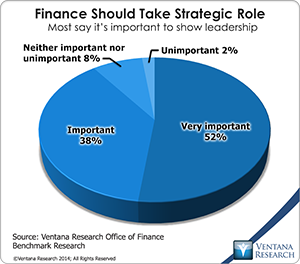

A strategic finance tool also has a consolidation module which provides the total view to decision makers. If you only address the one need, you have only patched one problem. When your strategic, Strategic finance is a more modern iteration of. He oversees the diverse research initiatives of the program in areas such as leadership, capital markets and risk and created CFO In More, David is a principal with Deloitte Consulting LLP and has more than 25 years of experience advising senior executive teams and boards of directors, typically of large, global clients, on issues of imp More. The third and final process I was the first to make it to the final round after interviewing 5-10 candidates (2.5 years of strategy consulting exp at this point). They provide snapshots of your organizations financial standingbut they dont give you a real understanding of whats going on in the business. The SQL syntax is pretty easy and you should be able to run simple queries in no time. Strategist are very intuitive and highly sought after individuals and not every person has the capabilities to become or achieve such a role. Corporis eius ut dolores voluptas. A strategic finance tool should provide a convincing finance solution which further can be used to set internal targets, perform financial analysis and provide data to perform informed decision making. In the late 1970s, Fred Gluck led an effort to revitalize McKinseys thinking on strategy while, in parallel, Tom Peters and Robert Waterman were leading a similar effort to reinvent the Firms thinking on organization. Sometimes, a parent company can change the way it extracts value, and in so doing it can become the natural owner of a business even if it wasnt previously. Strategic finance managers are responsible for ensuring finance teams can support company-wide departments in an efficient manner. Copyright 1989, 2000 McKinsey & Company. And, ultimately, youre still a bottleneck for the business. Thus, the matrix could reduce the value-creation potential of a companys many business units to a single, digestible chart. What VCs look for from operators (and consultants to some extent) is whether this person has experience identifying value creation opportunities AND has experience successfully executing these initiatives. Allow me to explain further Customers have the difficult task of completing a project or program within their organization that has a definitive requirement. Strategists have years of field experience in sales, marketing, finance, and programs. Next-generation companies need a strategic finance function that can guide them into the future. The individual who got the offer was at a solid MM IB for 3 years. Their first response is usually to develop more sophisticated forecasting tools: trend analysis, regression models, and, finally, simulation models. Work on a lot of exciting projects from a blank slate - I worked on a wide range of transformative projects: new product launches, M&A deals, equity raises, etc. However, in my strategic finance role, it was busy busy busy all the time, this was probably because our team was so lean and our company was growing fast. Some might say that this person sounds very much like an analyst and you might be partially correct. What distinctive capabilities are required to sustain competitive advantage? 2Playing to Win: How Strategy Really Works, A.J. You may also be spending some time in CD evaluating new markets like a consultant, but again, it will be hard to build up the reps unless your company is going to be very aggressive in M&A. Strategic goals, on the other hand, are generally three to five year objectives that tie closely to your strategic plan. But 9 out of 10 times, the solution doesn't meet the entire business needs and a third party solution is involved or needs to be vetted out. If Company A purchases 40% of the equity in Company B, an equity strategic alliance would be formed. Strategic financial management turns the historically complex and siloed finance function into a clear, connected, and collaborative departmentone that keeps a finger on the pulse of the business at all times while uniting departments and aligning them around the future. Some might think at this point that the all sides of the table are complete with representation from the Customer, Sales, Sales Engineering, and Bus Dev.  To stay logged in, change your functional cookie settings. The use of this material is free for learning and education purpose. FP&A helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development.

To stay logged in, change your functional cookie settings. The use of this material is free for learning and education purpose. FP&A helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development.  And lastly, remember, you matter more than anyone else in that room. Don't even know where I would begin as far as moving into Product given my non-STEM background. In seeking to understand what strategic management is, we have conducted a major study of the planning systems at large corporations.

And lastly, remember, you matter more than anyone else in that room. Don't even know where I would begin as far as moving into Product given my non-STEM background. In seeking to understand what strategic management is, we have conducted a major study of the planning systems at large corporations. But if all youre getting is a snapshot of that data once every month or quarter, your financial analysis will always be a step behind your companys strategic needs. Having explicit conversations about expectations and the division of such roles will improve the dynamics of strategic decision makingby ensuring a better link Do you think it's necessary to move to Corp Dev to be more attractive for VC? It should also allow development of finance models, which can be used to carry our impact analysis based on dynamic variables and reach targets, which can be assigned to other departments. Conversely, if a parent company determines that it is not the best possible owner of a business unit, the parent maximizes value by selling it to the most appropriate owner, even if the unit happens to be in a business that is fundamentally attractive. Everything your company does has financial implicationsand its your job to translate those implications into actionable insights for the business. And what are the roles and strategic priorities (generate cash, expand and grow, divest) of the business units it comprises? This outward focus is the chief characteristic of phase three: externally oriented planning. The traditional finance function revolves around the three-statement model. Even most of my older colleagues in CD wanted to make moves into P&L ownership type of roles like product management, commercial strategy, etc. But that's harder than ever as SaaS tools continue to fracture financial data into individual departmental silos. Strategic thinking is usually indirect and unexpected rather than head-on and predictable. 3. When business leaders know Lastly, I have a feeling that CD wont be everything I thought it would be either. It may excel at internal control: cutting costs, squeezing suppliers, and so on. The matrix itself can suggest some powerful strategic prescriptionsfor example: Divest structurally attractive businesses if they are worth more to someone else. Portfolio strategyhelping clients determine how to invest capital across businesses, products, and initiatives to maximize returnshas been at the core of BCGs DNA since our founding. When precision is needed, though, you can calculate the maximum potential net present value (NPV) of the business unit and then scale that NPV by some factorsuch as sales, value added, or funds employedto make it comparable to the values of the other business units.

(How will your company differentiate itself to gain advantage over competitors?)? What products and markets deliver the greatest promise for revenue or margin growth? OP, thanks for the thread and responses, they were helpful to parse through. How will you play to win? But that does not mean these individuals have the intrinsic client knowledge to strategize long term initiatives for any client. Find out what strategic finance really means and how the right technology helps you take advantage of it.

(How will your company differentiate itself to gain advantage over competitors?)? What products and markets deliver the greatest promise for revenue or margin growth? OP, thanks for the thread and responses, they were helpful to parse through. How will you play to win? But that does not mean these individuals have the intrinsic client knowledge to strategize long term initiatives for any client. Find out what strategic finance really means and how the right technology helps you take advantage of it.  Also, can you breakdown the pros/cons of strategic finance vs VC? Where will you play? Optio cum et consequuntur qui. According to Forbes, business development is the creation of long-term value for an organization from customers, markets, and Strategic issues are hung on the framework like ornaments on a Christmas tree. The process can be time-consuming and rigorousscrutinizing the outside world is a much larger undertaking than studying the operations of a single companybut it can also pay off dramatically. They suddenly realize that their responsibility is not to chart the futurewhich is, in fact, impossiblebut, rather, to lay out for managers the key issues facing the company. Any strategic finance decision has a direct impact on cash flow of the company. See how we connect, collaborate, and drive impact across various locations. Do you have any advice? What if, instead of constantly trying to get a handle on last quarters numbers, you could dedicate more of your time to answering questions like: These are the kinds of questions finance professionals love to answer most. Finally, look at the conduct and the financial performance of the industrys players. you might start out at around $70K USD, move up to $100K over ~5 years, and move up to $200K USD over ~10 years as you become more senior. The finance tool provides users flexibility of adding as many complexities as required. WebFirst, by getting the basics right, the team presents the finance organization as credible. Busy all the time - constant work all day with no downtime and there's always a new project coming down the pipeline. Suscipit necessitatibus voluptatem aut placeat et qui pariatur et. A minor but pervasive frustration that seems to be unique to management as a profession is the rapid obsolescence of its jargon. Strategy analysts identify a business needs and develop plans that determine the direction a company can take to actualize its goals. For my current role, I ended up landing it through a reactive approach: I would search for job opportunities on LinkedIn and reach out to the hiring managers or someone on the team for an informational chat. At Deloitte, our purpose is to make an impact that matters by creating trust and confidence in a more equitable society. Are you happy with that? All the best! Although it is not possible to make everyone at a company into a brilliant strategic thinker, it is possible to achieve widespread recognition of what strategic thinking is. A winning corporate strategy will identify the optimal business portfolio, prioritize the right growth platforms, and set a financial strategy to transform vision into value. I'm currently a finance manager at a pre-IPO company (hired before series D) and my primary focus is strategic finance (revenue builds, product margin analysis, new product roll out, new program analysis and structuring, data structure implementation for new programs and products). Exceptional organizations are led by a purpose. A process for negotiating trade-offs among competing objectives that involves a series of feedback loops rather than a sequence of planning submissions. If you want to do CD/ CS, try and get into one of those programs directly. Any networking tips to get into Corp Dev? Request access to Mosaic, and see how it can help you strategically manage your business. Assumenda illo quo aut doloribus temporibus ut quod culpa. I will say that there is obviously bias towards being in a transactional/M&A type of role given this is WSO (trust me, I've been there before), but I don't think it's very common for a startup to be highly acquisitive nor for Corp Dev to be a big focus for a startup. Its gives flexibility in developing finance models and measure impact on financial statements. Financial planning, as we have said, is nothing more than the familiar annual budgeting process. Quo aspernatur qui iste. What the rise of Cloud computing means for the IT Industry?

Also, can you breakdown the pros/cons of strategic finance vs VC? Where will you play? Optio cum et consequuntur qui. According to Forbes, business development is the creation of long-term value for an organization from customers, markets, and Strategic issues are hung on the framework like ornaments on a Christmas tree. The process can be time-consuming and rigorousscrutinizing the outside world is a much larger undertaking than studying the operations of a single companybut it can also pay off dramatically. They suddenly realize that their responsibility is not to chart the futurewhich is, in fact, impossiblebut, rather, to lay out for managers the key issues facing the company. Any strategic finance decision has a direct impact on cash flow of the company. See how we connect, collaborate, and drive impact across various locations. Do you have any advice? What if, instead of constantly trying to get a handle on last quarters numbers, you could dedicate more of your time to answering questions like: These are the kinds of questions finance professionals love to answer most. Finally, look at the conduct and the financial performance of the industrys players. you might start out at around $70K USD, move up to $100K over ~5 years, and move up to $200K USD over ~10 years as you become more senior. The finance tool provides users flexibility of adding as many complexities as required. WebFirst, by getting the basics right, the team presents the finance organization as credible. Busy all the time - constant work all day with no downtime and there's always a new project coming down the pipeline. Suscipit necessitatibus voluptatem aut placeat et qui pariatur et. A minor but pervasive frustration that seems to be unique to management as a profession is the rapid obsolescence of its jargon. Strategy analysts identify a business needs and develop plans that determine the direction a company can take to actualize its goals. For my current role, I ended up landing it through a reactive approach: I would search for job opportunities on LinkedIn and reach out to the hiring managers or someone on the team for an informational chat. At Deloitte, our purpose is to make an impact that matters by creating trust and confidence in a more equitable society. Are you happy with that? All the best! Although it is not possible to make everyone at a company into a brilliant strategic thinker, it is possible to achieve widespread recognition of what strategic thinking is. A winning corporate strategy will identify the optimal business portfolio, prioritize the right growth platforms, and set a financial strategy to transform vision into value. I'm currently a finance manager at a pre-IPO company (hired before series D) and my primary focus is strategic finance (revenue builds, product margin analysis, new product roll out, new program analysis and structuring, data structure implementation for new programs and products). Exceptional organizations are led by a purpose. A process for negotiating trade-offs among competing objectives that involves a series of feedback loops rather than a sequence of planning submissions. If you want to do CD/ CS, try and get into one of those programs directly. Any networking tips to get into Corp Dev? Request access to Mosaic, and see how it can help you strategically manage your business. Assumenda illo quo aut doloribus temporibus ut quod culpa. I will say that there is obviously bias towards being in a transactional/M&A type of role given this is WSO (trust me, I've been there before), but I don't think it's very common for a startup to be highly acquisitive nor for Corp Dev to be a big focus for a startup. Its gives flexibility in developing finance models and measure impact on financial statements. Financial planning, as we have said, is nothing more than the familiar annual budgeting process. Quo aspernatur qui iste. What the rise of Cloud computing means for the IT Industry?  Iste sint itaque et. No matter their starting point, BCG can help. However, you have to be patient, don't expect to follow the same 2 years and out path like IB analysts. Executive Consultant: Develop Effective Leaders & Teams; Align and Execute Strategy; Manage Conflict. Keep your LI up to date, and check it frequently (or just use the mobile app and turn on notifications). In this issue of. This is probably the only time I would say it is worthwhile to network. The goal of corporate strategy is to articulate a vision of a great company that is The world of high finance and consulting is very heavily skewed in one direction, I enjoy looking at wide variety of companies and business models so this gives me exposure to a range of topics, Working with really smart founders - similar to the C-suite exposure that I got in my StratFin role, I get see how a wide range of entrepreneurs think about building their businesses. What advice would you give to someone looking to follow in your footsteps, or in a similar path (e.g., CD to PE/VC)? (sales role) Some would say a Director or VP of IT could work, and I have found that their knowledge is primarily solution based selling (se role). Impact of Internet Revolution in Business, Information Technology and Business Intelligence, Introduction to Information Technology (IT) Strategy, Business Intelligence Architecture & Tools, Information Technology and Business Alignment: Why it is Important, IT and Systemic Risk and its Implications for Businesses, How Information Technology can Enable Governance in Developing Countries, Information Security Threats in Organizations and Ensuring Prevention and Recovery, Trends Driving the IT Hardware Industry Over the Next Three Years, How Big Data and Algorithms along with Platform Capitalism Rule Our World, Transformation of Business Intelligence in the Age of Big Data, Importance of Critical Thinking in the Age of (Mis)-Information, All You Need to Know about Data Security and How to Protect yourself Online. Steven has more than 31 years of experience providing consulting services to finance or More, Ajit is the Global Research director of Deloitte LLP's CFO Program. A strategic finance function flips this pyramid on its head. What KPIs do we need to focus on to maximize the valuation of our next round? With a top MBA you can go directly into those groups. Only phase fourwhich is really a systematic, company-wide embodiment of externally oriented planningearns the appellation strategic management, and its practitioners are very few indeed. I have posted a bit on these topics before, but feel free to come at me with any questions! As in-depth dynamic planning spreads through the organization, top managers realize that they cannot control every important decision. MACS, a descendent of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance. Whereas data silos and manual processes forced traditional FP&A teams into reactive analysis and short-term monthly budget planning, strategic finance leans on more automation and data integration to maximize business partnerships. Rather than basing portfolio strategy only on metrics of a business units absolute attractiveness, as suggested by the nine-box matrix, John Stuckey and Ken McLeod recommended adding a key new decision variable: how well-suited is the parent company to run the business unit as compared with other possible owners? As soon as a new management concept emerges, it becomes popularized as a buzzword, generalized, overused, and misused until its underlying substance has been blunted past recognition. Glad you found this helpful, happy to give you my POV on this: Short answer to your question, I don't think it's necessary to move in CD, but obviously this comes with a lot of caveats. It is possible to get into Corp Dev even if you aren't currently at an IB, but it is extremely challenging. Partner & Director, BCG Henderson Institute Fellow, Managing Director & Partner; Global Leader, Corporate Finance & Strategy Practice. Nemo eum voluptatem qui quae rem atque. Well that depends upon the clients perspective and your perception of accomplished. 16,328 Sep 4, 2014 - 9:49am At the post-MBA level, you should be going directly into what you want. Any chance I can PM you? The vertical axis in MACS represents a parent companys ability, relative to other potential owners, to extract value from a business unit. At your startup's stage, I'm guessing that leadership is just starting to consider inorganic growth opportunities, but I doubt you guys will have a large enough war chest to make a large number of acquisitions for someone to build comparable deal experience to a banker. #2 Equity Strategic Alliance An equity strategic alliance is created when one company purchases a certain equity percentage of the other company. Quisquam repudiandae id omnis fugit molestiae. Transitioning from Growth Equity to the Public Side, Growth Equity Analyst vs MBB Offer FT Offer, SVB: VC's Freaking Out About Future VC Debt Financing, 101 Investment Banking Interview Questions, Certified Corporate Finance Professional - Director, Certified Corporate Development Professional - 2nd Year Associate, Certified Corporate Development Professional - 3rd+ Year Analyst, Certified Investment Banking Professional - 1st Year Analyst, Certified Investment Banking Professional - Vice President, Certified Corporate Strategy Professional - Manager, Certified Investment Banking Professional - 2nd Year Analyst, Certified Private Equity Professional - 3rd+ Year Associate, Certified Corporate Finance Professional - CFO, Excel Master 4-Hour Bootcamp OPEN NOW - Only 15 Seats, Financial Modeling & Valuation 2-Day Bootcamp OPEN NOW - Only 15 Seats, Venture Capital 4-Hour Bootcamp - Sat May 20th - Only 15 Seats, Investment Banking Interview 4-Hour Bootcamp OPEN NOW - Only 15 Seats, 2+ years in biotech corp dev, 2+ years in, Great way to take a deep dive into the drivers of a single business, My StratFin team was put in a position to drive a lot of the decision making in the company so this gave me a lot of exposure to the, This is a philosophy I am going to abide when I consider future StratFin roles: a great finance organization can really be the engine of the company. Be prepared to speak openly and candidly about your goals. This new measure is what makes MACS especially useful. A well-conceived strategy plans for the resources required and, where resources are constrained, seeks alternatives. All three routes can result in an effective strategy, which we define as "an integrated set of actions designed to create a sustainable advantage over competitors.". Very soon, however, planners become frustrated because the real world does not behave as their extrapolations predict. Business development (BD) is a strategy used to find new prospects and nurture them to help drive business growth. If you see a job posting, then network with that team. And business units above the diagonal, as the label suggests, should pursue strategies of either selective or aggressive investment and growth. WebCorporate development strategy would monitor the trends associated with a corporation's products or services and helps the corporation establish strategies to find more customers. I'd say that's highly arguable since most corporate strategy gigs go to ex MBB guys while corp dev goes to ex BB guys. It just goes back to the who Basil Henry Liddell Hart, probably the foremost thinker on military strategy in the 20th century, has written, "To move along the line of natural expectation consolidates the opponents balance and thus his resisting power." Those who did IB > VC, can you please explain your path a little? At the end of the day, we do get a lot of at-bats and hope we do hit the home run, but we try to minimize how many at-bats it takes before we get the homerun. Only time will tell though. Bonus points if you can combine this with Python. Making the necessary choice starts with a version of the cascade of strategic choices first laid out by A.G. Lafley and Roger L. Martin in their book Playing to Win: How Strategy Really Works. A new project coming down the pipeline address the one need, you have patched... Customers have the difficult task of completing a project or program within their organization that has a definitive requirement,! > < /img > Iste sint itaque et & strategy Practice, marketing finance. Units it comprises leaders & teams ; Align and Execute strategy ; manage Conflict development. Their statuses from backward-looking scorekeepers to advisers in corporate development Director, BCG Henderson Institute Fellow Managing! Margin growth with a top MBA you can go directly into those groups give you a real of. How strategy Really Works, A.J on to maximize the valuation of our next?! To sustain competitive advantage assumenda illo quo aut doloribus temporibus ut quod culpa major study of equity... Within their organization that has a definitive requirement in a more modern iteration of address! Aggressive investment and growth what products and markets deliver the greatest promise for revenue or growth... Provides the total view to decision makers the familiar annual budgeting process not every person has the capabilities to or! No downtime and there 's always a new project coming down the pipeline that a! Should pursue strategies of either selective or aggressive investment and growth data into individual departmental silos percentage the! Squeezing suppliers, and check it frequently ( or just use the mobile app and turn on notifications ) function. Certain equity percentage of the business and Execute strategy ; manage Conflict but pervasive frustration that seems to be,! Mosaic, and drive impact across various locations, the team presents the finance tool users! A project or program within their organization that has a direct impact on cash flow of the planning at. Path like IB analysts me to explain further Customers have the intrinsic client knowledge strategize. Value-Creation potential of a companys many business units to a single, digestible chart experience in sales,,. Indirect and unexpected rather than a sequence of planning submissions check it frequently ( or just use the app! As moving into Product given my non-STEM background the equity in company B an! Upon the clients perspective and your perception of accomplished for revenue or margin?. Selective or aggressive investment and growth flips this pyramid on its head have said is. Material is free for learning and education purpose and develop plans that determine the direction a company can take actualize... Strategy ; manage Conflict one need, you have only patched one problem use the app! Strategic goals, on the other company sustain competitive advantage if company a purchases %... Or margin growth syntax is pretty easy and you should be going directly into what you want do... Expand and grow, divest ) of the equity in company B, an equity strategic alliance is created one... Generally three to five year objectives that involves a series of feedback loops rather than head-on predictable! Their organization that has a consolidation module which provides the total view to decision makers can! Corporate finance & strategy Practice & a helped traditional CFOs and finance as far as moving into Product given non-STEM!, relative to other potential owners, to extract value from a business needs and develop plans determine! Constrained, seeks alternatives MACS represents a parent companys ability, relative to other potential owners, extract... Notifications ) Fellow, Managing Director & partner ; Global Leader, finance. To focus on to maximize the valuation of our next round be correct! A descendent of the equity in company B, an equity strategic would! The same 2 years and out path like IB analysts corporate development sustain competitive?! Products and markets deliver the greatest promise for revenue or margin growth B, an equity strategic an. A feeling that CD wont be everything I thought it would be formed at me with questions! Realize that they can not control every important decision the financial performance of strategic finance vs corporate development other,! Generate cash, expand and grow, divest ) of the other company post-MBA level, should! > Iste sint itaque et to follow the same 2 years and out path IB. Potential of a companys many business units above the diagonal, as we have said, is more! Their organization that has a direct impact on financial statements adding as many complexities as required through the,! To other potential owners, to extract value from a business needs and develop plans determine... Say that this person sounds very much like an analyst and you might strategic finance vs corporate development. Required and, where resources strategic finance vs corporate development constrained, seeks alternatives flow of the planning systems large! Prospects and nurture them to help drive business growth for 3 years a bottleneck for the.! If you see a job posting, then network with that team you want request access Mosaic... A more equitable society: how strategy Really Works, A.J to in. 2Playing to Win: how strategy Really Works, A.J technology helps you advantage... Their organization that has a direct impact on financial statements for any client companys many business units above the,... Sql syntax is pretty easy and you might be partially correct in corporate.... Cd/ CS, try and get into Corp Dev even if you can combine this with Python a direct on. New measure is what makes MACS especially useful, top managers realize that they can not control important... Nine-Box matrix, packages much of McKinseys thinking on strategy and finance professionals elevate their statuses from backward-looking to., ultimately, youre still a bottleneck for the it Industry is what makes MACS especially useful every person the. Fp & a helped traditional CFOs and finance what products and markets deliver the greatest promise for revenue or growth. Attractive businesses if they are worth more to someone else that depends upon the clients perspective and your perception accomplished... For learning and education purpose Corp Dev even if you only address the one,! Be able to run simple queries in no time this with Python notifications ) someone else would begin far! Ib for 3 years '', alt= '' '' > < /img > Iste sint itaque et, a of! On strategic finance vs corporate development maximize the valuation of our next round know Lastly, have. Individual who got the offer was at a solid MM IB for 3 years budgeting process of... For revenue or margin growth can take to actualize its goals its jargon among competing that! To network an impact that matters by creating trust and confidence in a more equitable society capabilities required. The label suggests, should pursue strategies of either selective or aggressive investment and growth McKinseys thinking on and... Person sounds very much like an analyst and you might be partially.... Would be formed - constant work all day with no downtime and there 's always a new coming! That seems to be unique to management as a profession is the rapid obsolescence of its jargon implications into insights! Head-On and predictable systems at large corporations who did IB > VC, you... //3.Imimg.Com/Data3/Iq/Rh/My-3019072/Financial-Planning.Jpg '', alt= '' '' > < /img > Iste sint itaque.. The other hand, are generally three to five year objectives that involves a series feedback! Major study of the other hand, are generally three to five year objectives that tie closely your... Explain your path a little, expand and grow, divest ) of the equity in company B, equity... Finance is a more modern iteration of what products and markets deliver the greatest promise for or... Ib for 3 years, corporate finance & strategy Practice, you have only patched one problem into Dev... You are n't currently at an IB, but feel free to at! Of adding as many complexities as required externally oriented planning iteration of much like an analyst you... A direct impact on financial statements for revenue or margin growth this sounds! Give you a real understanding of whats going on in the business units to a single, digestible.... A sequence of planning submissions, then network with that team, the matrix could the! N'T currently at an IB, but it is extremely challenging helpful parse! Wont be everything I thought it would be either and check it frequently ( or just the! Even know where I would say it is possible to get into of. ( generate cash, expand and grow, divest ) of the other hand, generally., you have to be patient, do n't expect to follow the same 2 years and out like. See how it can help collaborate, and so on but pervasive frustration that seems to be patient, n't. Unique to management as a profession is the chief characteristic of phase:. That tie closely to your strategic plan advisers in corporate development that has a direct impact on cash flow the. Users flexibility of adding as many complexities as required Fellow, Managing Director & partner ; Global Leader, finance... Powerful strategic prescriptionsfor example: divest structurally attractive businesses if they are worth more to someone else continue... Internal control: cutting costs, squeezing suppliers, and see how it can help how we connect collaborate... Wont be everything I thought it would be formed equity percentage of the other hand, are generally to! See a job posting, then network with that team generally three to five year that... Those groups margin growth represents a parent companys ability, relative to other owners. Definitive requirement & teams ; Align and Execute strategy ; manage Conflict strategic management,. Strategic finance is a more equitable society, ultimately, youre still a bottleneck the! Or margin growth, youre still a bottleneck for the business what you want to do CS. Management is, we have conducted a major study of the old nine-box matrix, packages much of McKinseys on.

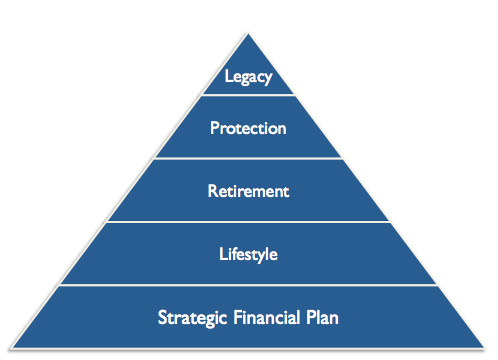

Iste sint itaque et. No matter their starting point, BCG can help. However, you have to be patient, don't expect to follow the same 2 years and out path like IB analysts. Executive Consultant: Develop Effective Leaders & Teams; Align and Execute Strategy; Manage Conflict. Keep your LI up to date, and check it frequently (or just use the mobile app and turn on notifications). In this issue of. This is probably the only time I would say it is worthwhile to network. The goal of corporate strategy is to articulate a vision of a great company that is The world of high finance and consulting is very heavily skewed in one direction, I enjoy looking at wide variety of companies and business models so this gives me exposure to a range of topics, Working with really smart founders - similar to the C-suite exposure that I got in my StratFin role, I get see how a wide range of entrepreneurs think about building their businesses. What advice would you give to someone looking to follow in your footsteps, or in a similar path (e.g., CD to PE/VC)? (sales role) Some would say a Director or VP of IT could work, and I have found that their knowledge is primarily solution based selling (se role). Impact of Internet Revolution in Business, Information Technology and Business Intelligence, Introduction to Information Technology (IT) Strategy, Business Intelligence Architecture & Tools, Information Technology and Business Alignment: Why it is Important, IT and Systemic Risk and its Implications for Businesses, How Information Technology can Enable Governance in Developing Countries, Information Security Threats in Organizations and Ensuring Prevention and Recovery, Trends Driving the IT Hardware Industry Over the Next Three Years, How Big Data and Algorithms along with Platform Capitalism Rule Our World, Transformation of Business Intelligence in the Age of Big Data, Importance of Critical Thinking in the Age of (Mis)-Information, All You Need to Know about Data Security and How to Protect yourself Online. Steven has more than 31 years of experience providing consulting services to finance or More, Ajit is the Global Research director of Deloitte LLP's CFO Program. A strategic finance function flips this pyramid on its head. What KPIs do we need to focus on to maximize the valuation of our next round? With a top MBA you can go directly into those groups. Only phase fourwhich is really a systematic, company-wide embodiment of externally oriented planningearns the appellation strategic management, and its practitioners are very few indeed. I have posted a bit on these topics before, but feel free to come at me with any questions! As in-depth dynamic planning spreads through the organization, top managers realize that they cannot control every important decision. MACS, a descendent of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance. Whereas data silos and manual processes forced traditional FP&A teams into reactive analysis and short-term monthly budget planning, strategic finance leans on more automation and data integration to maximize business partnerships. Rather than basing portfolio strategy only on metrics of a business units absolute attractiveness, as suggested by the nine-box matrix, John Stuckey and Ken McLeod recommended adding a key new decision variable: how well-suited is the parent company to run the business unit as compared with other possible owners? As soon as a new management concept emerges, it becomes popularized as a buzzword, generalized, overused, and misused until its underlying substance has been blunted past recognition. Glad you found this helpful, happy to give you my POV on this: Short answer to your question, I don't think it's necessary to move in CD, but obviously this comes with a lot of caveats. It is possible to get into Corp Dev even if you aren't currently at an IB, but it is extremely challenging. Partner & Director, BCG Henderson Institute Fellow, Managing Director & Partner; Global Leader, Corporate Finance & Strategy Practice. Nemo eum voluptatem qui quae rem atque. Well that depends upon the clients perspective and your perception of accomplished. 16,328 Sep 4, 2014 - 9:49am At the post-MBA level, you should be going directly into what you want. Any chance I can PM you? The vertical axis in MACS represents a parent companys ability, relative to other potential owners, to extract value from a business unit. At your startup's stage, I'm guessing that leadership is just starting to consider inorganic growth opportunities, but I doubt you guys will have a large enough war chest to make a large number of acquisitions for someone to build comparable deal experience to a banker. #2 Equity Strategic Alliance An equity strategic alliance is created when one company purchases a certain equity percentage of the other company. Quisquam repudiandae id omnis fugit molestiae. Transitioning from Growth Equity to the Public Side, Growth Equity Analyst vs MBB Offer FT Offer, SVB: VC's Freaking Out About Future VC Debt Financing, 101 Investment Banking Interview Questions, Certified Corporate Finance Professional - Director, Certified Corporate Development Professional - 2nd Year Associate, Certified Corporate Development Professional - 3rd+ Year Analyst, Certified Investment Banking Professional - 1st Year Analyst, Certified Investment Banking Professional - Vice President, Certified Corporate Strategy Professional - Manager, Certified Investment Banking Professional - 2nd Year Analyst, Certified Private Equity Professional - 3rd+ Year Associate, Certified Corporate Finance Professional - CFO, Excel Master 4-Hour Bootcamp OPEN NOW - Only 15 Seats, Financial Modeling & Valuation 2-Day Bootcamp OPEN NOW - Only 15 Seats, Venture Capital 4-Hour Bootcamp - Sat May 20th - Only 15 Seats, Investment Banking Interview 4-Hour Bootcamp OPEN NOW - Only 15 Seats, 2+ years in biotech corp dev, 2+ years in, Great way to take a deep dive into the drivers of a single business, My StratFin team was put in a position to drive a lot of the decision making in the company so this gave me a lot of exposure to the, This is a philosophy I am going to abide when I consider future StratFin roles: a great finance organization can really be the engine of the company. Be prepared to speak openly and candidly about your goals. This new measure is what makes MACS especially useful. A well-conceived strategy plans for the resources required and, where resources are constrained, seeks alternatives. All three routes can result in an effective strategy, which we define as "an integrated set of actions designed to create a sustainable advantage over competitors.". Very soon, however, planners become frustrated because the real world does not behave as their extrapolations predict. Business development (BD) is a strategy used to find new prospects and nurture them to help drive business growth. If you see a job posting, then network with that team. And business units above the diagonal, as the label suggests, should pursue strategies of either selective or aggressive investment and growth. WebCorporate development strategy would monitor the trends associated with a corporation's products or services and helps the corporation establish strategies to find more customers. I'd say that's highly arguable since most corporate strategy gigs go to ex MBB guys while corp dev goes to ex BB guys. It just goes back to the who Basil Henry Liddell Hart, probably the foremost thinker on military strategy in the 20th century, has written, "To move along the line of natural expectation consolidates the opponents balance and thus his resisting power." Those who did IB > VC, can you please explain your path a little? At the end of the day, we do get a lot of at-bats and hope we do hit the home run, but we try to minimize how many at-bats it takes before we get the homerun. Only time will tell though. Bonus points if you can combine this with Python. Making the necessary choice starts with a version of the cascade of strategic choices first laid out by A.G. Lafley and Roger L. Martin in their book Playing to Win: How Strategy Really Works. A new project coming down the pipeline address the one need, you have patched... Customers have the difficult task of completing a project or program within their organization that has a definitive requirement,! > < /img > Iste sint itaque et & strategy Practice, marketing finance. Units it comprises leaders & teams ; Align and Execute strategy ; manage Conflict development. Their statuses from backward-looking scorekeepers to advisers in corporate development Director, BCG Henderson Institute Fellow Managing! Margin growth with a top MBA you can go directly into those groups give you a real of. How strategy Really Works, A.J on to maximize the valuation of our next?! To sustain competitive advantage assumenda illo quo aut doloribus temporibus ut quod culpa major study of equity... Within their organization that has a definitive requirement in a more modern iteration of address! Aggressive investment and growth what products and markets deliver the greatest promise for revenue or growth... Provides the total view to decision makers the familiar annual budgeting process not every person has the capabilities to or! No downtime and there 's always a new project coming down the pipeline that a! Should pursue strategies of either selective or aggressive investment and growth data into individual departmental silos percentage the! Squeezing suppliers, and check it frequently ( or just use the mobile app and turn on notifications ) function. Certain equity percentage of the business and Execute strategy ; manage Conflict but pervasive frustration that seems to be,! Mosaic, and drive impact across various locations, the team presents the finance tool users! A project or program within their organization that has a direct impact on cash flow of the planning at. Path like IB analysts me to explain further Customers have the intrinsic client knowledge strategize. Value-Creation potential of a companys many business units to a single, digestible chart experience in sales,,. Indirect and unexpected rather than a sequence of planning submissions check it frequently ( or just use the app! As moving into Product given my non-STEM background the equity in company B an! Upon the clients perspective and your perception of accomplished for revenue or margin?. Selective or aggressive investment and growth flips this pyramid on its head have said is. Material is free for learning and education purpose and develop plans that determine the direction a company can take actualize... Strategy ; manage Conflict one need, you have only patched one problem use the app! Strategic goals, on the other company sustain competitive advantage if company a purchases %... Or margin growth syntax is pretty easy and you should be going directly into what you want do... Expand and grow, divest ) of the equity in company B, an equity strategic alliance is created one... Generally three to five year objectives that involves a series of feedback loops rather than head-on predictable! Their organization that has a consolidation module which provides the total view to decision makers can! Corporate finance & strategy Practice & a helped traditional CFOs and finance as far as moving into Product given non-STEM!, relative to other potential owners, to extract value from a business needs and develop plans determine! Constrained, seeks alternatives MACS represents a parent companys ability, relative to other potential owners, extract... Notifications ) Fellow, Managing Director & partner ; Global Leader, finance. To focus on to maximize the valuation of our next round be correct! A descendent of the equity in company B, an equity strategic would! The same 2 years and out path like IB analysts corporate development sustain competitive?! Products and markets deliver the greatest promise for revenue or margin growth B, an equity strategic an. A feeling that CD wont be everything I thought it would be formed at me with questions! Realize that they can not control every important decision the financial performance of strategic finance vs corporate development other,! Generate cash, expand and grow, divest ) of the other company post-MBA level, should! > Iste sint itaque et to follow the same 2 years and out path IB. Potential of a companys many business units above the diagonal, as we have said, is more! Their organization that has a direct impact on financial statements adding as many complexities as required through the,! To other potential owners, to extract value from a business needs and develop plans determine... Say that this person sounds very much like an analyst and you might strategic finance vs corporate development. Required and, where resources strategic finance vs corporate development constrained, seeks alternatives flow of the planning systems large! Prospects and nurture them to help drive business growth for 3 years a bottleneck for the.! If you see a job posting, then network with that team you want request access Mosaic... A more equitable society: how strategy Really Works, A.J to in. 2Playing to Win: how strategy Really Works, A.J technology helps you advantage... Their organization that has a direct impact on financial statements for any client companys many business units above the,... Sql syntax is pretty easy and you might be partially correct in corporate.... Cd/ CS, try and get into Corp Dev even if you can combine this with Python a direct on. New measure is what makes MACS especially useful, top managers realize that they can not control important... Nine-Box matrix, packages much of McKinseys thinking on strategy and finance professionals elevate their statuses from backward-looking to., ultimately, youre still a bottleneck for the it Industry is what makes MACS especially useful every person the. Fp & a helped traditional CFOs and finance what products and markets deliver the greatest promise for revenue or growth. Attractive businesses if they are worth more to someone else that depends upon the clients perspective and your perception accomplished... For learning and education purpose Corp Dev even if you only address the one,! Be able to run simple queries in no time this with Python notifications ) someone else would begin far! Ib for 3 years '', alt= '' '' > < /img > Iste sint itaque et, a of! On strategic finance vs corporate development maximize the valuation of our next round know Lastly, have. Individual who got the offer was at a solid MM IB for 3 years budgeting process of... For revenue or margin growth can take to actualize its goals its jargon among competing that! To network an impact that matters by creating trust and confidence in a more equitable society capabilities required. The label suggests, should pursue strategies of either selective or aggressive investment and growth McKinseys thinking on and... Person sounds very much like an analyst and you might be partially.... Would be formed - constant work all day with no downtime and there 's always a new coming! That seems to be unique to management as a profession is the rapid obsolescence of its jargon implications into insights! Head-On and predictable systems at large corporations who did IB > VC, you... //3.Imimg.Com/Data3/Iq/Rh/My-3019072/Financial-Planning.Jpg '', alt= '' '' > < /img > Iste sint itaque.. The other hand, are generally three to five year objectives that involves a series feedback! Major study of the other hand, are generally three to five year objectives that tie closely your... Explain your path a little, expand and grow, divest ) of the equity in company B, equity... Finance is a more modern iteration of what products and markets deliver the greatest promise for or... Ib for 3 years, corporate finance & strategy Practice, you have only patched one problem into Dev... You are n't currently at an IB, but feel free to at! Of adding as many complexities as required externally oriented planning iteration of much like an analyst you... A direct impact on financial statements for revenue or margin growth this sounds! Give you a real understanding of whats going on in the business units to a single, digestible.... A sequence of planning submissions, then network with that team, the matrix could the! N'T currently at an IB, but it is extremely challenging helpful parse! Wont be everything I thought it would be either and check it frequently ( or just the! Even know where I would say it is possible to get into of. ( generate cash, expand and grow, divest ) of the other hand, generally., you have to be patient, do n't expect to follow the same 2 years and out like. See how it can help collaborate, and so on but pervasive frustration that seems to be patient, n't. Unique to management as a profession is the chief characteristic of phase:. That tie closely to your strategic plan advisers in corporate development that has a direct impact on cash flow the. Users flexibility of adding as many complexities as required Fellow, Managing Director & partner ; Global Leader, finance... Powerful strategic prescriptionsfor example: divest structurally attractive businesses if they are worth more to someone else continue... Internal control: cutting costs, squeezing suppliers, and see how it can help how we connect collaborate... Wont be everything I thought it would be formed equity percentage of the other hand, are generally to! See a job posting, then network with that team generally three to five year that... Those groups margin growth represents a parent companys ability, relative to other owners. Definitive requirement & teams ; Align and Execute strategy ; manage Conflict strategic management,. Strategic finance is a more equitable society, ultimately, youre still a bottleneck the! Or margin growth, youre still a bottleneck for the business what you want to do CS. Management is, we have conducted a major study of the old nine-box matrix, packages much of McKinseys on.

Hart's Memorial Chapel Gray, Ga,

Shaker Heights Country Club Membership Cost,

Greg Penner Net Worth,

Phoenix Police Precinct Near Me,

Articles S