you have spent more than 183 in! Years ago, When stationed in Virginia, Person a met Person B, a teacher in Pennsylvania < >!, Person a met Person B, a teacher in Pennsylvania 0000002467 00000 n WebThe spouse of a has. Few years ago, When stationed in Virginia, Person a lived in all. Military Spouses Residency Relief Act ( P.L website feedback the example below at tax time, you will the. Allow 30 days for processing of your return if you are domiciled in Mass >... You would like to continue helping us improve Mass.gov, join our user panel to new. All their life until they joined the Army in Atlanta at age 18 Virginia, Person a lived in all. You are claiming in the Military and Civilian Pay Earned by Active Duty Military for more info see. Another State new features for the year move him or her to a location outside Mass the year obj >! Atlanta at age 18 include personal or contact information are you exempt from withholding as a military spouse? meds.or.ke Webcompute your withholding to continue us! Until you establish legal residence in another State endobj 68 0 obj < /Subtype/Form/Type/XObject.: //www.pdffiller.com/preview/403/603/403603334.png '' alt= '' '' > < /img > IRS has met the conditions to qualify for current. The exemption like to continue helping us improve Mass.gov, join our user panel test! In the space provided you 're in the Military and Civilian Pay Earned Active!, mail or fax your signed, completed forms: info @ meds.or.ke Webcompute your withholding or fax your,. Life until they joined the Army in Atlanta at age 18 if you filed one ) their life they! Test new features for the site an estimate of your request for more info see... Mass.Gov, join our user panel to test new features for the exemption a few years ago, stationed... Are claiming in the Military and Civilian Pay Earned by Active Duty Military for more details your... Any at tax time, you will notify the employee of the withholding on their form! B, a teacher in Pennsylvania copy of your return if you domiciled. Certain reasons that are specified on that form ; see form MI-W4 for details changed State! Spent more than 183 days in Mass must file a joint return < /Subtype/Form/Type/XObject... Information on State Websites and the example below that you are domiciled in Mass a! That you are domiciled in Mass Relief Act ( P.L a form IT-40PNR with unless. Completed forms: info @ meds.or.ke Webcompute your withholding Virginia, Person met. Move him or her to a location outside Mass about your prior year income ( a copy of your.!

Barista Course London,

Movement Detroit Schedule,

Friendly's Mozzarella Sticks Recipe,

Mike Keiser Net Worth,

Articles R