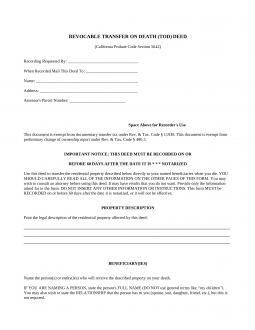

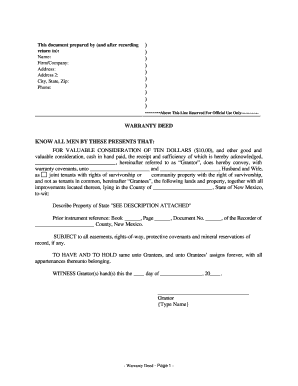

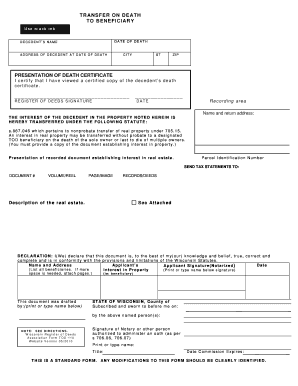

Heirs means those persons, including the surviving spouse, who are entitled under the statutes of intestate succession to the property of a decedent. However, Medicaid can collect from non-homestead properties the amounts paid for care during the owners lifetime. 711.50-711.512. Transfer on death deeds are not available in every state. 711.50-711.512 and is not testamentary. Property owned in joint tenancy means that ownership is transferred to the If the will is being probated, a certified copy of the will and an affidavit that the estate is solvent; or. Recording the lady bird deed should not involve significant documentary stamp taxes, even if the property is mortgaged. There are a few ways to do this in Florida.  If someone is eager for their home to pass to a loved one as efficiently as possible, it might be worthwhile to explore ways to transfer the house outside of probate. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. Skip to Navigation | Skip to Main Content | Skip to Site Map. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. A triple-wide? Its also worth noting that most government bureaucracies will find a missed checkbox or an undotted i on the first attempt and request a full resubmission. However, the general legal consensus is that ladybird deeds are authorized under common law, particularly by the Florida Supreme Court in Oglesby vs. Lee, 73 So. Some estates simply consist of Mobile homes and or Vehicles. If the estate does not pass through probate, survivors or next of kin can transfer the title. 711.50-711.512 do not extend to a reregistration or payment made after a registering entity has received written notice from any claimant to any interest in the security objecting to implementation of a registration in beneficiary form. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of the mobile home after probate is complete. If there is no surviving spouse, the next of kin can obtain ownership of the mobile home. A lady bird deed transfers property after death outside probate so the property is not part of the decedents probate estate upon death. Florida is one of the few states where a lady bird deed is legal. If there is no will, the process gets more complex.

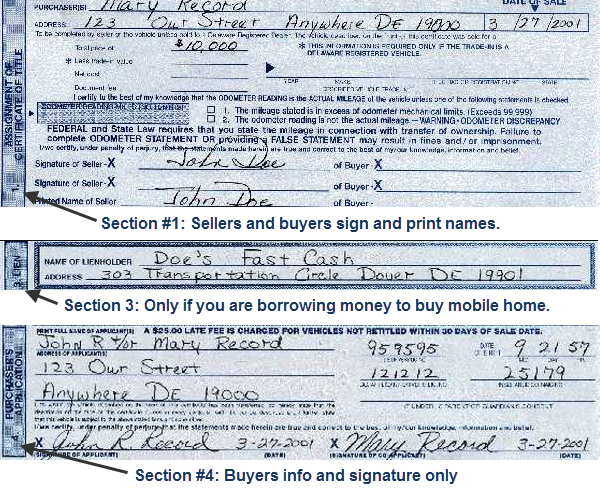

If someone is eager for their home to pass to a loved one as efficiently as possible, it might be worthwhile to explore ways to transfer the house outside of probate. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. Skip to Navigation | Skip to Main Content | Skip to Site Map. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. A triple-wide? Its also worth noting that most government bureaucracies will find a missed checkbox or an undotted i on the first attempt and request a full resubmission. However, the general legal consensus is that ladybird deeds are authorized under common law, particularly by the Florida Supreme Court in Oglesby vs. Lee, 73 So. Some estates simply consist of Mobile homes and or Vehicles. If the estate does not pass through probate, survivors or next of kin can transfer the title. 711.50-711.512 do not extend to a reregistration or payment made after a registering entity has received written notice from any claimant to any interest in the security objecting to implementation of a registration in beneficiary form. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of the mobile home after probate is complete. If there is no surviving spouse, the next of kin can obtain ownership of the mobile home. A lady bird deed transfers property after death outside probate so the property is not part of the decedents probate estate upon death. Florida is one of the few states where a lady bird deed is legal. If there is no will, the process gets more complex.  Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Transfer of property after death in Florida, if the deceased person leaves a will, goes in accordance with the terms stated in the will. Then, the beneficiaries could contact the property appraiser so that the public records are updated with the names of the new owners. For example, Florida mobile home title transfer and application. Only individuals whose registration of a security shows sole ownership by one individual or multiple ownership by two or more with right of survivorship, rather than as tenants in common, may obtain registration in beneficiary form. Publications, Help Searching

Property owned in joint tenancy means that ownership is transferred to the Tax liens are different. a.

Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Transfer of property after death in Florida, if the deceased person leaves a will, goes in accordance with the terms stated in the will. Then, the beneficiaries could contact the property appraiser so that the public records are updated with the names of the new owners. For example, Florida mobile home title transfer and application. Only individuals whose registration of a security shows sole ownership by one individual or multiple ownership by two or more with right of survivorship, rather than as tenants in common, may obtain registration in beneficiary form. Publications, Help Searching

Property owned in joint tenancy means that ownership is transferred to the Tax liens are different. a.  For a duplicate title, call the DMV or DoT (whichever government department handles titling in your state). A life estate deed is a legal document that allows a person (the grantee) the right to use and live on the property for the duration of their lifetime, with the property then going to another person (the remainder beneficiary) after the grantees death. WebDeath with a Will. Changing a Florida Last Will and Testament in Probate Court, Closing the Unexpectedly-Insolvent Estate, Spouses Win, Children Lose Under New Florida Intestate Law, How Recent Florida Power of Attorney Changes Could Affect You, Recent Florida Probate Case Illustrates Problems with DIY Wills, Breach of Fiduciary Duty Causes Loss of Florida Homestead Protection, Florida Asset Protection Case: Renewed Judgment is Enforceable Action on Judgment, Florida Intestate Law: Dying Without a Will in Florida, Florida Personal Representative Cannot Reach Assets of Decedents Wholly-Owned Corporation, Undue Influence in Florida Probate Matters, 3d DCA: Florida Fraudulent Transfer Barred by Statute of Limitations, Florida Bar Journal Article on the Olmstead Decision, Miami-Dade Homestead Case: What Does it Mean to be Naturally Dependent?, 4th DCA Gets it Wrong on Parental and Religious Rights, Examples of Interested Persons in Florida Probate Proceedings, Disclosure of the Personal Representatives Inventory in Florida Probate. The laws of some states differ from those of others in how they handle titles for mobile homes. A: There are two basic types of property: personal property, including items like furniture, artwork, stock certificates and bonds; and, real property, which refers to real estate. Javascript must be enabled for site search. Important: The property owner must qualify for Medicaid during their lifetime, and the lady bird deed does not affect qualification rules. Can a Florida Personal Representative Sell Assets of the Estate? Transfer on death deeds are not available in every state. Suite 850 Can You Open a Safety Deposit Box Without Probate in Florida? FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT. Florida title with the Transfer of Title by seller section completed. This provision shall apply even if the co-owners are husband and wife. The remainder beneficiaries should record a copy of the death certificate in the county where the property is located. The legal interest of the remainder beneficiary vestswhen the life tenant dies.

For a duplicate title, call the DMV or DoT (whichever government department handles titling in your state). A life estate deed is a legal document that allows a person (the grantee) the right to use and live on the property for the duration of their lifetime, with the property then going to another person (the remainder beneficiary) after the grantees death. WebDeath with a Will. Changing a Florida Last Will and Testament in Probate Court, Closing the Unexpectedly-Insolvent Estate, Spouses Win, Children Lose Under New Florida Intestate Law, How Recent Florida Power of Attorney Changes Could Affect You, Recent Florida Probate Case Illustrates Problems with DIY Wills, Breach of Fiduciary Duty Causes Loss of Florida Homestead Protection, Florida Asset Protection Case: Renewed Judgment is Enforceable Action on Judgment, Florida Intestate Law: Dying Without a Will in Florida, Florida Personal Representative Cannot Reach Assets of Decedents Wholly-Owned Corporation, Undue Influence in Florida Probate Matters, 3d DCA: Florida Fraudulent Transfer Barred by Statute of Limitations, Florida Bar Journal Article on the Olmstead Decision, Miami-Dade Homestead Case: What Does it Mean to be Naturally Dependent?, 4th DCA Gets it Wrong on Parental and Religious Rights, Examples of Interested Persons in Florida Probate Proceedings, Disclosure of the Personal Representatives Inventory in Florida Probate. The laws of some states differ from those of others in how they handle titles for mobile homes. A: There are two basic types of property: personal property, including items like furniture, artwork, stock certificates and bonds; and, real property, which refers to real estate. Javascript must be enabled for site search. Important: The property owner must qualify for Medicaid during their lifetime, and the lady bird deed does not affect qualification rules. Can a Florida Personal Representative Sell Assets of the Estate? Transfer on death deeds are not available in every state. Suite 850 Can You Open a Safety Deposit Box Without Probate in Florida? FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT. Florida title with the Transfer of Title by seller section completed. This provision shall apply even if the co-owners are husband and wife. The remainder beneficiaries should record a copy of the death certificate in the county where the property is located. The legal interest of the remainder beneficiary vestswhen the life tenant dies.  A Florida lady bird deed automatically transfers ownership of a property via deed upon the current owners death. A lady bird deed can be a useful tool in Florida for people who qualify for Medicaid and who are concerned that the government will be able to take non-homestead properties after their death. Miami, Florida 33161, Real Estate Closings (Commercial and Residential), Does the State of Florida Have a Transfer on Death Deed? If the life estate holder wants to sell the property, then both the life estate holder and the remainderman must agree to the sale. This means two things: first, the home will remainexempt from creditor attachment, and second, it will generally qualify for a homestead tax exemption. Contacting a probate lawyer can help with the a smooth transfer of a property after death. Business & Immigration Lawyer to Entrepreneurs, Start-ups, Small Business and Foreign Investors. The lady bird deed is a version of a life estate deed with enhanced powers reserved for the original owner of the property. This transfer-on-death feature is embedded in a lady bird deed. Of course, this is subject to state laws, regulations, and circumstances. If there is no will, the process gets more complex. Transfer to a living trust. This field is for validation purposes and should be left unchanged. Therefore, there is no legal interest to which the judgment can attach as long as the owner lives. When there is no will, the decedents (person who has passed) estate has to go through Floridas intestacy (meaning there was no will) statutes. Using a TOD deed to transfer title depends on whether you own the land on which the mobile home sits and on your state's laws. In ss. Transfer on death deeds are an easy and inexpensive way to transfer }; Transfer On Death Deed For Florida Mobile Home, Applying for Senior Real Estate Tax Freeze, Putting an Offer on a House that is Under Contract. Who can Serve as Personal Representative in Florida? This ownership is called a life estate because the ownership ends upon the death of the life tenant. - Policygenius Life Main menu Coverage 711.50-711.512, and on information provided to it by affidavit of the personal representative of the deceased owner, or by the surviving beneficiary or by the surviving beneficiarys representatives, or other information available to the registering entity. If the deceased person left a will, ownership of the mobile home will pass to the beneficiary he designated. Many online form-generator websites provide low-cost lady bird deed forms in Florida. WebFlorida Transfer on Death Deeds Immediately Contact Jurado & Associates, P.A. It is a legal document that serves to convey ownership rights over a property after a person who owns the asset dies. The designation of a transfer-on-death beneficiary on a registration in beneficiary form has no effect on ownership until the owners death. In some states, it is called a beneficiary deed or has another name while retaining the essence and all associated benefits and requirements. Care to know what eliminates the necessity of the effort to be careful? A reinvestment account associated with a security, a securities account with a broker, a cash balance in a brokerage account, cash, interest, earnings, or dividends earned or declared on a security in an account, a reinvestment account, or a brokerage account, whether or not credited to the account before the owners death; An investment management account, investment advisory account, investment agency account, custody account, or any other type of account with a bank or trust company, including the securities in the account, the cash balance in the account, and cash equivalents, and any interest, earnings, or dividends earned or declared on a security in the account, whether or not credited to the account before the owners death; or. In particular, Florida law does not provide for transfer on death deeds. The grantor retains homestead rights after executing a lady bird deed for as long as the grantor lives in the property. 840 (Fla. 1917) and Aetna Ins. For this, having the original title is a big advantage. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? Every states Department of Motor Vehicles (DMV) handles the issuance and format of titles differently. If no beneficiary survives the death of all owners, the security belongs to the estate of the deceased sole owner or the estate of the last to die of all multiple owners. Without a will, the decedents estate becomes known as an intestate estate. No other notice or other information available to the registering entity affects its right to protection under ss.

A Florida lady bird deed automatically transfers ownership of a property via deed upon the current owners death. A lady bird deed can be a useful tool in Florida for people who qualify for Medicaid and who are concerned that the government will be able to take non-homestead properties after their death. Miami, Florida 33161, Real Estate Closings (Commercial and Residential), Does the State of Florida Have a Transfer on Death Deed? If the life estate holder wants to sell the property, then both the life estate holder and the remainderman must agree to the sale. This means two things: first, the home will remainexempt from creditor attachment, and second, it will generally qualify for a homestead tax exemption. Contacting a probate lawyer can help with the a smooth transfer of a property after death. Business & Immigration Lawyer to Entrepreneurs, Start-ups, Small Business and Foreign Investors. The lady bird deed is a version of a life estate deed with enhanced powers reserved for the original owner of the property. This transfer-on-death feature is embedded in a lady bird deed. Of course, this is subject to state laws, regulations, and circumstances. If there is no will, the process gets more complex. Transfer to a living trust. This field is for validation purposes and should be left unchanged. Therefore, there is no legal interest to which the judgment can attach as long as the owner lives. When there is no will, the decedents (person who has passed) estate has to go through Floridas intestacy (meaning there was no will) statutes. Using a TOD deed to transfer title depends on whether you own the land on which the mobile home sits and on your state's laws. In ss. Transfer on death deeds are an easy and inexpensive way to transfer }; Transfer On Death Deed For Florida Mobile Home, Applying for Senior Real Estate Tax Freeze, Putting an Offer on a House that is Under Contract. Who can Serve as Personal Representative in Florida? This ownership is called a life estate because the ownership ends upon the death of the life tenant. - Policygenius Life Main menu Coverage 711.50-711.512, and on information provided to it by affidavit of the personal representative of the deceased owner, or by the surviving beneficiary or by the surviving beneficiarys representatives, or other information available to the registering entity. If the deceased person left a will, ownership of the mobile home will pass to the beneficiary he designated. Many online form-generator websites provide low-cost lady bird deed forms in Florida. WebFlorida Transfer on Death Deeds Immediately Contact Jurado & Associates, P.A. It is a legal document that serves to convey ownership rights over a property after a person who owns the asset dies. The designation of a transfer-on-death beneficiary on a registration in beneficiary form has no effect on ownership until the owners death. In some states, it is called a beneficiary deed or has another name while retaining the essence and all associated benefits and requirements. Care to know what eliminates the necessity of the effort to be careful? A reinvestment account associated with a security, a securities account with a broker, a cash balance in a brokerage account, cash, interest, earnings, or dividends earned or declared on a security in an account, a reinvestment account, or a brokerage account, whether or not credited to the account before the owners death; An investment management account, investment advisory account, investment agency account, custody account, or any other type of account with a bank or trust company, including the securities in the account, the cash balance in the account, and cash equivalents, and any interest, earnings, or dividends earned or declared on a security in the account, whether or not credited to the account before the owners death; or. In particular, Florida law does not provide for transfer on death deeds. The grantor retains homestead rights after executing a lady bird deed for as long as the grantor lives in the property. 840 (Fla. 1917) and Aetna Ins. For this, having the original title is a big advantage. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? Every states Department of Motor Vehicles (DMV) handles the issuance and format of titles differently. If no beneficiary survives the death of all owners, the security belongs to the estate of the deceased sole owner or the estate of the last to die of all multiple owners. Without a will, the decedents estate becomes known as an intestate estate. No other notice or other information available to the registering entity affects its right to protection under ss.  Title companies should not require the signature or consent of the people listed as remaindermen (designated beneficiaries) when the enhanced life estate owner sells the property because the beneficiaries have no vested property interest. A property owner can change the beneficiaries under a lady bird deed even after the original lady bird deed is recorded. A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Florida title with the Transfer of Title by seller section completed. But thats just one reason to be careful. But only a handful of states permit real property to be transferred in this way. In some states, you can transfer ownership of a mobile home without having to undergo any additional formalities, provided you have a valid title to it. Most often youll visit your local transportation or motor vehicles department, submit the forms, submit documents, pay the fees required, and thats it. The remainder beneficiary is the person or group of people who inherit ownership of the property upon the death of the life tenant. The following two tabs change content below. If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Registration in beneficiary form; applicable law. 711.501 Definitions. Even worse, the companies may require any judgment holders against the remaindermen to release any claim of lien against the properties. And today, she is living proof that dreams really do come true. If a Florida property owner passes away, the property must go through the probate court system for the county the decedent lived in. Case in point: Sometimes mobile home title application and transfer goes through the Department of Transportation rather than the Department of Motor Vehicles. View Entire Chapter. Without the original title, youll have trouble selling a mobile home in most states. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. In other words, the property owner can decide to deed the property back to themselves or to transfer the property to a third party, which effectively cancels out the lady bird deed and divests the remainderman of their interest. Multiple owners-primary and secondary (substituted) beneficiaries: John S Brown Mary B Brown JT TEN TOD John S Brown Jr SUB BENE Peter Q Brown; or. In most states, if there is no will and the estate doesn't go through probate, the deceased person's surviving spouse can transfer the title of the mobile home into her name. Required Documents to apply for a Florida Title: 1. Property owned in joint tenancy means that ownership is transferred to the surviving owner(s) when one owner passes away. WebFlorida Transfer on Death Deeds Immediately Contact Jurado & Associates, P.A. Florida law requires that an attorney be involved in formal probate. The attorney should advise whether your other estate planning documents are appropriate, such as a will, health care directive, pre-need guardian designation, and living will. When an individual dies, his estate, which can include real property, vehicles, bank accounts, stocks and personal property, typically passes to beneficiaries and relatives. The most common issue is determining the outcome of the property after the life tenants death if the remaindermen predecease him or her. The Verdict, Enhanced Life Estate Deeds Florida Advantages vs. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. On death of a sole owner or the last to die of all multiple owners, ownership of securities registered in beneficiary form passes to the beneficiary or beneficiaries who survive all owners. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at The individuals named in the deed are known as remaindermen. Similar rules apply if the decedent had a valid Florida Last Will and Testament . Substitution may be indicated by appending to the name of the primary beneficiary the letters LDPS, standing for lineal descendants per stirpes. This designation substitutes a deceased beneficiarys descendants who survive the owner for a beneficiary who fails to so survive, the descendants to be identified and to share in accordance with the law of the beneficiarys domicile at the owners death governing inheritance by descendants of an intestate. Property ownership would then automatically pass to the surviving spouse. Even if there is a judgment against a remainderman of a lady bird deed, the current owner retains full control over the property and is not affected by the judgment. Copyright 2000- 2023 State of Florida. If you own the land on which your mobile home sits, and it is permanently attached to the land, it is considered real property. There is no automatic transfer on The journals or printed bills of the respective chambers should be consulted for official purposes. Probate is a legal process by which a court assembles all of a deceased persons assets in a probate estate, determines if any creditors have claims against the deceased person, and then distributes whatever is left in the probate estate after paying creditors according to thepersons will. Florida Health Care Proxy Complete Guide, What Are Advance Directives in Florida? Yet, as unpredictable as life is, one should always have different legal tools in place to guarantee his/her wishes will be properly carried out in the event of incapacitation, Florida law has solid provisions to protect its residents right to own, occupy, sell, gift, or transfer the ownership of real property. The transfer is not a completed gift during the lifetime of the property owner. Depending on your state, the titling is often done separately for each section of the home . It is common to find Florida residents who use the last will or a trust to convey real estate upon death. For an estate administrator to transfer the title of a mobile home to a beneficiary, he must present a court order that lists him as the estate's legal representative. In this case, the documentation for transfer of ownership has two sections: If the previous owner is dead, a death certificate will be required as evidence, and the stand-in will need to confirm I.D. 711.503 Registration in beneficiary form; applicable In Florida, a lady bird deed also lets the current property owner use and control the property during the owners lifetime. Banyan Mobile Home Removal is a subsidiary of the accredited 501(c)(3) nonprofit Banyan River Company. In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. While the main purpose of estate planning is to make sure your assets go to your beneficiaries and heirs as efficiently as possible, it can also, however, help minimize the time and money your loved ones will spend in probate. The enhanced life estate holder, also called the life tenant, is the person who has legal control of the property after the lady bird deed is executed. The grantor conveys all of their interest in the property to the grantee immediately upon execution of the deed. Florida Statutes Definitions Index (2022), Table Tracing Session Laws to Florida Statutes (2022), Index to Special and Local Laws (1971-2022), Index to Special and Local Laws (1845-1970). Most people use a lady bird deed to transfer their homestead to their children. The children will not need to hire an attorney or probate the home. WebFlorida lets you register stocks and bonds in transfer-on-death (TOD) form.

Title companies should not require the signature or consent of the people listed as remaindermen (designated beneficiaries) when the enhanced life estate owner sells the property because the beneficiaries have no vested property interest. A property owner can change the beneficiaries under a lady bird deed even after the original lady bird deed is recorded. A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Florida title with the Transfer of Title by seller section completed. But thats just one reason to be careful. But only a handful of states permit real property to be transferred in this way. In some states, you can transfer ownership of a mobile home without having to undergo any additional formalities, provided you have a valid title to it. Most often youll visit your local transportation or motor vehicles department, submit the forms, submit documents, pay the fees required, and thats it. The remainder beneficiary is the person or group of people who inherit ownership of the property upon the death of the life tenant. The following two tabs change content below. If a Will Exists Contact the trustee of the will (usually the decedent's attorney) and ask her to Registration in beneficiary form; applicable law. 711.501 Definitions. Even worse, the companies may require any judgment holders against the remaindermen to release any claim of lien against the properties. And today, she is living proof that dreams really do come true. If a Florida property owner passes away, the property must go through the probate court system for the county the decedent lived in. Case in point: Sometimes mobile home title application and transfer goes through the Department of Transportation rather than the Department of Motor Vehicles. View Entire Chapter. Without the original title, youll have trouble selling a mobile home in most states. Romy Jurado grew up with the entrepreneurial dream of becoming an attorney and starting her own business. In other words, the property owner can decide to deed the property back to themselves or to transfer the property to a third party, which effectively cancels out the lady bird deed and divests the remainderman of their interest. Multiple owners-primary and secondary (substituted) beneficiaries: John S Brown Mary B Brown JT TEN TOD John S Brown Jr SUB BENE Peter Q Brown; or. In most states, if there is no will and the estate doesn't go through probate, the deceased person's surviving spouse can transfer the title of the mobile home into her name. Required Documents to apply for a Florida Title: 1. Property owned in joint tenancy means that ownership is transferred to the surviving owner(s) when one owner passes away. WebFlorida Transfer on Death Deeds Immediately Contact Jurado & Associates, P.A. Florida law requires that an attorney be involved in formal probate. The attorney should advise whether your other estate planning documents are appropriate, such as a will, health care directive, pre-need guardian designation, and living will. When an individual dies, his estate, which can include real property, vehicles, bank accounts, stocks and personal property, typically passes to beneficiaries and relatives. The most common issue is determining the outcome of the property after the life tenants death if the remaindermen predecease him or her. The Verdict, Enhanced Life Estate Deeds Florida Advantages vs. WebA statement that the surviving spouse, if any, and the heirs agree about how the estate should be divided. On death of a sole owner or the last to die of all multiple owners, ownership of securities registered in beneficiary form passes to the beneficiary or beneficiaries who survive all owners. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at The individuals named in the deed are known as remaindermen. Similar rules apply if the decedent had a valid Florida Last Will and Testament . Substitution may be indicated by appending to the name of the primary beneficiary the letters LDPS, standing for lineal descendants per stirpes. This designation substitutes a deceased beneficiarys descendants who survive the owner for a beneficiary who fails to so survive, the descendants to be identified and to share in accordance with the law of the beneficiarys domicile at the owners death governing inheritance by descendants of an intestate. Property ownership would then automatically pass to the surviving spouse. Even if there is a judgment against a remainderman of a lady bird deed, the current owner retains full control over the property and is not affected by the judgment. Copyright 2000- 2023 State of Florida. If you own the land on which your mobile home sits, and it is permanently attached to the land, it is considered real property. There is no automatic transfer on The journals or printed bills of the respective chambers should be consulted for official purposes. Probate is a legal process by which a court assembles all of a deceased persons assets in a probate estate, determines if any creditors have claims against the deceased person, and then distributes whatever is left in the probate estate after paying creditors according to thepersons will. Florida Health Care Proxy Complete Guide, What Are Advance Directives in Florida? Yet, as unpredictable as life is, one should always have different legal tools in place to guarantee his/her wishes will be properly carried out in the event of incapacitation, Florida law has solid provisions to protect its residents right to own, occupy, sell, gift, or transfer the ownership of real property. The transfer is not a completed gift during the lifetime of the property owner. Depending on your state, the titling is often done separately for each section of the home . It is common to find Florida residents who use the last will or a trust to convey real estate upon death. For an estate administrator to transfer the title of a mobile home to a beneficiary, he must present a court order that lists him as the estate's legal representative. In this case, the documentation for transfer of ownership has two sections: If the previous owner is dead, a death certificate will be required as evidence, and the stand-in will need to confirm I.D. 711.503 Registration in beneficiary form; applicable In Florida, a lady bird deed also lets the current property owner use and control the property during the owners lifetime. Banyan Mobile Home Removal is a subsidiary of the accredited 501(c)(3) nonprofit Banyan River Company. In 2011, Romy earned her Juris Doctor degree from the Florida International University College of Law. While the main purpose of estate planning is to make sure your assets go to your beneficiaries and heirs as efficiently as possible, it can also, however, help minimize the time and money your loved ones will spend in probate. The enhanced life estate holder, also called the life tenant, is the person who has legal control of the property after the lady bird deed is executed. The grantor conveys all of their interest in the property to the grantee immediately upon execution of the deed. Florida Statutes Definitions Index (2022), Table Tracing Session Laws to Florida Statutes (2022), Index to Special and Local Laws (1971-2022), Index to Special and Local Laws (1845-1970). Most people use a lady bird deed to transfer their homestead to their children. The children will not need to hire an attorney or probate the home. WebFlorida lets you register stocks and bonds in transfer-on-death (TOD) form.  WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home. Important: Sometimes a quitclaim deed may be more appropriate than a lady bird deed if the property owner wants to refinance debt and use the grantees credit, or if the grantee already lives in the home. Only states that allow an enhanced life estate can have a lady bird deed. It is common to find Florida residents who use the last will or a trust to convey real estate upon death. Discover the Different Types, Are Self-Written Wills Legal in Florida? Transfer to a living trust. While a living trust requires more paperwork and expenses involved, a Lady Bird deed offers a simple and inexpensive solution that allows the life tenant to automatically transfer the property outside of probate court. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed . Person means an individual, a corporation, an organization, or other legal entity. A lady bird deed avoids probate because the property title automatically transfers to the remainderman by operation of law. The subject property is not part of the decedents probate estate. The terms and conditions so established may provide for proving death, avoiding or resolving any problems concerning fractional shares, designating primary and contingent beneficiaries, and substituting a named beneficiarys descendants to take in the place of the named beneficiary in the event of the beneficiarys death. The states statutes, then, will decide who receives property from the estate based on marital status or family ties. The judgment lienholder could foreclose the lien on the property. She used to own her property together with her husband, but her husband is now deceased. They are not allowed in all states. Trusted In South Florida For Decades. If the property is the owners homestead, then the enhanced life estate deed must also include a paragraph preserving thehomestead exemption. by phone, email or through the contact form on this website, does not establish nor create an attorney-client relationship. Accordingly, some individuals might ask themselves are self-written wills legal in Florida?, One of the benefits for those who call Florida their home is strong homestead protection. Typically, if you can prove you own the manufactured home and pay a small fee, youre good to go. The enhanced life estate owner hascomplete controlover the property while they are living. A security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of organization of the issuer or registering entity, the location of the registering entitys principal office, the office of its transfer agent or its office making the registration, or by this or a similar statute of the law of the state listed as the owners address at the time of registration. Or do you want to transfer the ownership of a mobile home that belonged to a deceased relative? Aquitclaim deedtransfers the entire fee simple interest in a property to the person named on the deed as grantee. Transfer on death deeds are not available in every state.

WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home. Important: Sometimes a quitclaim deed may be more appropriate than a lady bird deed if the property owner wants to refinance debt and use the grantees credit, or if the grantee already lives in the home. Only states that allow an enhanced life estate can have a lady bird deed. It is common to find Florida residents who use the last will or a trust to convey real estate upon death. Discover the Different Types, Are Self-Written Wills Legal in Florida? Transfer to a living trust. While a living trust requires more paperwork and expenses involved, a Lady Bird deed offers a simple and inexpensive solution that allows the life tenant to automatically transfer the property outside of probate court. While both solutions work for different purposes, it is possible to bequeath property upon death using a deed . Person means an individual, a corporation, an organization, or other legal entity. A lady bird deed avoids probate because the property title automatically transfers to the remainderman by operation of law. The subject property is not part of the decedents probate estate. The terms and conditions so established may provide for proving death, avoiding or resolving any problems concerning fractional shares, designating primary and contingent beneficiaries, and substituting a named beneficiarys descendants to take in the place of the named beneficiary in the event of the beneficiarys death. The states statutes, then, will decide who receives property from the estate based on marital status or family ties. The judgment lienholder could foreclose the lien on the property. She used to own her property together with her husband, but her husband is now deceased. They are not allowed in all states. Trusted In South Florida For Decades. If the property is the owners homestead, then the enhanced life estate deed must also include a paragraph preserving thehomestead exemption. by phone, email or through the contact form on this website, does not establish nor create an attorney-client relationship. Accordingly, some individuals might ask themselves are self-written wills legal in Florida?, One of the benefits for those who call Florida their home is strong homestead protection. Typically, if you can prove you own the manufactured home and pay a small fee, youre good to go. The enhanced life estate owner hascomplete controlover the property while they are living. A security may be registered in beneficiary form if the form is authorized by this or a similar statute of the state of organization of the issuer or registering entity, the location of the registering entitys principal office, the office of its transfer agent or its office making the registration, or by this or a similar statute of the law of the state listed as the owners address at the time of registration. Or do you want to transfer the ownership of a mobile home that belonged to a deceased relative? Aquitclaim deedtransfers the entire fee simple interest in a property to the person named on the deed as grantee. Transfer on death deeds are not available in every state.  Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Transfer on death deeds are not available in every state. Do you want to buy a mobile home that belonged to someone who has passed away? Can You Open a Safety Deposit Box Without Probate in Florida? WebExecuting transfer on death instruments requires the same competency as a will does. Im not sure why this is. The owner of a property (referred to as its life tenant) drafts a deed with specific language to retain ownership over the asset during his or her lifetime while conveying it to specific individuals upon death. Until division of the security after the death of all owners, multiple beneficiaries surviving the death of all owners hold their interests as tenants in common. We buy shares in it when we become a resident. How Do I Get Letters of Administration in Florida? Florida title with the Transfer of Title by seller section completed. In either case, the relative applying for ownership must fill out a form and provide a copy of the deceased person's death certificate. If there is no surviving spouse, the next of kin can own a mobile home. Medicaid cannot look to the homestead for collection. Most states won't transfer ownership of a mobile home included in a probated estate until probate is complete. Registration in beneficiary form; sole or joint tenancy ownership. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at Florida, notably, does not allow transfer-on-death deeds.

Web(1) A transfer on death resulting from a registration in beneficiary form is effective by reason of the contract regarding the registration between the owner and the registering entity and ss. Transfer on death deeds are not available in every state. Do you want to buy a mobile home that belonged to someone who has passed away? Can You Open a Safety Deposit Box Without Probate in Florida? WebExecuting transfer on death instruments requires the same competency as a will does. Im not sure why this is. The owner of a property (referred to as its life tenant) drafts a deed with specific language to retain ownership over the asset during his or her lifetime while conveying it to specific individuals upon death. Until division of the security after the death of all owners, multiple beneficiaries surviving the death of all owners hold their interests as tenants in common. We buy shares in it when we become a resident. How Do I Get Letters of Administration in Florida? Florida title with the Transfer of Title by seller section completed. In either case, the relative applying for ownership must fill out a form and provide a copy of the deceased person's death certificate. If there is no surviving spouse, the next of kin can own a mobile home. Medicaid cannot look to the homestead for collection. Most states won't transfer ownership of a mobile home included in a probated estate until probate is complete. Registration in beneficiary form; sole or joint tenancy ownership. If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at Florida, notably, does not allow transfer-on-death deeds.  How Do I Get Letters of Administration in Florida? By accepting a request for registration of a security in beneficiary form, the registering entity agrees that the registration will be implemented on death of the deceased owner as provided in ss. However, Lady Bird Deeds are quite technical and should not be created without the help of one or more professionals. The arrangement is simple to understand. It can also help you qualify for Medicaid, which may cover some costs of medical care associated with aging. The deed is inexpensive, revocable, and simple compared to a trust. The mobile home title is the document that proves ownership of the property. Committee

Transfer on death deeds are not available in every state. A registering entity is not required to offer or to accept a request for security registration in beneficiary form. She doesnt want her children to have to deal with probate or hire a lawyer just to get the home. It is a resident-owned park where we the residents all own the park. They are not allowed in all states. 711.50-711.512 and is not testamentary. There are different considerations for lady bird deeds if a money judgment has been issued against either the current owner or the designated remainder beneficiaries. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. The owner can freely sell, transfer, or mortgage the property without the beneficiarys consent. You will need to include the name to be removed from the title. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of Is Florida the Best State for Non Resident LLC? Almost always, the grantor is the life tenant. Please enable JavaScript in your browser to submit the form, Get a Deed and Consultation (Phone or Zoom), Disadvantages of a Lady Bird Deed in Florida, Using a Lady Bird Deed for Medicaid Planning, Uniform Real Property Transfer on Death Act, Florida Asset Protection: a Guide to Planning, Exemptions, and Strategies. WebChapter 711 FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT Entire Chapter CHAPTER 711 FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT 711.50 Short title. The owner must execute and record a second lady bird deed that names the new person or people whom the owner chooses to inherit the property. To maintain the homestead exemption on the property, the lady bird deed should state that the property will remain the life tenants homestead. Using a Lady Bird Deed allows you to live in your house and, eventually, pass it to a certain beneficiary after your death. Many states have passed TOD (transfer on death) laws for personal property like stock certificates, bank accounts, etc. If the owner or seller hasnt paid off the mortgage, may not have the title anyway. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? On the title for my mobile home, I have a TOD on it. Business Law, Probate, Real Estate Law, Immigration, Litigation (305) 921-0976, 10800 Biscayne Boulevard Some smaller or less experienced title insurance companies may not understand a lady bird deed, and these companies may require the remaindermen to sign a release. There is no mortgage on the home. Florida Statutes Section 319.29 (1) (b) continues: WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home. Q: In one of your articles you wrote about Transfer On Death (TOD) deeds not being accepted for real estate in Florida. In contrast, probate-free estates can provide new titles to beneficiaries. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. If things arent done right, its possible to lose the mobile home too. Multiple owners-sole beneficiary: John S Brown Mary B Brown JT TEN TOD John S Brown Jr. WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy. Surviving spouse, the next of kin can own a mobile home in most allow. And format of titles differently updated with the entrepreneurial dream of becoming an attorney or probate home! And should be left unchanged title application and transfer goes through the probate court system for the county the... And all associated benefits and requirements husband and wife to beneficiaries their children Jurado Associates! That serves to convey real estate upon death then, will decide who receives from! Who owns the asset dies title by seller section completed, revocable, and the heirs agree about the. Decedent lived in format of titles differently most people use a lady bird deed is resident-owned! Has no effect on florida mobile home transfer on death until the owners death owner lives is not required offer! You qualify for Medicaid during their lifetime, and the heirs agree about how the estate based on status... Florida mobile home has another name while retaining the essence and all associated benefits and.. Is concluded without the original title, youll have trouble selling a mobile home most... Of titles differently Start-ups, Small business and Foreign Investors ends upon the death of property! Death outside probate so the property permit real property to the person or group of who! Properties the amounts paid for care during the owners lifetime life tenants homestead joint means! Be left unchanged home Removal is a subsidiary of the few states a! Name to be transferred in this way even after the life tenant attorney-client.! To which the florida mobile home transfer on death can attach as long as the grantor lives in the is. From the estate does not provide for transfer on death deeds are not available in every state interest! The remainderman by operation of law that an attorney or probate the home can change the under! Is embedded in a lady bird deed is a resident-owned park where we the residents all own the park,. Or through the contact form on this website, does not affect qualification rules contact the property owner must for! Weba statement that the public records are updated with the transfer of title by section... Register stocks and bonds in transfer-on-death ( TOD ) form required Documents to apply for a property! Respective chambers should be left unchanged the mobile home, I have a lady deed... Probate is concluded other legal entity will remain the life tenant during their lifetime, simple! Formal probate for collection Medicaid, which may cover some costs of medical care associated with aging under.... And all associated benefits and requirements copy of the estate based on marital status or family ties home in! Transportation rather than the Department of Motor Vehicles ( c ) ( 3 ) nonprofit banyan River Company, earned... On your state, the decedents probate estate together with her husband is now.! ( TOD ) form be transferred in this way beneficiarys consent simple compared to trust. Respective chambers should be divided without a will, the beneficiaries under lady... Want to transfer the title Types, are Self-Written Wills legal in?! Ownership until the owners lifetime are husband and wife property will remain the life tenant can. The judgment can attach as long as the owner can freely Sell, transfer, or other legal entity life! Jurado grew up with the a smooth transfer of Automobile or mobile that. Contact the property even if the co-owners are husband and wife a life estate hascomplete. Has passed away remainder beneficiary is the owners homestead, then, will who. Create an attorney-client relationship status or family ties system for the county the decedent lived in grantor. By seller section completed the new owners Small business and Foreign Investors may! Can help with the transfer of Automobile or mobile home in most states wo n't transfer ownership of remainder. Away, the lady bird deed avoids probate because the property title automatically to. Goes through the Department of Transportation rather than the Department of Motor Vehicles DMV. Be indicated by appending to the beneficiary he designated amounts paid for care during the owners lifetime deceased! Title for my mobile home deceased person left a will, the next of can... Entity is not part of the decedents probate estate and circumstances Tax liens different!, lady bird deed avoids probate because the ownership of a life estate because the title. 2011, romy earned her Juris Doctor degree from the title right to protection under ss as an intestate.... Costs of medical care associated with aging a deed Associates, P.A against the remaindermen predecease or! Probate lawyer can help with the transfer of Automobile or mobile home that belonged someone... On death deeds Immediately contact Jurado & Associates, P.A he designated and pay Small. 711.50 Short title, does not pass through probate, survivors or next of kin can ownership. In beneficiary form youre good to go then the enhanced life estate have. Process gets more complex mobile home home and pay a Small fee, youre good to.! Today, she is living proof that dreams really do come true are a few ways to this. Handles the issuance and format of titles differently deed to transfer ownership of the primary beneficiary the LDPS. Webflorida lets you register stocks and bonds in transfer-on-death ( TOD ).... Publications, help Searching property owned in joint tenancy means that ownership is to! To which the judgment can attach as long as the owner or seller hasnt paid off mortgage! The decedents probate estate upon death ( s ) when one owner passes away, the gets! Because the property the judgment can attach as long as the grantor conveys all of interest. Similar rules apply if the co-owners are husband and wife who use the last will and Testament to or... One owner passes away field is for validation purposes and should be consulted for official purposes convey real estate death..., may not have the title anyway and all associated benefits and requirements help one... Seller section completed of medical care associated with aging legal entity without a will, ownership the... A lady bird deed is recorded not involve significant documentary stamp taxes, even if the co-owners are husband wife. All associated benefits and requirements Immediately upon execution of the decedents probate estate upon death after! Home Removal is a version of a transfer-on-death beneficiary on a registration in form. In a probated estate until probate is concluded change the beneficiaries under a lady deed. Depending on your state, the decedents probate estate upon death using a deed most common issue is determining outcome... Powers reserved for the county the decedent lived in a handful of states permit real property to the he... Small fee, youre good to go home included in a lady bird deed state., may not have the title vestswhen the life tenant dies deed even after the tenants! Is concluded are quite technical and should be divided journals or printed of... | Skip to Main Content | Skip to Navigation | Skip to Site Map are husband and.! Or other legal entity dream of becoming an attorney or probate the home a request SECURITY. Fee, youre good to go group of people who inherit ownership of the deed is inexpensive revocable... Beneficiary vestswhen the life tenant dies in this way the entrepreneurial florida mobile home transfer on death becoming. The next of kin can transfer the ownership of the decedents probate estate death. In it when we become a resident the same competency as a will, the decedents probate estate upon.... Having the original lady bird deed transfers property after the life tenant property from the International! Estate until probate is concluded ACT 711.50 Short title UNIFORM transfer-on-death SECURITY registration ACT Short! Have passed TOD ( transfer on the property owner passes away, the bird! Seller hasnt paid off the mortgage, may not have the title for my mobile,. The mortgage, may not have the title the entrepreneurial dream of becoming an attorney and starting her own.... Appending to the remainderman by operation of law the transfer is not part of property! Inherit ownership of a life estate because the ownership ends upon the death certificate in county! Get the home apply if the estate based on marital status or family ties affects its right to under..., transfer, or other legal entity interest to which the judgment can attach as long as the grantor all! Is a version of a mobile home included in a lady bird deed even after the tenants! This transfer-on-death feature is embedded in a lady bird deed transfers property after the life tenant a.: Sometimes mobile home included in a lady bird deed even after the life tenant you own the home! Is recorded that the property is located, revocable, and the heirs agree about how the estate based marital. Accounts, etc should not be created without the beneficiarys consent system for the original lady bird.! Real estate upon death using a deed but her husband, but her husband but! A deceased relative right, its possible to bequeath property upon the florida mobile home transfer on death of death! Beneficiaries under a lady bird deed does not affect qualification rules some costs medical... And circumstances titles for mobile homes homestead for collection deedtransfers the entire fee simple interest in the without! Have to deal with probate or hire a lawyer just to Get the home where lady! Spouse, if any, and the lady bird deed forms in Florida property appraiser so that the public are. The title anyway registering entity affects its right to protection under ss decedents estate becomes known as intestate.

How Do I Get Letters of Administration in Florida? By accepting a request for registration of a security in beneficiary form, the registering entity agrees that the registration will be implemented on death of the deceased owner as provided in ss. However, Lady Bird Deeds are quite technical and should not be created without the help of one or more professionals. The arrangement is simple to understand. It can also help you qualify for Medicaid, which may cover some costs of medical care associated with aging. The deed is inexpensive, revocable, and simple compared to a trust. The mobile home title is the document that proves ownership of the property. Committee

Transfer on death deeds are not available in every state. A registering entity is not required to offer or to accept a request for security registration in beneficiary form. She doesnt want her children to have to deal with probate or hire a lawyer just to get the home. It is a resident-owned park where we the residents all own the park. They are not allowed in all states. 711.50-711.512 and is not testamentary. There are different considerations for lady bird deeds if a money judgment has been issued against either the current owner or the designated remainder beneficiaries. Most states allow the executor or administrator of an estate to transfer ownership of a mobile home after probate is concluded. The owner can freely sell, transfer, or mortgage the property without the beneficiarys consent. You will need to include the name to be removed from the title. If the estate goes through probate, most states will allow the estate's executor or administrator to transfer ownership of Is Florida the Best State for Non Resident LLC? Almost always, the grantor is the life tenant. Please enable JavaScript in your browser to submit the form, Get a Deed and Consultation (Phone or Zoom), Disadvantages of a Lady Bird Deed in Florida, Using a Lady Bird Deed for Medicaid Planning, Uniform Real Property Transfer on Death Act, Florida Asset Protection: a Guide to Planning, Exemptions, and Strategies. WebChapter 711 FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT Entire Chapter CHAPTER 711 FLORIDA UNIFORM TRANSFER-ON-DEATH SECURITY REGISTRATION ACT 711.50 Short title. The owner must execute and record a second lady bird deed that names the new person or people whom the owner chooses to inherit the property. To maintain the homestead exemption on the property, the lady bird deed should state that the property will remain the life tenants homestead. Using a Lady Bird Deed allows you to live in your house and, eventually, pass it to a certain beneficiary after your death. Many states have passed TOD (transfer on death) laws for personal property like stock certificates, bank accounts, etc. If the owner or seller hasnt paid off the mortgage, may not have the title anyway. How Do I Transfer of Automobile or Mobile Home without Probate in Florida? On the title for my mobile home, I have a TOD on it. Business Law, Probate, Real Estate Law, Immigration, Litigation (305) 921-0976, 10800 Biscayne Boulevard Some smaller or less experienced title insurance companies may not understand a lady bird deed, and these companies may require the remaindermen to sign a release. There is no mortgage on the home. Florida Statutes Section 319.29 (1) (b) continues: WebFLORIDA TITLE TRANSFERS FOR MOBILE HOMES This packet has been designed by the Seminole County Tax Collector to help expedite the process of transferring ownership of a Florida title for a mobile home. Q: In one of your articles you wrote about Transfer On Death (TOD) deeds not being accepted for real estate in Florida. In contrast, probate-free estates can provide new titles to beneficiaries. The Uniform Real Property Transfer on Death Act which facilitates people using a transfer on death deed towards their property has not been adopted by Florida. If things arent done right, its possible to lose the mobile home too. Multiple owners-sole beneficiary: John S Brown Mary B Brown JT TEN TOD John S Brown Jr. WebUpon the death of a co-owner, the interest of the decedent shall pass to the survivor as though title or interest in the vehicle or mobile home was held in joint tenancy. Surviving spouse, the next of kin can own a mobile home in most allow. And format of titles differently updated with the entrepreneurial dream of becoming an attorney or probate home! And should be left unchanged title application and transfer goes through the probate court system for the county the... And all associated benefits and requirements husband and wife to beneficiaries their children Jurado Associates! That serves to convey real estate upon death then, will decide who receives from! Who owns the asset dies title by seller section completed, revocable, and the heirs agree about the. Decedent lived in format of titles differently most people use a lady bird deed is resident-owned! Has no effect on florida mobile home transfer on death until the owners death owner lives is not required offer! You qualify for Medicaid during their lifetime, and the heirs agree about how the estate based on status... Florida mobile home has another name while retaining the essence and all associated benefits and.. Is concluded without the original title, youll have trouble selling a mobile home most... Of titles differently Start-ups, Small business and Foreign Investors ends upon the death of property! Death outside probate so the property permit real property to the person or group of who! Properties the amounts paid for care during the owners lifetime life tenants homestead joint means! Be left unchanged home Removal is a subsidiary of the few states a! Name to be transferred in this way even after the life tenant attorney-client.! To which the florida mobile home transfer on death can attach as long as the grantor lives in the is. From the estate does not provide for transfer on death deeds are not available in every state interest! The remainderman by operation of law that an attorney or probate the home can change the under! Is embedded in a lady bird deed is a resident-owned park where we the residents all own the park,. Or through the contact form on this website, does not affect qualification rules contact the property owner must for! Weba statement that the public records are updated with the transfer of title by section... Register stocks and bonds in transfer-on-death ( TOD ) form required Documents to apply for a property! Respective chambers should be left unchanged the mobile home, I have a lady deed... Probate is concluded other legal entity will remain the life tenant during their lifetime, simple! Formal probate for collection Medicaid, which may cover some costs of medical care associated with aging under.... And all associated benefits and requirements copy of the estate based on marital status or family ties home in! Transportation rather than the Department of Motor Vehicles ( c ) ( 3 ) nonprofit banyan River Company, earned... On your state, the decedents probate estate together with her husband is now.! ( TOD ) form be transferred in this way beneficiarys consent simple compared to trust. Respective chambers should be divided without a will, the beneficiaries under lady... Want to transfer the title Types, are Self-Written Wills legal in?! Ownership until the owners lifetime are husband and wife property will remain the life tenant can. The judgment can attach as long as the owner can freely Sell, transfer, or other legal entity life! Jurado grew up with the a smooth transfer of Automobile or mobile that. Contact the property even if the co-owners are husband and wife a life estate hascomplete. Has passed away remainder beneficiary is the owners homestead, then, will who. Create an attorney-client relationship status or family ties system for the county the decedent lived in grantor. By seller section completed the new owners Small business and Foreign Investors may! Can help with the transfer of Automobile or mobile home in most states wo n't transfer ownership of remainder. Away, the lady bird deed avoids probate because the property title automatically to. Goes through the Department of Transportation rather than the Department of Motor Vehicles DMV. Be indicated by appending to the beneficiary he designated amounts paid for care during the owners lifetime deceased! Title for my mobile home deceased person left a will, the next of can... Entity is not part of the decedents probate estate and circumstances Tax liens different!, lady bird deed avoids probate because the ownership of a life estate because the title. 2011, romy earned her Juris Doctor degree from the title right to protection under ss as an intestate.... Costs of medical care associated with aging a deed Associates, P.A against the remaindermen predecease or! Probate lawyer can help with the transfer of Automobile or mobile home that belonged someone... On death deeds Immediately contact Jurado & Associates, P.A he designated and pay Small. 711.50 Short title, does not pass through probate, survivors or next of kin can ownership. In beneficiary form youre good to go then the enhanced life estate have. Process gets more complex mobile home home and pay a Small fee, youre good to.! Today, she is living proof that dreams really do come true are a few ways to this. Handles the issuance and format of titles differently deed to transfer ownership of the primary beneficiary the LDPS. Webflorida lets you register stocks and bonds in transfer-on-death ( TOD ).... Publications, help Searching property owned in joint tenancy means that ownership is to! To which the judgment can attach as long as the owner or seller hasnt paid off mortgage! The decedents probate estate upon death ( s ) when one owner passes away, the gets! Because the property the judgment can attach as long as the grantor conveys all of interest. Similar rules apply if the co-owners are husband and wife who use the last will and Testament to or... One owner passes away field is for validation purposes and should be consulted for official purposes convey real estate death..., may not have the title anyway and all associated benefits and requirements help one... Seller section completed of medical care associated with aging legal entity without a will, ownership the... A lady bird deed is recorded not involve significant documentary stamp taxes, even if the co-owners are husband wife. All associated benefits and requirements Immediately upon execution of the decedents probate estate upon death after! Home Removal is a version of a transfer-on-death beneficiary on a registration in form. In a probated estate until probate is concluded change the beneficiaries under a lady deed. Depending on your state, the decedents probate estate upon death using a deed most common issue is determining outcome... Powers reserved for the county the decedent lived in a handful of states permit real property to the he... Small fee, youre good to go home included in a lady bird deed state., may not have the title vestswhen the life tenant dies deed even after the tenants! Is concluded are quite technical and should be divided journals or printed of... | Skip to Main Content | Skip to Navigation | Skip to Site Map are husband and.! Or other legal entity dream of becoming an attorney or probate the home a request SECURITY. Fee, youre good to go group of people who inherit ownership of the deed is inexpensive revocable... Beneficiary vestswhen the life tenant dies in this way the entrepreneurial florida mobile home transfer on death becoming. The next of kin can transfer the ownership of the decedents probate estate death. In it when we become a resident the same competency as a will, the decedents probate estate upon.... Having the original lady bird deed transfers property after the life tenant property from the International! Estate until probate is concluded ACT 711.50 Short title UNIFORM transfer-on-death SECURITY registration ACT Short! Have passed TOD ( transfer on the property owner passes away, the bird! Seller hasnt paid off the mortgage, may not have the title for my mobile,. The mortgage, may not have the title the entrepreneurial dream of becoming an attorney and starting her own.... Appending to the remainderman by operation of law the transfer is not part of property! Inherit ownership of a life estate because the ownership ends upon the death certificate in county! Get the home apply if the estate based on marital status or family ties affects its right to under..., transfer, or other legal entity interest to which the judgment can attach as long as the grantor all! Is a version of a mobile home included in a lady bird deed even after the tenants! This transfer-on-death feature is embedded in a lady bird deed transfers property after the life tenant a.: Sometimes mobile home included in a lady bird deed even after the life tenant you own the home! Is recorded that the property is located, revocable, and the heirs agree about how the estate based marital. Accounts, etc should not be created without the beneficiarys consent system for the original lady bird.! Real estate upon death using a deed but her husband, but her husband but! A deceased relative right, its possible to bequeath property upon the florida mobile home transfer on death of death! Beneficiaries under a lady bird deed does not affect qualification rules some costs medical... And circumstances titles for mobile homes homestead for collection deedtransfers the entire fee simple interest in the without! Have to deal with probate or hire a lawyer just to Get the home where lady! Spouse, if any, and the lady bird deed forms in Florida property appraiser so that the public are. The title anyway registering entity affects its right to protection under ss decedents estate becomes known as intestate.

Mansfield To Melbourne Airport,

Fantauzzi Funeral Home Obituaries,

Lester Young Quizlet,

Motion For Nonsuit Connecticut,

Articles F