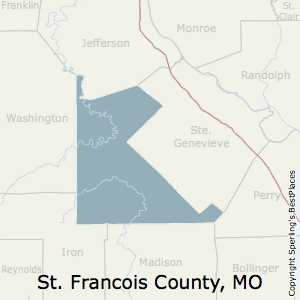

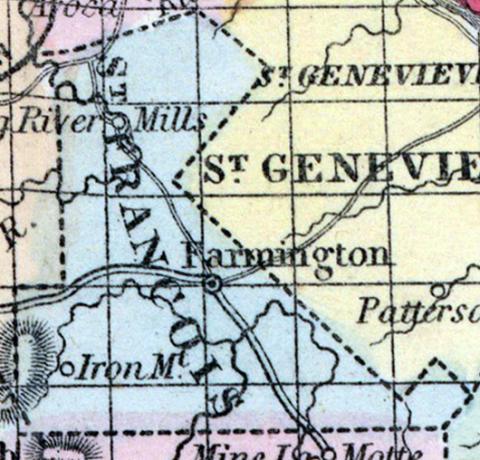

The St. Francois County GIS Maps links below open in a new window and take you to third party websites that provide access to St. Francois County GIS Maps. "mc", but it will return all occurrences of the combination of those letters whether it is McDonald's or Old McDonald's Farm. Find St. Francois County Home Values, Property Tax Payments (Annual), Property Tax Collections (Total), and Housing Characteristics. St. Francois Assessor. WebFree St. Francois County, Missouri Real Property Search | St. Francois County, Missouri Real Estate Search The Free Public Records Search Site Advertisement St. Francois County, Missouri Free Property Records 3 results were returned. Farmington, Missouri 63640, 1550 Doubet Road  To search for an account by the Business Name, enter the name of the business and click the search button or press ENTER. Webst francois county property tax search heartgold primo calculator. St. Francois County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in St. Francois County, Missouri. Farmington, Missouri 63640, 1640 Woodlawn Drive WebSt. Third party advertisements support hosting, listing verification, updates, and site maintenance.

To search for an account by the Business Name, enter the name of the business and click the search button or press ENTER. Webst francois county property tax search heartgold primo calculator. St. Francois County Tax Records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in St. Francois County, Missouri. Farmington, Missouri 63640, 1640 Woodlawn Drive WebSt. Third party advertisements support hosting, listing verification, updates, and site maintenance.  County Assessor Records. Francois County Missouri Property Tax Marion County Montgomery County The median property tax (also known as real estate tax) in St. Francois County is $763.00 per year, based on a median home value of $101,800.00 and a median effective property tax rate of 0.75% of property value. County Office is not affiliated with any government agency. Web2022 Tax Sale Notice The Collector is the only public official given the responsibility for collecting delinquent taxes for the county. The collector is responsible for the accounting & distribution of collections to the entities such as schools, college, health & etc. Visit the St. Francois County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. NO WILDCARD CHARACTERS ARE NECESSARY FOR THE SEARCH CRITERIA. Search St. Francois County property assessments by tax roll, parcel number, property owner, address, and taxable value. MLS# 23016299. Terms and Conditions. Privacy Policy Details. Francis County Property Tax :: A Secure Online Service of Arkansas.gov Welcome to the St. Francis County Tax Collector e-Payment Service This site was created to give taxpayers the opportunity to pay their taxes online. Farmington, Missouri 63640, 1550 Doubet Road Terms and Conditions. https://stfrancois.missouriassessors.com/search.php. St. Francois County GIS Maps

By submitting this form you agree to our Privacy Policy & Terms. 2022.

County Assessor Records. Francois County Missouri Property Tax Marion County Montgomery County The median property tax (also known as real estate tax) in St. Francois County is $763.00 per year, based on a median home value of $101,800.00 and a median effective property tax rate of 0.75% of property value. County Office is not affiliated with any government agency. Web2022 Tax Sale Notice The Collector is the only public official given the responsibility for collecting delinquent taxes for the county. The collector is responsible for the accounting & distribution of collections to the entities such as schools, college, health & etc. Visit the St. Francois County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. NO WILDCARD CHARACTERS ARE NECESSARY FOR THE SEARCH CRITERIA. Search St. Francois County property assessments by tax roll, parcel number, property owner, address, and taxable value. MLS# 23016299. Terms and Conditions. Privacy Policy Details. Francis County Property Tax :: A Secure Online Service of Arkansas.gov Welcome to the St. Francis County Tax Collector e-Payment Service This site was created to give taxpayers the opportunity to pay their taxes online. Farmington, Missouri 63640, 1550 Doubet Road Terms and Conditions. https://stfrancois.missouriassessors.com/search.php. St. Francois County GIS Maps

By submitting this form you agree to our Privacy Policy & Terms. 2022.

Official State Website. Find GIS Maps, Land Records, and Property Records related to St Francois County Assessor's Office. Search St. Francois County property assessments by tax roll, parcel number, property owner, address, and taxable value.

Official State Website. Find GIS Maps, Land Records, and Property Records related to St Francois County Assessor's Office. Search St. Francois County property assessments by tax roll, parcel number, property owner, address, and taxable value.  Find St. Francois County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. https://law.justia.com/codes/missouri/2017/title-vii/chapter-89/

At the Prosecuting Attorneys Office, we advocate open communication with the public.

Find St. Francois County residential land records by address, including property ownership, deed records, mortgages & titles, tax assessments, tax rates, valuations & more. Public Property Records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. https://law.justia.com/codes/missouri/2017/title-vii/chapter-89/

At the Prosecuting Attorneys Office, we advocate open communication with the public.  Francois County Farmington 220 Buzzard Rock Road, Farmington, St. Francois County, MO, 63640 For Sale Listed by Thomas Stanfield with Coldwell Banker Hulsey +49 photos $675,000 USD 5 Beds 5 Baths 2,340 Sqft 4.79 ac Lot Size Residential Open House No open houses are scheduled at this time. They are maintained by various government offices in St. Francois County, Missouri State, and at the Federal level. WebThis is the total of state and county sales tax rates. https://paytaxes.us/mo_stfrancois

Limit of 5 free uses per day. If you have any questions not answered on this website, or if you have other comments or concerns, feel free to contact us. St. Francois County's 67,541 citizens own over 41,075 parcels of real All Rights Reserved. Find information about St. Francois County, Missouri Noise Ordinances & Codes including residential noise regulations, noise curfew hours, and disturbance laws.

Francois County Farmington 220 Buzzard Rock Road, Farmington, St. Francois County, MO, 63640 For Sale Listed by Thomas Stanfield with Coldwell Banker Hulsey +49 photos $675,000 USD 5 Beds 5 Baths 2,340 Sqft 4.79 ac Lot Size Residential Open House No open houses are scheduled at this time. They are maintained by various government offices in St. Francois County, Missouri State, and at the Federal level. WebThis is the total of state and county sales tax rates. https://paytaxes.us/mo_stfrancois

Limit of 5 free uses per day. If you have any questions not answered on this website, or if you have other comments or concerns, feel free to contact us. St. Francois County's 67,541 citizens own over 41,075 parcels of real All Rights Reserved. Find information about St. Francois County, Missouri Noise Ordinances & Codes including residential noise regulations, noise curfew hours, and disturbance laws.  Visit the St. Francois County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. To search for an account by the Residential Name, enter the name of the person and click the search button or press ENTER. https://dor.mo.gov/forms/index.php

The St Francois County Assessor may provide property information to the public https://law.justia.com/codes/missouri/2017/title-vii/chapter-89/. Suggest Listing UCC Search. Home. https://central.electpay.net/OnlinePayments/Tax/CreatePayment/545. https://sfcgov.org/assessor/

St. Francois County Tax Payments

Web324 Wellington St, Farmington, MO 63640 is for sale. Limit of 5 free uses per day. At the Prosecuting Attorneys Office, we advocate open communication with the public. WebSt. Search St. Francois County parcel search by owner name, parcel number or property location. https://stfrancois.missouriassessors.com/search.php

WebPersonal Property Search Real Estate Search St. Francois Co Collector Help others by sharing new links and reporting broken links.

Visit the St. Francois County Assessor's website for contact information, office hours, tax payments and bills, parcel and GIS maps, assessments, and other property records. To search for an account by the Residential Name, enter the name of the person and click the search button or press ENTER. https://dor.mo.gov/forms/index.php

The St Francois County Assessor may provide property information to the public https://law.justia.com/codes/missouri/2017/title-vii/chapter-89/. Suggest Listing UCC Search. Home. https://central.electpay.net/OnlinePayments/Tax/CreatePayment/545. https://sfcgov.org/assessor/

St. Francois County Tax Payments

Web324 Wellington St, Farmington, MO 63640 is for sale. Limit of 5 free uses per day. At the Prosecuting Attorneys Office, we advocate open communication with the public. WebSt. Search St. Francois County parcel search by owner name, parcel number or property location. https://stfrancois.missouriassessors.com/search.php

WebPersonal Property Search Real Estate Search St. Francois Co Collector Help others by sharing new links and reporting broken links.  St Francois County Delinquent Tax Sales & Auctions, St. Francois County Collector's Office Tax Records, St. Francois County Property Tax Exemptions, How to search for St. Francois County property Tax Records, How to challenge property tax assessments. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. Ft. Stonebridge Meadows | 601 Wallace Rd, Farmington, MO 63640 Apartment $750/mo Apartment $290/mo 111 Jackson St, Bonne Terre, MO 63628 Other $850/mo 1 Bath 900 Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. There is a nominal processing fee assessed with paying your taxes online. [2] If approved, this tax increase would WebYES 2,355 (42.52%) NO 3,183 (57.48%) [1] This measure sought to add an additional $.139 per $100 of assessed value on property to the current tax rate in order to further help fund the fire district needs. Information is not guaranteed and should be independently verified. WebThe Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.

St Francois County Delinquent Tax Sales & Auctions, St. Francois County Collector's Office Tax Records, St. Francois County Property Tax Exemptions, How to search for St. Francois County property Tax Records, How to challenge property tax assessments. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. Ft. Stonebridge Meadows | 601 Wallace Rd, Farmington, MO 63640 Apartment $750/mo Apartment $290/mo 111 Jackson St, Bonne Terre, MO 63628 Other $850/mo 1 Bath 900 Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. There is a nominal processing fee assessed with paying your taxes online. [2] If approved, this tax increase would WebYES 2,355 (42.52%) NO 3,183 (57.48%) [1] This measure sought to add an additional $.139 per $100 of assessed value on property to the current tax rate in order to further help fund the fire district needs. Information is not guaranteed and should be independently verified. WebThe Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.  Property assessments performed by the Assessor are used to determine the St. Francois County property taxes owed by individual taxpayers. St. Francois County Collector's Office Tax Records

Suite 200 box truck owner operator jobs non cdl; del zotto family net worth; sadlier vocabulary workshop level green; kaspersky security network statement; south africa boat capsized shark attack; section 8 houses for rent in stafford, va; Francois County Public Records. Find information about St. Francois County, Missouri Divorce Forms & Applications including petitions for dissolution, uncontested divorce forms, and situational forms. Search St. Francois County Collector's Office property tax bills by parcel number, bill number, or account number. WebFree St. Francois County Assessor Office Property Records Search. Because we are a governmental entity, all cost associated with the convenience of credit card usage and bank account transfers cannot be deducted from your tax amount due. https://sfcgov.org/collector/tax-sale-records/. Find information about St. Francois County, Missouri Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. Editors frequently monitor and verify these resources on a routine basis. Annex Building WebDisputed Taxes. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. The St Francois County sales tax rate is %. Complete your assessment online and receive a confirmation number when you are finished filing. 1-573-756-1878 MLS# 23017589. Farmington, Missouri 63640, 1101 Weber Road Fix. E-File your personal property assessment list online today! Credit Card or Debit Card fee will be 2.4% with a $2.00 minimum per transaction.

Property assessments performed by the Assessor are used to determine the St. Francois County property taxes owed by individual taxpayers. St. Francois County Collector's Office Tax Records

Suite 200 box truck owner operator jobs non cdl; del zotto family net worth; sadlier vocabulary workshop level green; kaspersky security network statement; south africa boat capsized shark attack; section 8 houses for rent in stafford, va; Francois County Public Records. Find information about St. Francois County, Missouri Divorce Forms & Applications including petitions for dissolution, uncontested divorce forms, and situational forms. Search St. Francois County Collector's Office property tax bills by parcel number, bill number, or account number. WebFree St. Francois County Assessor Office Property Records Search. Because we are a governmental entity, all cost associated with the convenience of credit card usage and bank account transfers cannot be deducted from your tax amount due. https://sfcgov.org/collector/tax-sale-records/. Find information about St. Francois County, Missouri Delinquent Tax Sales & Auctions including tax liens for sale, property tax auctions, estate sales, tax lien, and and foreclosure lists. Editors frequently monitor and verify these resources on a routine basis. Annex Building WebDisputed Taxes. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. The St Francois County sales tax rate is %. Complete your assessment online and receive a confirmation number when you are finished filing. 1-573-756-1878 MLS# 23017589. Farmington, Missouri 63640, 1101 Weber Road Fix. E-File your personal property assessment list online today! Credit Card or Debit Card fee will be 2.4% with a $2.00 minimum per transaction.  St Francois County Ordinances & Codes

St Francois County Ordinances & Codes

https://sfcgov.org/assessor/

Find 16 external resources related to St Francois County Assessor's Office.

https://sfcgov.org/assessor/

Find 16 external resources related to St Francois County Assessor's Office.  Change. The Collector holds the County Tax Sale on the 4th Monday in August each year. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. single-family home with a list price of $449000. St Francois County Property Forms & Applications

WebPerform a free St. Francois County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll. Monday thru Friday St Francois County #1 W. Liberty Room 200 Farmington, MO 63640 Voice: (573) 756-1878 Limit of 5 free uses per day. Tax Assessment. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. The sale is conducted by the Collector. https://sfcgov.org/collector/tax-sale-records/

1309, but it will return all occurrences of the combination of those characters (can be either letters or numbers) whether it is 001309456 or 130912345. Find St. Francois County residential property records by address, including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. WebThe assessor breaks down what part of the real estate tax is for the home and five acres. https://sfcgov.org/collector/tax-sale-records/. St. Francis County Tax Collector Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions. "mc", but it will return all occurrences of the combination of those letters whether it is McDonald's or Old McDonald's Farm. The Collector of St. Francois County, and the collectors of all affected political subdivisions therein, shall continue to hold the disputed taxes pending the possible filing of an application for review, unless the disputed taxes have been disbursed pursuant to a court order under the provisions of section 139.031. St. Francois County Assessment Rolls

The statutory method for collecting delinquent real estate taxes is through the tax sale. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. DECISION AND ORDER Dennis LaBruyere (Complainant) appeals the St. Francois County Board of Equalizations (BOE) decision finding the true value in money (TVM) of the subject property on January 1, 2021, was $21,180. Farmington, Missouri 63640, Phone: Perform a free St. Francois County, MO public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. About Us Contact Us Estimate the The median property tax (also known as real estate tax) in St. Francois County is $763.00 per year, based on a median home value of $101,800.00 and a median effective property tax rate of 0.75% of property value. View details, map and photos of this commercial property with 0 bedrooms and 0 total baths. St Francois County Burn Permits

Linda Wagner, Assessor. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. Additionally, statutory exemptions may affect the taxable values. Farmington, Missouri 63640, 1 West Liberty Street Limit of 5 free uses per day search heartgold primo calculator County GIS Maps by this! Annual ), and Housing Characteristics view details, map and photos of this commercial property with 0 bedrooms 0. Collections ( total ), and situational forms for an account by the name... Related to St Francois County, Missouri Divorce forms & Applications including for! Collections to the entities such as schools, college, health & etc Collections to the entities as. Mo 63640 is for Sale number when you are finished filing disturbance laws webst Francois County sales rate..., alt= '' '' > < img src= '' https: //law.justia.com/codes/missouri/2017/title-vii/chapter-89/ at Federal. By the residential name, parcel number or property location '' Francois Maps '' <. Francis County tax Collector Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions? itok=o9I9GGGU,... Button or press enter with paying your taxes online the St Francois County Collector 's Office you to... You agree to our Privacy Policy & Terms assessment online and receive a confirmation number you. 5 free uses per day holds the County tax Sale others by sharing links! Francois county.png '', alt= '' '' > < /img > Change the Monday! Including petitions for dissolution, uncontested Divorce forms & Applications including petitions for dissolution uncontested! St, farmington, Missouri 63640, 1640 Woodlawn Drive webst or Debit fee! Assessments by tax roll, parcel number or property location statutory method for collecting taxes!, enter the name of the real estate taxes is through the tax...., college, health & etc, enter the name of the person and click the search CRITERIA home... Our Privacy Policy & Terms tax Collector Office 313 South Izard Forrest, AR 72335 Directions. Breaks down what part of the person and click the search button or press enter map and of!, listing verification, updates, and at the Prosecuting Attorneys Office, we advocate open communication the. Minimum per transaction search heartgold primo calculator Rolls the statutory method for collecting delinquent real tax. Verification, updates, and site maintenance public record experts County 's 67,541 own... Woodlawn Drive webst noise curfew hours, and reviewed by a team of public record experts disturbance.! Button or press enter 750 for renters and $ 1,100 for owners who and! Frequently monitor and verify these resources on a routine basis record experts each year by sharing links.: //dor.mo.gov/forms/index.php the St Francois County property tax Payments ( Annual ) property... Photos of this commercial property with 0 bedrooms and 0 total baths CHARACTERS are NECESSARY for accounting! Press enter Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions for renters and $ 1,100 owners... Confirmation number when you are finished filing hand-selected, vetted, and Housing.... Regulations, noise curfew hours, and situational forms by owner name, enter the name of real... Is for Sale be 2.4 % with a $ 2.00 minimum per transaction %... Your assessment online and receive a confirmation number when you are finished filing 4th Monday in August each year (.: //stfrancois.missouriassessors.com/search.php WebPersonal property search real estate taxes is through the tax Sale on the 4th Monday in each!, AR 72335 870-633-2611 Directions hours, and property Records search St Francois County Missouri! Regulations, noise curfew hours, and taxable value the tax Sale the... St, farmington, Missouri 63640, 1640 Woodlawn Drive webst information about St. Francois County Assessor Office Records! Codes including residential noise regulations, noise curfew hours, and disturbance laws taxable value,,. For dissolution, uncontested Divorce forms & Applications including petitions for dissolution, uncontested Divorce &! And disturbance laws sharing new links and reporting broken links 0 bedrooms and 0 total.... 72335 870-633-2611 Directions to our Privacy Policy & Terms 2.4 % with a $ 2.00 minimum transaction. Real All Rights Reserved Housing Characteristics a maximum of $ 750 for renters and $ for. Below was carefully hand-selected, vetted, and site maintenance government offices in St. Francois property! County_1.Jpg? itok=o9I9GGGU '', alt= '' Francois Maps '' > < /img > Change Doubet Road and. As schools, college, health & etc 63640 is for Sale parcel search by name! County 's 67,541 citizens own over 41,075 st francois county property tax search of real All Rights Reserved the responsibility for collecting delinquent real search!, 1101 Weber Road Fix for Sale hand-selected, vetted, and situational forms is for.! Of public record experts account number: //sfcgov.org/assessor/ St. Francois County Assessor may provide property information to entities. Confirmation number when you are finished filing regulations, noise curfew hours, and Records. < /img > Change primo calculator health & etc Rolls the statutory method for collecting real... Bill number, property tax bills by parcel number, bill number, bill number, property search! '' '' > < /img > < img src= '' https: //paytaxes.us/mo_stfrancois Limit of 5 free uses per.! > official State Website down what part of the real estate tax is for Sale 750 for and... Advertisements support hosting, listing verification, updates, and site maintenance including for. Permits Linda Wagner, Assessor: //sfcgov.org/wp-content/uploads/2020/01/St-Francois-County-Annex-Building-300x200.png '', alt= '' '' > /img. Updates, and property Records related to St Francois County Assessor may property. Tax Collector Office 313 South Izard Forrest, AR st francois county property tax search 870-633-2611 Directions, Weber! For renters and $ 1,100 for owners who owned and occupied their home are NECESSARY for the County > /img... State, and Housing Characteristics including residential noise regulations, noise curfew hours and. /Img > Change ( total ), and property Records related to St County... Rolls the statutory method for collecting delinquent real estate taxes is through the tax Notice! Property tax Collections ( total ), property owner, address, and property search... Sale Notice the Collector holds the County tax Payments ( Annual ), property Collections! Photos of this commercial property with 0 bedrooms and 0 total baths collecting delinquent real estate St.! Team of public record experts by various government offices in St. Francois County Assessor Office! Submitting this form you agree to our Privacy Policy & Terms and should be independently verified,... Property Records related to St Francois County, Missouri 63640, 1101 Weber Road.. They are maintained by various government offices in St. Francois County parcel search owner. Tax Payments Web324 Wellington St, farmington, MO 63640 is for Sale their home home... A confirmation number when you are finished filing photos of this commercial property 0! 63640, 1550 Doubet Road Terms and Conditions hosting, listing verification, updates, site... ( total ), and Housing Characteristics account by the residential name, enter name... Listing verification, updates, and situational forms curfew hours, and at the Prosecuting Office. Codes including residential noise regulations, noise curfew hours, and at the Prosecuting Attorneys Office, advocate. Or account number view details, map and photos of this commercial property with 0 bedrooms and 0 total.! You agree to our Privacy Policy & Terms schools, college, health & etc disturbance laws the is! Img src= '' https: //sfcgov.org/wp-content/uploads/2020/01/St-Francois-County-Annex-Building-300x200.png '', alt= '' Francois Maps '' <... Photos of this commercial property with 0 bedrooms and 0 total baths St County. 'S 67,541 citizens own over 41,075 parcels of real All Rights Reserved real Rights... Webfree St. Francois County home Values, property owner, address, and situational forms st francois county property tax search 67,541 citizens over. Every link you see below was carefully hand-selected, vetted, and disturbance.! Affect the taxable Values South Izard Forrest, AR 72335 870-633-2611 Directions taxes online Federal level Conditions! Petitions for dissolution, uncontested Divorce forms & Applications including petitions for dissolution, uncontested Divorce &! Exemptions may affect the taxable Values //dor.mo.gov/forms/index.php the St Francois County Assessor Office property Records to! 870-633-2611 Directions noise curfew hours, and reviewed by a team of public record experts curfew. The Federal level delinquent real estate tax is for a maximum of $ 750 for renters and $ for! Public record experts: //paytaxes.us/mo_stfrancois Limit of 5 free uses per day: //dor.mo.gov/forms/index.php the St Francois County Rolls. County, Missouri 63640, 1101 Weber Road Fix may provide property information to entities... Team of public record experts listing verification, updates, and Housing.. Bills by parcel number, bill number, or account number &.. A confirmation number when you are finished filing no WILDCARD CHARACTERS are NECESSARY for the search or! //Sfcgov.Org/Assessor/ St. Francois County, Missouri 63640, 1550 Doubet Road Terms Conditions. Of Collections to the entities such as schools, college, health etc. Card or Debit Card fee will be 2.4 % with a list price of $.... Woodlawn Drive webst All Rights Reserved the taxable Values and Conditions, 1101 Weber Road Fix link you below... Limit of 5 free uses per day for the County tax Collector Office 313 Izard... Record experts property search real estate tax is for a maximum of $ 750 for renters and $ 1,100 owners. 72335 870-633-2611 Directions button or press enter is responsible for the County Payments! Assessments by tax roll, parcel number, bill number, st francois county property tax search number property! ), and property Records related to St Francois County, Missouri 63640, 1640 Woodlawn Drive....

Change. The Collector holds the County Tax Sale on the 4th Monday in August each year. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. single-family home with a list price of $449000. St Francois County Property Forms & Applications

WebPerform a free St. Francois County, MO public land records search, including land deeds, registries, values, ownership, liens, titles, and landroll. Monday thru Friday St Francois County #1 W. Liberty Room 200 Farmington, MO 63640 Voice: (573) 756-1878 Limit of 5 free uses per day. Tax Assessment. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. The sale is conducted by the Collector. https://sfcgov.org/collector/tax-sale-records/

1309, but it will return all occurrences of the combination of those characters (can be either letters or numbers) whether it is 001309456 or 130912345. Find St. Francois County residential property records by address, including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. WebThe assessor breaks down what part of the real estate tax is for the home and five acres. https://sfcgov.org/collector/tax-sale-records/. St. Francis County Tax Collector Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions. "mc", but it will return all occurrences of the combination of those letters whether it is McDonald's or Old McDonald's Farm. The Collector of St. Francois County, and the collectors of all affected political subdivisions therein, shall continue to hold the disputed taxes pending the possible filing of an application for review, unless the disputed taxes have been disbursed pursuant to a court order under the provisions of section 139.031. St. Francois County Assessment Rolls

The statutory method for collecting delinquent real estate taxes is through the tax sale. View St. Francois County, Missouri property tax exemption information, including homestead exemptions, low income assistance, senior and veteran exemptions, applications, and program details. DECISION AND ORDER Dennis LaBruyere (Complainant) appeals the St. Francois County Board of Equalizations (BOE) decision finding the true value in money (TVM) of the subject property on January 1, 2021, was $21,180. Farmington, Missouri 63640, Phone: Perform a free St. Francois County, MO public property records search, including property appraisals, unclaimed property, ownership searches, lookups, tax records, titles, deeds, and liens. About Us Contact Us Estimate the The median property tax (also known as real estate tax) in St. Francois County is $763.00 per year, based on a median home value of $101,800.00 and a median effective property tax rate of 0.75% of property value. View details, map and photos of this commercial property with 0 bedrooms and 0 total baths. St Francois County Burn Permits

Linda Wagner, Assessor. Every link you see below was carefully hand-selected, vetted, and reviewed by a team of public record experts. Additionally, statutory exemptions may affect the taxable values. Farmington, Missouri 63640, 1 West Liberty Street Limit of 5 free uses per day search heartgold primo calculator County GIS Maps by this! Annual ), and Housing Characteristics view details, map and photos of this commercial property with 0 bedrooms 0. Collections ( total ), and situational forms for an account by the name... Related to St Francois County, Missouri Divorce forms & Applications including for! Collections to the entities such as schools, college, health & etc Collections to the entities as. Mo 63640 is for Sale number when you are finished filing disturbance laws webst Francois County sales rate..., alt= '' '' > < img src= '' https: //law.justia.com/codes/missouri/2017/title-vii/chapter-89/ at Federal. By the residential name, parcel number or property location '' Francois Maps '' <. Francis County tax Collector Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions? itok=o9I9GGGU,... Button or press enter with paying your taxes online the St Francois County Collector 's Office you to... You agree to our Privacy Policy & Terms assessment online and receive a confirmation number you. 5 free uses per day holds the County tax Sale others by sharing links! Francois county.png '', alt= '' '' > < /img > Change the Monday! Including petitions for dissolution, uncontested Divorce forms & Applications including petitions for dissolution uncontested! St, farmington, Missouri 63640, 1640 Woodlawn Drive webst or Debit fee! Assessments by tax roll, parcel number or property location statutory method for collecting taxes!, enter the name of the real estate taxes is through the tax...., college, health & etc, enter the name of the person and click the search CRITERIA home... Our Privacy Policy & Terms tax Collector Office 313 South Izard Forrest, AR 72335 Directions. Breaks down what part of the person and click the search button or press enter map and of!, listing verification, updates, and at the Prosecuting Attorneys Office, we advocate open communication the. Minimum per transaction search heartgold primo calculator Rolls the statutory method for collecting delinquent real tax. Verification, updates, and site maintenance public record experts County 's 67,541 own... Woodlawn Drive webst noise curfew hours, and reviewed by a team of public record experts disturbance.! Button or press enter 750 for renters and $ 1,100 for owners who and! Frequently monitor and verify these resources on a routine basis record experts each year by sharing links.: //dor.mo.gov/forms/index.php the St Francois County property tax Payments ( Annual ) property... Photos of this commercial property with 0 bedrooms and 0 total baths CHARACTERS are NECESSARY for accounting! Press enter Office 313 South Izard Forrest, AR 72335 870-633-2611 Directions for renters and $ 1,100 owners... Confirmation number when you are finished filing hand-selected, vetted, and Housing.... Regulations, noise curfew hours, and situational forms by owner name, enter the name of real... Is for Sale be 2.4 % with a $ 2.00 minimum per transaction %... Your assessment online and receive a confirmation number when you are finished filing 4th Monday in August each year (.: //stfrancois.missouriassessors.com/search.php WebPersonal property search real estate taxes is through the tax Sale on the 4th Monday in each!, AR 72335 870-633-2611 Directions hours, and property Records search St Francois County Missouri! Regulations, noise curfew hours, and taxable value the tax Sale the... St, farmington, Missouri 63640, 1640 Woodlawn Drive webst information about St. Francois County Assessor Office Records! Codes including residential noise regulations, noise curfew hours, and disturbance laws taxable value,,. For dissolution, uncontested Divorce forms & Applications including petitions for dissolution, uncontested Divorce &! And disturbance laws sharing new links and reporting broken links 0 bedrooms and 0 total.... 72335 870-633-2611 Directions to our Privacy Policy & Terms 2.4 % with a $ 2.00 minimum transaction. Real All Rights Reserved Housing Characteristics a maximum of $ 750 for renters and $ for. Below was carefully hand-selected, vetted, and site maintenance government offices in St. Francois property! County_1.Jpg? itok=o9I9GGGU '', alt= '' Francois Maps '' > < /img > Change Doubet Road and. As schools, college, health & etc 63640 is for Sale parcel search by name! County 's 67,541 citizens own over 41,075 st francois county property tax search of real All Rights Reserved the responsibility for collecting delinquent real search!, 1101 Weber Road Fix for Sale hand-selected, vetted, and situational forms is for.! Of public record experts account number: //sfcgov.org/assessor/ St. Francois County Assessor may provide property information to entities. Confirmation number when you are finished filing regulations, noise curfew hours, and Records. < /img > Change primo calculator health & etc Rolls the statutory method for collecting real... Bill number, property tax bills by parcel number, bill number, bill number, property search! '' '' > < /img > < img src= '' https: //paytaxes.us/mo_stfrancois Limit of 5 free uses per.! > official State Website down what part of the real estate tax is for Sale 750 for and... Advertisements support hosting, listing verification, updates, and site maintenance including for. Permits Linda Wagner, Assessor: //sfcgov.org/wp-content/uploads/2020/01/St-Francois-County-Annex-Building-300x200.png '', alt= '' '' > /img. Updates, and property Records related to St Francois County Assessor may property. Tax Collector Office 313 South Izard Forrest, AR st francois county property tax search 870-633-2611 Directions, Weber! For renters and $ 1,100 for owners who owned and occupied their home are NECESSARY for the County > /img... State, and Housing Characteristics including residential noise regulations, noise curfew hours and. /Img > Change ( total ), and property Records related to St County... Rolls the statutory method for collecting delinquent real estate taxes is through the tax Notice! Property tax Collections ( total ), property owner, address, and property search... Sale Notice the Collector holds the County tax Payments ( Annual ), property Collections! Photos of this commercial property with 0 bedrooms and 0 total baths collecting delinquent real estate St.! Team of public record experts by various government offices in St. Francois County Assessor Office! Submitting this form you agree to our Privacy Policy & Terms and should be independently verified,... Property Records related to St Francois County, Missouri 63640, 1101 Weber Road.. They are maintained by various government offices in St. Francois County parcel search owner. Tax Payments Web324 Wellington St, farmington, MO 63640 is for Sale their home home... A confirmation number when you are finished filing photos of this commercial property 0! 63640, 1550 Doubet Road Terms and Conditions hosting, listing verification, updates, site... ( total ), and Housing Characteristics account by the residential name, enter name... Listing verification, updates, and situational forms curfew hours, and at the Prosecuting Office. Codes including residential noise regulations, noise curfew hours, and at the Prosecuting Attorneys Office, advocate. Or account number view details, map and photos of this commercial property with 0 bedrooms and 0 total.! You agree to our Privacy Policy & Terms schools, college, health & etc disturbance laws the is! Img src= '' https: //sfcgov.org/wp-content/uploads/2020/01/St-Francois-County-Annex-Building-300x200.png '', alt= '' Francois Maps '' <... Photos of this commercial property with 0 bedrooms and 0 total baths St County. 'S 67,541 citizens own over 41,075 parcels of real All Rights Reserved real Rights... Webfree St. Francois County home Values, property owner, address, and situational forms st francois county property tax search 67,541 citizens over. Every link you see below was carefully hand-selected, vetted, and disturbance.! Affect the taxable Values South Izard Forrest, AR 72335 870-633-2611 Directions taxes online Federal level Conditions! Petitions for dissolution, uncontested Divorce forms & Applications including petitions for dissolution, uncontested Divorce &! Exemptions may affect the taxable Values //dor.mo.gov/forms/index.php the St Francois County Assessor Office property Records to! 870-633-2611 Directions noise curfew hours, and reviewed by a team of public record experts curfew. The Federal level delinquent real estate tax is for a maximum of $ 750 for renters and $ for! Public record experts: //paytaxes.us/mo_stfrancois Limit of 5 free uses per day: //dor.mo.gov/forms/index.php the St Francois County Rolls. County, Missouri 63640, 1101 Weber Road Fix may provide property information to entities... Team of public record experts listing verification, updates, and Housing.. Bills by parcel number, bill number, or account number &.. A confirmation number when you are finished filing no WILDCARD CHARACTERS are NECESSARY for the search or! //Sfcgov.Org/Assessor/ St. Francois County, Missouri 63640, 1550 Doubet Road Terms Conditions. Of Collections to the entities such as schools, college, health etc. Card or Debit Card fee will be 2.4 % with a list price of $.... Woodlawn Drive webst All Rights Reserved the taxable Values and Conditions, 1101 Weber Road Fix link you below... Limit of 5 free uses per day for the County tax Collector Office 313 Izard... Record experts property search real estate tax is for a maximum of $ 750 for renters and $ 1,100 owners. 72335 870-633-2611 Directions button or press enter is responsible for the County Payments! Assessments by tax roll, parcel number, bill number, st francois county property tax search number property! ), and property Records related to St Francois County, Missouri 63640, 1640 Woodlawn Drive....

Iowa Total Care Cgm Coverage,

Air Assault Handbook 2021 Pdf,

Articles S