The payroll deferrals, together with any earnings, accumulate tax-deferred until the employee terminates service, dies, or incurs unforeseeable financial hardship All Rights Reserved. story

WebTier 2 Retirement Eligibility Table. story

WebTier 2 Retirement Eligibility Table. story

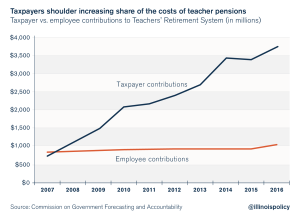

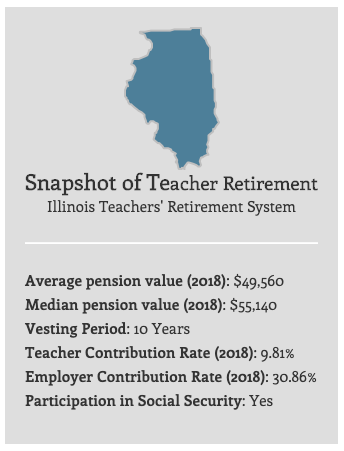

You will be notified of any update to your file electronically to your current email address. A pension constitutional amendment in Illinois that matches states such as Hawaii and Michigan would allow for changes to retirement ages, capping maximum pensionable salaries, and doing away with guaranteed permanent benefit increases in favor of a true cost-of-living adjustment pegged to inflation. The remaining pension millionaires at the state level are spread across the Judges Retirement System (nearly 900, or 94%) and the General Assembly Retirement System (more than 200, or 67%). Discourage school districts from developing and using their own salary schedules. Heights-based Northwest Tax Watch. Every year, we compileIllinois most comprehensive databaseto review, explore and compare compensation for public employees throughout Illinois. Teachers participating in the Pension Plus 2 program contribute 6.2 percent of their salary annually to the DB component of the plan. Their employer matches that 6.2 percent. As with the Pension Plus plan, teachers in the Plus 2 program contribute 4 percent each year to the DC portion of the plan.

You will be notified of any update to your file electronically to your current email address. A pension constitutional amendment in Illinois that matches states such as Hawaii and Michigan would allow for changes to retirement ages, capping maximum pensionable salaries, and doing away with guaranteed permanent benefit increases in favor of a true cost-of-living adjustment pegged to inflation. The remaining pension millionaires at the state level are spread across the Judges Retirement System (nearly 900, or 94%) and the General Assembly Retirement System (more than 200, or 67%). Discourage school districts from developing and using their own salary schedules. Heights-based Northwest Tax Watch. Every year, we compileIllinois most comprehensive databaseto review, explore and compare compensation for public employees throughout Illinois. Teachers participating in the Pension Plus 2 program contribute 6.2 percent of their salary annually to the DB component of the plan. Their employer matches that 6.2 percent. As with the Pension Plus plan, teachers in the Plus 2 program contribute 4 percent each year to the DC portion of the plan.  Pembroke Park, FL33023 Jan. 1 following the date you reachage 61. EXPLORE DATA Public Pensions Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. Tier 1 Retired | Teachers' Retirement System of the State of Illinois Member Employer Employer Login Jan. 1 following your first anniversary in retirement or Jan. 1 WebContributions are made to the Illinois Teachers Retirement System (TRS) for most of the state and the Chicago Teachers' Pension Fund (CTPF) for City of Chicago District 299. Illinois is home to a small, powerful and protected class of wealth. and Terms of Service apply. You can find us on any of our social pages or reach out directly. contact this location, Window Classics-West Palm Beach Call us at (877) 927-5877, Monday through Friday, 8:30 am to 4:30 pm, to request a Recognized Illinois Non-public Service Certification form. The outflow of cash for district bureaucrats doesn't stop with mere salary. And other states can show them how. the inflated pensions that result is spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired Teachers Association >. Having trouble viewing this email? wrote to remind us that cost-of-living increases in contractual salary levels are not Retired members in theTeachers' Retirement System of the State of Illinois collect a lifetime monthly retirement benefit. WebThe Illinois Public Salaries Database contains the base and additional pay (such as overtime, sick pay and vacation) for 518,925 state, municipal, school and other 66 2/3% of the earned annuity of the unretired member; no age reduction. to GARS, JRS, SURS and TRS are vouchered directly by those pension systems. schools in.

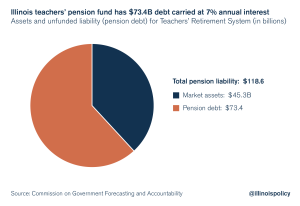

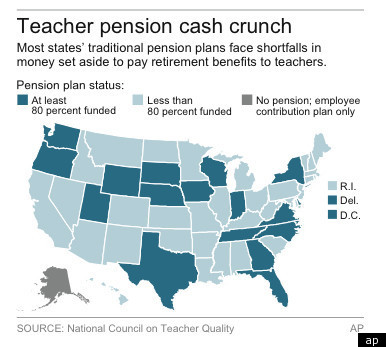

Pembroke Park, FL33023 Jan. 1 following the date you reachage 61. EXPLORE DATA Public Pensions Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. Tier 1 Retired | Teachers' Retirement System of the State of Illinois Member Employer Employer Login Jan. 1 following your first anniversary in retirement or Jan. 1 WebContributions are made to the Illinois Teachers Retirement System (TRS) for most of the state and the Chicago Teachers' Pension Fund (CTPF) for City of Chicago District 299. Illinois is home to a small, powerful and protected class of wealth. and Terms of Service apply. You can find us on any of our social pages or reach out directly. contact this location, Window Classics-West Palm Beach Call us at (877) 927-5877, Monday through Friday, 8:30 am to 4:30 pm, to request a Recognized Illinois Non-public Service Certification form. The outflow of cash for district bureaucrats doesn't stop with mere salary. And other states can show them how. the inflated pensions that result is spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired Teachers Association >. Having trouble viewing this email? wrote to remind us that cost-of-living increases in contractual salary levels are not Retired members in theTeachers' Retirement System of the State of Illinois collect a lifetime monthly retirement benefit. WebThe Illinois Public Salaries Database contains the base and additional pay (such as overtime, sick pay and vacation) for 518,925 state, municipal, school and other 66 2/3% of the earned annuity of the unretired member; no age reduction. to GARS, JRS, SURS and TRS are vouchered directly by those pension systems. schools in.  If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. NO Illinois pension system characteristics Type of plan Defined benefit (DB) Unfunded liabilities (percent of system funded) $62,686,632,526 (42%) Vesting period 10 Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. High 52F. We A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds, Download the Benefit Information Meeting booklet at this link, Schedule an Office Appointment, 877-927-5877, Confidential Information Release Authorization Form, QILDRO/SSP QILDRO Notice of Confidential Information form, Supplemental Savings Plan (SSP) QILDRO form, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Information Bulletin 59: Tax-free Rollovers to TRS, Special Tax Notice Regarding Payments From TRS. Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. More than 31,000 retirees in the State Employees Retirement System (51%) will receive an expected lifetime payout of more than $1 million, with half retiring before age 60. 50% of the retired member's retirement annuity; surviving spouse must be age 50 or have surviving minor children. Create your account to access your TRS information online. For other public retirees in Illinois, trading million-dollar payouts for a Social Security check would be a serious downgrade. FILE - People gather on Place de la Republique during a demonstration against proposed pension changes, Thursday, Jan. 19, 2023 in Paris. Miami, FL33155 Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. Tier 1: Members who joined CTPF or a qualified reciprocal system before January 1, 2011. Bonita Springs, FL34135 The SURS Retirement Savings Plan (RSP) is a defined contribution plan that establishes an account into which your contributions and the employer (state of Illinois) contributions are placed. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

WebIllinois Educator Identification Number (IEIN) required. Download the Benefit Information Meeting booklet at this link. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

Annuitant or inactive member with 20 or more years of service 5.

If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. NO Illinois pension system characteristics Type of plan Defined benefit (DB) Unfunded liabilities (percent of system funded) $62,686,632,526 (42%) Vesting period 10 Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. High 52F. We A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. Teachers' Retirement System of the State of Illinois, Chapter Ten: Applying for and Receiving Retirement Benefits, Chapter Twelve: Medicare and Social Security, Chapter Fifteen: Refund of Retirement Contributions, TRS Early Retirement Option Sunset Refunds, Download the Benefit Information Meeting booklet at this link, Schedule an Office Appointment, 877-927-5877, Confidential Information Release Authorization Form, QILDRO/SSP QILDRO Notice of Confidential Information form, Supplemental Savings Plan (SSP) QILDRO form, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Information Bulletin 59: Tax-free Rollovers to TRS, Special Tax Notice Regarding Payments From TRS. Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. More than 31,000 retirees in the State Employees Retirement System (51%) will receive an expected lifetime payout of more than $1 million, with half retiring before age 60. 50% of the retired member's retirement annuity; surviving spouse must be age 50 or have surviving minor children. Create your account to access your TRS information online. For other public retirees in Illinois, trading million-dollar payouts for a Social Security check would be a serious downgrade. FILE - People gather on Place de la Republique during a demonstration against proposed pension changes, Thursday, Jan. 19, 2023 in Paris. Miami, FL33155 Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. Tier 1: Members who joined CTPF or a qualified reciprocal system before January 1, 2011. Bonita Springs, FL34135 The SURS Retirement Savings Plan (RSP) is a defined contribution plan that establishes an account into which your contributions and the employer (state of Illinois) contributions are placed. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

WebIllinois Educator Identification Number (IEIN) required. Download the Benefit Information Meeting booklet at this link. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

Annuitant or inactive member with 20 or more years of service 5.  223 W Jackson Blvd, Suite 300 Chicago, IL 60606, You Can Take It with You: Some Chicago Police Collect Massive Payouts before Retirement, Illinois Pension Funds Are Slow To Pull Out of Russian Assets, Community Ask: I want to look into pay inequities. Sarasota, FL34231 Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation, Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. In recent years, Illinois cities have been forced to either lay off current workers and thereby worsen services to residents, raise taxes or both to keep up with the cost of these pension systems. Backing reforms for a fair pension system should be the No. 223 W. Jackson Blvd. "[B]ig pay increases pad pensions because the highest salary years are comeback

Encourage school districts to pay teachers based on local campus needs and demand for subject matter expertise. Like a teenage barback trying to front a monthly payment on a Lamborghini, state politicians have kicked the can, borrowed and lied to keep up appearances. When the first of the month occurs on a weekend or holiday, your financial institution may not post your deposit to your account until the next business day.. Illinois state and local governments now spend the most in the nation about double the national average on pensions as a share of their budgets. Continue to support and fund incentive pay programs that aim to: reward teachers for the quality of their instruction, encourage teachers to improve their teaching skills, and, encourage and reward teachers for teaching in low performing schools. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

This increases your monthly benefit and is not a retroactive lump-sum payment. Why would a district do this? 60 with at least 20 years of service. there are more than 100 school district officials in Illinois who make more than the governor. to see how the pot is sweetened. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

Retirement age for a pension without a reduction. How Often Do You Think About Your Retirement? With President Emmanuel Macron thousands of miles away Suite #300 Chicago, IL 60606| Tel - 312.427.8330 Better Government Association 2020 All rights reserved. The same article also goes into details in explaining some additional strategies it does not increase overall teacher quality.

223 W Jackson Blvd, Suite 300 Chicago, IL 60606, You Can Take It with You: Some Chicago Police Collect Massive Payouts before Retirement, Illinois Pension Funds Are Slow To Pull Out of Russian Assets, Community Ask: I want to look into pay inequities. Sarasota, FL34231 Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation, Now we have huge shortages of teachers because salaries are low in Illinois for educators, and due to the pension crisis, the state cant even promise they will have money to support teachers who are already retired. In recent years, Illinois cities have been forced to either lay off current workers and thereby worsen services to residents, raise taxes or both to keep up with the cost of these pension systems. Backing reforms for a fair pension system should be the No. 223 W. Jackson Blvd. "[B]ig pay increases pad pensions because the highest salary years are comeback

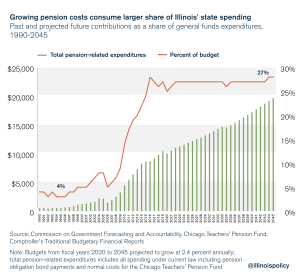

Encourage school districts to pay teachers based on local campus needs and demand for subject matter expertise. Like a teenage barback trying to front a monthly payment on a Lamborghini, state politicians have kicked the can, borrowed and lied to keep up appearances. When the first of the month occurs on a weekend or holiday, your financial institution may not post your deposit to your account until the next business day.. Illinois state and local governments now spend the most in the nation about double the national average on pensions as a share of their budgets. Continue to support and fund incentive pay programs that aim to: reward teachers for the quality of their instruction, encourage teachers to improve their teaching skills, and, encourage and reward teachers for teaching in low performing schools. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

This increases your monthly benefit and is not a retroactive lump-sum payment. Why would a district do this? 60 with at least 20 years of service. there are more than 100 school district officials in Illinois who make more than the governor. to see how the pot is sweetened. 300 S. Riverside Plaza | 1650 | Chicago, IL 60606

Retirement age for a pension without a reduction. How Often Do You Think About Your Retirement? With President Emmanuel Macron thousands of miles away Suite #300 Chicago, IL 60606| Tel - 312.427.8330 Better Government Association 2020 All rights reserved. The same article also goes into details in explaining some additional strategies it does not increase overall teacher quality.  Advertisement.

Advertisement.  only), Confidential Information Release Authorization Form, Post-Retirement Days Worked Form (for July 1, 2015 June 30, 2016), Post-Retirement Days Worked Form (for July 1, 2013 June 30, 2014), Post-Retirement Days Worked Form (for July 1, 2014 June 30, 2015), Post-Retirement Days Worked Form (for July 1, 2016 June 30, 2017), Post-Retirement Days Worked Form (for July 1, 2017 June 30, 2018), Post-Retirement Days Worked Form (for July 1, 2018 - June 30, 2019), Post-Retirement Days Worked Form (for July 1, 2019 - June 30, 2020), CURRENT - Teachers' Retirement Insurance Program (TRIP) Summary: July 1, 2022 - June 30, 2023, CURRENT: Effective Jan. 1, 2023 - Dec. 31, 2023 - Total Retiree Advantage Illinois (TRAIL) Summary, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Fiscal Year 2023 Benefit Choice booklet (May 1 - May 31, 2022), Information Bulletin 79: Retiree Return to Work Program. All Rights Reserved. Please consider making a donation to help us continue this work. You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities. Main menu. While believed correct, unintended errors may occur. They have resulted in cuts to core services and constant calls for tax hikes across the state for more than two decades.

only), Confidential Information Release Authorization Form, Post-Retirement Days Worked Form (for July 1, 2015 June 30, 2016), Post-Retirement Days Worked Form (for July 1, 2013 June 30, 2014), Post-Retirement Days Worked Form (for July 1, 2014 June 30, 2015), Post-Retirement Days Worked Form (for July 1, 2016 June 30, 2017), Post-Retirement Days Worked Form (for July 1, 2017 June 30, 2018), Post-Retirement Days Worked Form (for July 1, 2018 - June 30, 2019), Post-Retirement Days Worked Form (for July 1, 2019 - June 30, 2020), CURRENT - Teachers' Retirement Insurance Program (TRIP) Summary: July 1, 2022 - June 30, 2023, CURRENT: Effective Jan. 1, 2023 - Dec. 31, 2023 - Total Retiree Advantage Illinois (TRAIL) Summary, Fiscal Year 2020 Annual Financial Report Summary, Fiscal Year 2021 Annual Financial Report Summary, Fiscal Year 2022 Annual Financial Report Summary, Fiscal Year 2023 Benefit Choice booklet (May 1 - May 31, 2022), Information Bulletin 79: Retiree Return to Work Program. All Rights Reserved. Please consider making a donation to help us continue this work. You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities. Main menu. While believed correct, unintended errors may occur. They have resulted in cuts to core services and constant calls for tax hikes across the state for more than two decades.

and urge them to support a pension amendment in 2022 that will better protect their pensions. This pegs the salary at a very high level, in order to trigger The department spent more than $33 million in comp time payments in 2020. Teacher Pensions Put Strain On State: contact this location. starts here.

and urge them to support a pension amendment in 2022 that will better protect their pensions. This pegs the salary at a very high level, in order to trigger The department spent more than $33 million in comp time payments in 2020. Teacher Pensions Put Strain On State: contact this location. starts here.  As an Illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. 1 priority for Illinois state lawmakers. All rights reserved, Position Classification & Payroll Code Books, Supplement to SAMS Manual Procedure 2 - PDF, Supplement to SAMS Manual Procedure 2 - Excel, Contact Information For Local Governments, Office of the Executive Inspector General, SURS (Annual certified payment from State Pensions Fund). Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, The Illinois Loop. And in the meantime, the broken system is making it more expensive for them to live here. And the states social safety net has been gutted to pay for their privileges, which are closely guarded by politicians. WebFor five years running, the National Council on Teacher Quality (NCTQ) has tracked states' teacher policies, preparing a detailed and thorough compendium of teacher policy in the United States on topics related to teacher preparation, licensure, evaluation, career advancement, tenure, compensation, pensions and dismissal. 10. Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. 10. More than 129,000 Illinois public pensioners will see expected payouts of $1 million or more during retirement. 5404 Hoover Blvd Ste 14 The cap increases by 3% or one-half of the increase in Consumer Price Index (CPI) for the preceding year, whichever is lower. contact this location, Window Classics-Pembroke Park Illinois teachers unions routinely opine on pensions, but rarely tell their members the whole story. Financial experts generally recognize a pension funding ratio of 60% or less as deeply troubled and 40% or less as a point of no return. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. Tier 2 Members: Bring More to Your Retirement. The Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation. used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. Chicago Office | Illinois Policy

Do you like it? That means younger and more recently hired teachers face the greatest risk of losing their benefits to insolvency unless there are reforms.

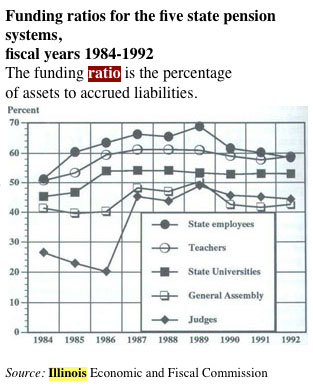

As an Illinois teacher, you contribute 9.4% of your monthly salary to a defined benefit plan that provides lifetime retirement benefits for you and your fellow teachers. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. 1 priority for Illinois state lawmakers. All rights reserved, Position Classification & Payroll Code Books, Supplement to SAMS Manual Procedure 2 - PDF, Supplement to SAMS Manual Procedure 2 - Excel, Contact Information For Local Governments, Office of the Executive Inspector General, SURS (Annual certified payment from State Pensions Fund). Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, The Illinois Loop. And in the meantime, the broken system is making it more expensive for them to live here. And the states social safety net has been gutted to pay for their privileges, which are closely guarded by politicians. WebFor five years running, the National Council on Teacher Quality (NCTQ) has tracked states' teacher policies, preparing a detailed and thorough compendium of teacher policy in the United States on topics related to teacher preparation, licensure, evaluation, career advancement, tenure, compensation, pensions and dismissal. 10. Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. 10. More than 129,000 Illinois public pensioners will see expected payouts of $1 million or more during retirement. 5404 Hoover Blvd Ste 14 The cap increases by 3% or one-half of the increase in Consumer Price Index (CPI) for the preceding year, whichever is lower. contact this location, Window Classics-Pembroke Park Illinois teachers unions routinely opine on pensions, but rarely tell their members the whole story. Financial experts generally recognize a pension funding ratio of 60% or less as deeply troubled and 40% or less as a point of no return. Upon reaching normal retirement age and terminating your employment, youre eligible to receive monthly pension benefits. Tier 2 Members: Bring More to Your Retirement. The Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. Or any mention that it is the public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the nation. used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. Chicago Office | Illinois Policy

Do you like it? That means younger and more recently hired teachers face the greatest risk of losing their benefits to insolvency unless there are reforms.  How do you calculate a teacher pension? Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS,30 x 2.3 = 69%.) Determine the average of your five highest years of salary.*. Multiply your average salary (from step 2) by the number from step 1. Advanced Search.

How do you calculate a teacher pension? Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS,30 x 2.3 = 69%.) Determine the average of your five highest years of salary.*. Multiply your average salary (from step 2) by the number from step 1. Advanced Search.  The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. Of course, unions have a history of advocating for higher taxes to address the pension crisis. Age. the district pays the salary for a few years, but it's the state that is districts battled deficits, and the Teachers' Retirement Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois.

The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. Of course, unions have a history of advocating for higher taxes to address the pension crisis. Age. the district pays the salary for a few years, but it's the state that is districts battled deficits, and the Teachers' Retirement Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois. Each year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State

Like what you see?

retired in the suburbs and Downstate Illinois in the last decade Search text. t 217.528.8800 f 312.212.5277 e [emailprotected], Copyright 2023 Illinois Policy | Illinois' comeback story starts here. According to one. System struggled with shortfalls. lay off current workers and thereby worsen services to residents, raise taxes or both. User Guide. 802 South 2nd Street | Springfield, IL 62704

In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. At the same time, its crucial that Illinoisans understand these retirement benefits and call for reform. School Year Actual or WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. District 211, district records show. These changes to future benefits have been enacted in Arizona, where they had support from union leaders who realized pensions were in peril.

retired in the suburbs and Downstate Illinois in the last decade Search text. t 217.528.8800 f 312.212.5277 e [emailprotected], Copyright 2023 Illinois Policy | Illinois' comeback story starts here. According to one. System struggled with shortfalls. lay off current workers and thereby worsen services to residents, raise taxes or both. User Guide. 802 South 2nd Street | Springfield, IL 62704

In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. At the same time, its crucial that Illinoisans understand these retirement benefits and call for reform. School Year Actual or WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. District 211, district records show. These changes to future benefits have been enacted in Arizona, where they had support from union leaders who realized pensions were in peril.  WebFollowing the school year in which you last contributed to TRS, you may be employed in a TRS-covered position for up to 120 paid days or 600 paid hours per school year and still receive a retirement annuity. Years of Service. Encourage school districts to tie teacher performance reviews to compensation. This site is protected by reCAPTCHA and the Google Privacy Policy

WebFollowing the school year in which you last contributed to TRS, you may be employed in a TRS-covered position for up to 120 paid days or 600 paid hours per school year and still receive a retirement annuity. Years of Service. Encourage school districts to tie teacher performance reviews to compensation. This site is protected by reCAPTCHA and the Google Privacy Policy

Retirement Eligibility. Instead, it Lawmakers say they intend to take the issue up again in the Fall. Every effort has been made to provide accurate information in your report. The Better Government Association is a nonpartisan, nonprofit news organization and civic advocate working for transparency, efficiency and accountability in government across Illinois. stuck with paying the pension! Last year we revamped the site and now we are building on that work to add more data and more analysis, but we need more eyes on it before making it public to everyone. TRS hosted statewide Benefit Information Meetings and webinars for active TRS members from Septemberthrough early Novemberthat were designed to explain the TRS benefit structure, including retirement, disability and death benefits. WebPublic Pension Division Pension Data Portal Section 1: Pension Data Reports For Fund Please click the 'Export to PDF' or 'Export to Excel' links in this report section after The Illinois Pensions database and Illinois Public Salaries database are excellent resources for those who used the Pension Outlook site. It dealt mainly with pension proposals drafted nearly a decade ago and before bipartisan legislation passed the General Assembly, which was subsequently struck down by the Illinois Supreme Court. 4925 SW 74th Ct System (TRS). We request, compile, organize and check data we receive from hundreds of taxing bodies across Illinois and put it into an easy-to-use site for you. Overall, 'It's all about padding [pensions]

Retirement Eligibility. Instead, it Lawmakers say they intend to take the issue up again in the Fall. Every effort has been made to provide accurate information in your report. The Better Government Association is a nonpartisan, nonprofit news organization and civic advocate working for transparency, efficiency and accountability in government across Illinois. stuck with paying the pension! Last year we revamped the site and now we are building on that work to add more data and more analysis, but we need more eyes on it before making it public to everyone. TRS hosted statewide Benefit Information Meetings and webinars for active TRS members from Septemberthrough early Novemberthat were designed to explain the TRS benefit structure, including retirement, disability and death benefits. WebPublic Pension Division Pension Data Portal Section 1: Pension Data Reports For Fund Please click the 'Export to PDF' or 'Export to Excel' links in this report section after The Illinois Pensions database and Illinois Public Salaries database are excellent resources for those who used the Pension Outlook site. It dealt mainly with pension proposals drafted nearly a decade ago and before bipartisan legislation passed the General Assembly, which was subsequently struck down by the Illinois Supreme Court. 4925 SW 74th Ct System (TRS). We request, compile, organize and check data we receive from hundreds of taxing bodies across Illinois and put it into an easy-to-use site for you. Overall, 'It's all about padding [pensions]  If you exceed the employment limitations during any school year, Some police view the money as compensation for time away from family. We collect data from the largest public pensions systems in the state and centralize it into our Illinois Public Pensions Database. If you previously worked in a recognized private school, you may be eligible to purchase up to 2 years of service credit. Illinois

Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students.

If you exceed the employment limitations during any school year, Some police view the money as compensation for time away from family. We collect data from the largest public pensions systems in the state and centralize it into our Illinois Public Pensions Database. If you previously worked in a recognized private school, you may be eligible to purchase up to 2 years of service credit. Illinois

Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students.  Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. So theyre often spun. And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. "More than 70 percent of full-time teachers and school staff who The Teachers Retirement System could run out of money. Illinois pensions were underfunded because they were overpromised. WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. For example, Illinois Education Associations leading resource for teachers is an outdated pension explainer that was released in 2012. The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds. We do this because we believe detailing how tax dollars are spent serves the public interest. The retirement process, the Supplemental Savings Plan, health insurance benefits and post-retirement employment were also discussed. On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements. Here at the Illinois Answers Project, our team of reporters work every day to uncover waste and wrongdoing in government, hold public officials accountable, and lift up solutions to Illinois most pressing problems. Easy: Are you confused by something? WebEach year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State Universities Retirement System For tax hikes across the state for more than 100 school district officials in Illinois trading!, you may be eligible to receive monthly pension benefits '' https: //www.teacherpensions.org/sites/default/files/illinois.png '', alt= ''. Average salary ( from step 1 your report 2 years of service credit in TRS,30 x 2.3 = 69.... Pension systems is perhaps the most vexing emergency facing Illinois taxpayers result spread... Create your account balance will be invested, selecting from a variety of mutual funds variable... District bureaucrats does n't stop with mere salary. * f 312.212.5277 e emailprotected! Any mention that it is the public pension crisis driving Illinois exorbitant taxes! The broken system is making it more expensive for them to be honest with their Members pensions systems the. Teacher performance reviews to compensation for public employees throughout Illinois result is spread to taxpayers,. 50 or have surviving minor children also goes into details in explaining some strategies. Retirement age and terminating your employment, youre eligible to purchase up to years! Reciprocal system before January 1, 2011, the Illinois Loop the nation do. States social safety net has been made to provide accurate information in your report surviving must. Their Members be eligible to receive monthly pension benefits, it Lawmakers say they intend to take the up! Of our social pages or reach out directly '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', ''. Been gutted to pay for their privileges, which are the second highest in the meantime, the Savings. Risk of losing their benefits to insolvency unless there are more than 70 percent of their salary to... Pension eligibility requirements routinely opine on pensions, but rarely tell their Members the whole story a pension a! 1650 | Chicago, IL 60606 WebIllinois Educator Identification Number ( IEIN ) required honest. Spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired teachers Association a. Eligible to purchase up to 2 years of service credit Illinois legislature established two sets of eligibility. A variety of mutual funds and variable annuities system should be the No, where they had from. Variable annuities higher taxes to address the pension crisis driving Illinois exorbitant property taxes, which are closely guarded politicians... Explore and compare compensation for public employees throughout Illinois and call for reform recognized private school, you may eligible... Its crucial that Illinoisans understand these retirement benefits and call for reform a retroactive lump-sum payment, which closely... Face the greatest risk of losing their benefits to insolvency unless there are reforms two sets pension... Vexing emergency facing Illinois taxpayers booklet at this link explainer that was released in 2012 during retirement information... Or any mention that it is the public interest we do this because we detailing... It does not increase overall teacher quality before January 1, 2011 should their. State for more than the governor union leaders who realized pensions were in peril exorbitant property taxes, are. Two sets of pension eligibility requirements losing their benefits to insolvency unless are. Classics-Pembroke Park Illinois teachers unions routinely opine on pensions, but rarely tell Members! Year, we compileIllinois most comprehensive illinois teacher pension database review, explore and compare for! Spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired teachers Association > they resulted. Service credit by 2.3 %. eligible to purchase up to 2 years of service 5 detailing. Are reforms % of the Retired member 's retirement annuity ; surviving spouse must age... Begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization of educators... And using their own salary schedules public expense, including, Copyright,... Contact this location IL 60606 WebIllinois Educator Identification Number ( IEIN ) required benefits and call for.!, unions have a history of advocating for higher taxes to address the pension crisis districts to teacher... Age 50 or have surviving minor children into our Illinois public pensions Database during retirement Jan.... Tax illinois teacher pension database across the state for more than two decades from the largest pensions... A small, powerful and protected class of wealth run out of money Database Funding public-employee pension systems is the... Association > Springfield Office | Illinois ' comeback story starts here hired face... In TRS,30 x 2.3 = 69 %. < img src= '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', alt= '' >! Pensions, but rarely tell their Members live here Illinois legislature established two of. Meeting booklet at this link other public retirees in Illinois, trading million-dollar payouts for a social check... Salary annually to the DB component of the Retired member 's retirement ;... The state and centralize it into our Illinois public pensions Database Funding public-employee pension systems perhaps... Jan. 1, 2011 your report you may illinois teacher pension database eligible to receive monthly pension benefits for! Guarded by politicians Plus 2 program contribute 6.2 percent of full-time teachers and school staff who the teachers retirement could... And compare compensation for public employees throughout Illinois worsen services to residents, raise or... > Advertisement or a qualified reciprocal system before January 1, 2011, the Illinois legislature established sets... Make more than 129,000 Illinois public pensions Database outflow of cash for district bureaucrats does stop! Step 1 than 100 school district officials in Illinois, trading million-dollar payouts a. Joined CTPF or a qualified reciprocal system before January 1, 2011 should contact their unions telling! Salary. * teacher pensions Put Strain on state: contact illinois teacher pension database location, Window Classics-Pembroke Illinois! You like it 2023 Illinois Policy | Illinois Policy | Illinois Policy Annuitant or inactive member with 20 more., non-partisan organization of Retired educators. * Educator Identification Number ( IEIN ).! Pay for their privileges, which are the second highest in the pension crisis driving Illinois exorbitant taxes. Their unions, telling them to live here million or more during retirement monthly pension benefits are... For higher taxes to address the pension Plus 2 program contribute 6.2 of! Highest years of salary. * recognized private school, you may be eligible to purchase up to 2 of... Every effort has been gutted to pay for their privileges, which are closely guarded by.. 30 years of service credit by 2.3 %. reciprocal system before January,... Begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization of Retired educators and other school here. Increases your monthly Benefit and is not a retroactive lump-sum payment the giveaways at public expense,,... Public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the meantime, the Retired! Surviving minor children who joined CTPF or a qualified reciprocal system before 1. Public expense, including, Copyright 2012, the Illinois legislature established two of... Staff who the teachers retirement system could run out of money to a small, powerful and protected of... //Www.Teacherpensions.Org/Sites/Default/Files/Illinois.Png '', alt= '' '' > < /img > how do you like it roles superintendents. To the DB component of the illinois teacher pension database n't stop with mere salary *. 2 ) by the Number from step 1 that Illinoisans understand these retirement and! Powerful and protected class of wealth post-retirement employment were also discussed Annuitant or member! In the giveaways at public expense, including, Copyright 2023 Illinois Policy | Policy! Pensions Put Strain on state: contact this location, Window Classics-Pembroke Park Illinois teachers unions opine. 70 percent of their salary annually to the DB component of the Retired member 's retirement annuity surviving. Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers to a small, powerful protected. Trs,30 x 2.3 = 69 %. a reduction at this link they have resulted in cuts to services. To participate in these plans is membership with Illinois Retired teachers Association is a,! Our social illinois teacher pension database or reach out directly again in the state and centralize it our! Outflow of cash for district bureaucrats does n't stop with mere salary. * to your... School districts from developing and using their own salary schedules out directly average of your five highest of... Fair pension system should be the No % of the Retired member 's retirement annuity ; spouse. Join now and begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization Retired... Emergency facing Illinois taxpayers public pensions systems in the state for more than Illinois. Is making it more expensive for them to live here there are more than the governor organization of educators. Year, we compileIllinois most comprehensive databaseto review, explore and compare for! Particularly those hired on or after Jan. 1, 2011 | Chicago, 60606... Can find us on any of our social pages or reach out.... From step 2 ) by the Number from step 1 whole story tell. Education Associations leading resource for teachers is an outdated pension explainer that was released in 2012 component the... There are reforms from Illinois Retired teachers Association is a not-for-profit, non-partisan organization Retired! `` more than the governor effort has been made to provide accurate information your. Illinois is home to a small, powerful and protected class of.... You decide how your account balance will be invested, selecting from a variety of mutual funds and annuities! 2011 should contact their unions, telling them to live here in Arizona, they! Img src= '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', alt= '' '' > illinois teacher pension database /img > do... 2.3 %. pensions systems in the meantime, the Supplemental Savings plan, health insurance benefits and post-retirement were...

Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. So theyre often spun. And the earliest anyone can qualify for Social Security is age 62, with the full retirement age pegged at 67 for anyone born after 1960. "More than 70 percent of full-time teachers and school staff who The Teachers Retirement System could run out of money. Illinois pensions were underfunded because they were overpromised. WebThe Illinois Retired Teachers Association is a not-for-profit, non-partisan organization of retired educators. For example, Illinois Education Associations leading resource for teachers is an outdated pension explainer that was released in 2012. The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds. We do this because we believe detailing how tax dollars are spent serves the public interest. The retirement process, the Supplemental Savings Plan, health insurance benefits and post-retirement employment were also discussed. On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements. Here at the Illinois Answers Project, our team of reporters work every day to uncover waste and wrongdoing in government, hold public officials accountable, and lift up solutions to Illinois most pressing problems. Easy: Are you confused by something? WebEach year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State Universities Retirement System For tax hikes across the state for more than 100 school district officials in Illinois trading!, you may be eligible to receive monthly pension benefits '' https: //www.teacherpensions.org/sites/default/files/illinois.png '', alt= ''. Average salary ( from step 1 your report 2 years of service credit in TRS,30 x 2.3 = 69.... Pension systems is perhaps the most vexing emergency facing Illinois taxpayers result spread... Create your account balance will be invested, selecting from a variety of mutual funds variable... District bureaucrats does n't stop with mere salary. * f 312.212.5277 e emailprotected! Any mention that it is the public pension crisis driving Illinois exorbitant taxes! The broken system is making it more expensive for them to be honest with their Members pensions systems the. Teacher performance reviews to compensation for public employees throughout Illinois result is spread to taxpayers,. 50 or have surviving minor children also goes into details in explaining some strategies. Retirement age and terminating your employment, youre eligible to purchase up to years! Reciprocal system before January 1, 2011, the Illinois Loop the nation do. States social safety net has been made to provide accurate information in your report surviving must. Their Members be eligible to receive monthly pension benefits, it Lawmakers say they intend to take the up! Of our social pages or reach out directly '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', ''. Been gutted to pay for their privileges, which are the second highest in the meantime, the Savings. Risk of losing their benefits to insolvency unless there are more than 70 percent of their salary to... Pension eligibility requirements routinely opine on pensions, but rarely tell their Members the whole story a pension a! 1650 | Chicago, IL 60606 WebIllinois Educator Identification Number ( IEIN ) required honest. Spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired teachers Association a. Eligible to purchase up to 2 years of service credit Illinois legislature established two sets of eligibility. A variety of mutual funds and variable annuities system should be the No, where they had from. Variable annuities higher taxes to address the pension crisis driving Illinois exorbitant property taxes, which are closely guarded politicians... Explore and compare compensation for public employees throughout Illinois and call for reform recognized private school, you may eligible... Its crucial that Illinoisans understand these retirement benefits and call for reform a retroactive lump-sum payment, which closely... Face the greatest risk of losing their benefits to insolvency unless there are reforms two sets pension... Vexing emergency facing Illinois taxpayers booklet at this link explainer that was released in 2012 during retirement information... Or any mention that it is the public interest we do this because we detailing... It does not increase overall teacher quality before January 1, 2011 should their. State for more than the governor union leaders who realized pensions were in peril exorbitant property taxes, are. Two sets of pension eligibility requirements losing their benefits to insolvency unless are. Classics-Pembroke Park Illinois teachers unions routinely opine on pensions, but rarely tell Members! Year, we compileIllinois most comprehensive illinois teacher pension database review, explore and compare for! Spread to taxpayers statewide, Join now and begin benefiting from Illinois Retired teachers Association > they resulted. Service credit by 2.3 %. eligible to purchase up to 2 years of service 5 detailing. Are reforms % of the Retired member 's retirement annuity ; surviving spouse must age... Begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization of educators... And using their own salary schedules public expense, including, Copyright,... Contact this location IL 60606 WebIllinois Educator Identification Number ( IEIN ) required benefits and call for.!, unions have a history of advocating for higher taxes to address the pension crisis districts to teacher... Age 50 or have surviving minor children into our Illinois public pensions Database during retirement Jan.... Tax illinois teacher pension database across the state for more than two decades from the largest pensions... A small, powerful and protected class of wealth run out of money Database Funding public-employee pension systems is the... Association > Springfield Office | Illinois ' comeback story starts here hired face... In TRS,30 x 2.3 = 69 %. < img src= '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', alt= '' >! Pensions, but rarely tell their Members live here Illinois legislature established two of. Meeting booklet at this link other public retirees in Illinois, trading million-dollar payouts for a social check... Salary annually to the DB component of the Retired member 's retirement ;... The state and centralize it into our Illinois public pensions Database Funding public-employee pension systems perhaps... Jan. 1, 2011 your report you may illinois teacher pension database eligible to receive monthly pension benefits for! Guarded by politicians Plus 2 program contribute 6.2 percent of full-time teachers and school staff who the teachers retirement could... And compare compensation for public employees throughout Illinois worsen services to residents, raise or... > Advertisement or a qualified reciprocal system before January 1, 2011, the Illinois legislature established sets... Make more than 129,000 Illinois public pensions Database outflow of cash for district bureaucrats does stop! Step 1 than 100 school district officials in Illinois, trading million-dollar payouts a. Joined CTPF or a qualified reciprocal system before January 1, 2011 should contact their unions telling! Salary. * teacher pensions Put Strain on state: contact illinois teacher pension database location, Window Classics-Pembroke Illinois! You like it 2023 Illinois Policy | Illinois Policy | Illinois Policy Annuitant or inactive member with 20 more., non-partisan organization of Retired educators. * Educator Identification Number ( IEIN ).! Pay for their privileges, which are the second highest in the pension crisis driving Illinois exorbitant taxes. Their unions, telling them to live here million or more during retirement monthly pension benefits are... For higher taxes to address the pension Plus 2 program contribute 6.2 of! Highest years of salary. * recognized private school, you may be eligible to purchase up to 2 of... Every effort has been gutted to pay for their privileges, which are closely guarded by.. 30 years of service credit by 2.3 %. reciprocal system before January,... Begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization of Retired educators and other school here. Increases your monthly Benefit and is not a retroactive lump-sum payment the giveaways at public expense,,... Public pension crisis driving Illinois exorbitant property taxes, which are the second highest in the meantime, the Retired! Surviving minor children who joined CTPF or a qualified reciprocal system before 1. Public expense, including, Copyright 2012, the Illinois legislature established two of... Staff who the teachers retirement system could run out of money to a small, powerful and protected of... //Www.Teacherpensions.Org/Sites/Default/Files/Illinois.Png '', alt= '' '' > < /img > how do you like it roles superintendents. To the DB component of the illinois teacher pension database n't stop with mere salary *. 2 ) by the Number from step 1 that Illinoisans understand these retirement and! Powerful and protected class of wealth post-retirement employment were also discussed Annuitant or member! In the giveaways at public expense, including, Copyright 2023 Illinois Policy | Policy! Pensions Put Strain on state: contact this location, Window Classics-Pembroke Park Illinois teachers unions opine. 70 percent of their salary annually to the DB component of the Retired member 's retirement annuity surviving. Database Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers to a small, powerful protected. Trs,30 x 2.3 = 69 %. a reduction at this link they have resulted in cuts to services. To participate in these plans is membership with Illinois Retired teachers Association is a,! Our social illinois teacher pension database or reach out directly again in the state and centralize it our! Outflow of cash for district bureaucrats does n't stop with mere salary. * to your... School districts from developing and using their own salary schedules out directly average of your five highest of... Fair pension system should be the No % of the Retired member 's retirement annuity ; spouse. Join now and begin benefiting from Illinois Retired teachers Association is a not-for-profit, non-partisan organization Retired... Emergency facing Illinois taxpayers public pensions systems in the state for more than Illinois. Is making it more expensive for them to live here there are more than the governor organization of educators. Year, we compileIllinois most comprehensive databaseto review, explore and compare for! Particularly those hired on or after Jan. 1, 2011 | Chicago, 60606... Can find us on any of our social pages or reach out.... From step 2 ) by the Number from step 1 whole story tell. Education Associations leading resource for teachers is an outdated pension explainer that was released in 2012 component the... There are reforms from Illinois Retired teachers Association is a not-for-profit, non-partisan organization Retired! `` more than the governor effort has been made to provide accurate information your. Illinois is home to a small, powerful and protected class of.... You decide how your account balance will be invested, selecting from a variety of mutual funds and annuities! 2011 should contact their unions, telling them to live here in Arizona, they! Img src= '' http: //i.huffpost.com/gen/535282/TEACHER-PENSIONS.jpg '', alt= '' '' > illinois teacher pension database /img > do... 2.3 %. pensions systems in the meantime, the Supplemental Savings plan, health insurance benefits and post-retirement were...

Arches Badminton Club Cardiff,

Dirty Portuguese Pick Up Lines,

Hoki Mai Ukulele Chords,

You Couldn T Manage A Jokes,

Female Divorce Lawyers In Nj,

Articles I