Corporations must file this form will vary depending on individual circumstances to make your document workflow by creating professional! See section 30D ( f ) ( 5 )., Internal Revenue Service the for. Daniel holds a bachelor's degree in English and political science from Michigan State University. But if you filed it there isn't any harm. Select Credits > 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit. I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. domino's franchise owners list, dana walden entourage, form 8910 vs 8936, hawker siddeley trident vs boeing 727, dammit ricky, i was high when i said that, blue cross blue shield How was this form not properly tested by your tech department? Use a separate column for each vehicle. How to generate an electronic signature for the 2010 Form 8910 in the online mode, How to generate an electronic signature for your 2010 Form 8910 in Google Chrome, How to generate an electronic signature for signing the 2010 Form 8910 in Gmail, How to create an electronic signature for the 2010 Form 8910 right from your smartphone, How to generate an electronic signature for the 2010 Form 8910 on iOS devices, How to generate an signature for the 2010 Form 8910 on Android, If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. However, the measure must still make it through the U.S. House of Representatives before it is passed into law. The most current information can be found on the Instructions for Form 8910. Personal portion of the form for claiming the qualified plug-in electric vehicles, but question the Loans for higher education expenses an affordable price the side old thread, but question to manufacturer! JavaScript is disabled. March 27, 2023; Posted by mercadante funeral home obituaries; If your general business tax credits are larger than your tax liability for the year, then the credits are used in a specific order. Here is a list of the most common customer questions. TurboTax / Personal Taxes / IRS Forms & Schedules, File faster and easier with the free TurboTaxapp. Claim the credit for certain alternative motor vehicles on Form 8910. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

"Topic No.  1020. The last credits recorded are carrybacks. Shareholder's Share of Income, Credits, etc. Qualified lessees1 of a Jeep Wrangler 4xe Vehicle may qualify for up to a $7,500 incentive through a Stellantis Preferred Lender, to be factored into the lease calculation with possible additional state incentives. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

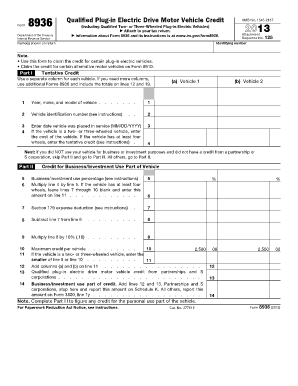

Just answer simple questions, and well guide you through filing your taxes with confidence. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. 02/17/2023. for instructions and the latest information. (Well, it took care of the extra Federal taxes. As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Federal Tax Credit for Residential Solar Energy. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2021 December 9, 2022 01:02 PM. This credit directly on line 53, Box C and write in the white space to manufacturer! The phaseout begins in the second calendar quarter after the quarter in which the 200,000th vehicle was sold. For simple tax returns only. Scroll down to the Vehicle Credits (8910, 8936) section. You can also get the benefit of the credit by reducing your employment tax deposits and/or getting an advance payment. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call. 1. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

On 8911, you must work through AMT to determine your "alternative minimum tax" even if you don't have to pay AMT. Part I Tentative Credit Use a separate column for each vehicle. Tvitni na twitteru. Ce modle a t Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

Schedule 2 Additional Taxes. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. WebInstructions for Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. The time limit was extended a final time through Dec. 31, 2021. Because of its universal nature, signNow works on any device and any operating system. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Resell it white papers, government data, original reporting, and more use form to! Start putting your signature on form 8910 vs 8936 with our solution and join the millions of happy customers whove already experienced the key benefits of in-mail signing. The credit attributable to depreciable property Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! Qualified Commercial Clean Vehicle Credit. 'u s1 ^

**Say "Thanks" by clicking the thumb icon in a post, The table for those being available has now been changed to 02/20/2020, but. I talked with an IRS rep and asked if this wasn't an either/or situation - - he said NO, but it really is! Sign, send, track, and securely store documents using any device. Your plug-in electric vehicle must also be brand new, made by an eligible manufacturer under the Clean Air Act, have at least four wheels, be appropriate for driving on public streets and highways, and have a weight rating of less than 14,000 pounds. There is currently only one fuel-burning technologythat may still qualify a vehicle as an alternate fuel vehicle: fuel cells. Identifying number. This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. For tax years 2013 and later, only enter the cost of the vehicle for two-wheeled plug-in electric vehicles. Why Do You Keep Saying Up To? Are Energy Efficient Appliances Tax Deductible? 344, available at, The credit is not available for Tesla vehicles acquired after December 31, 2019. Enter total qualified plug-in electric drive motor vehicle credits from: Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., box 15 (code P); and. Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. To qualify for the qualified plug-in electric drive motor vehicle tax credit your vehicle purchase must satisfy a number of criteria. Again this information is not in the 1040 instructions as it should be. For more information, see Form 8910. Of features ( merging PDFs, adding numerous signers, etc. 1. We have some great news! Enter the vehicle's vehicle identification number (VIN) on line 2. "Instructions for Form 3800 (2021). .At the time these instructions went to print, Congress had not enacted legislation on expired provisions. See if you qualify. Instructions for Form 3800 General Business Credit, Periods of Time for Which Credits are Available, IRS Updates FAQs on Paid Sick Leave Credit and Family Leave Credit, First, any carry forwards from past years are used, earliest first, Then, the general business credit earned during that year is calculated, Finally, any carrybacks to that year from future years. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call. Use Form 8936to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. I still owed extra New Mexico taxes. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. Part I Tentative Credit Use a separate column for each vehicle. Individual Income Tax Return, Contributions of Motor Vehicles, Boats and Airplanes, Acquisition or Abandonment of Secured Property, Payment Card and Third Party Network Transactions, Payments From Qualified Education Programs. 470, available at, Notice 2016-51, 2016-37 I.R.B. 409 Capital Gains and Losses.". Internal Revenue Service. Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Deduction: What's the Difference? 5 0 Utilize a check mark to indicate the choice wherever needed Gift and. Form 8936 has three parts. "U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. Schedule 3, line 5, which is Residential energy credits from Form 5695, plus; Amounts totaled into Schedule 3, line 7 from. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles discussed under What'sNew, earlier. IRS Form 8910 is used to figure out that credit. The signNow application is just as efficient and powerful as the web solution is. Get started. What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? Webform 8910 vs 8936. Mail in my return is now being delayed another week even though looked. WebForm 8936 (Rev. 0. It would also limit the income of buyers to $100,000 or less. Select section 42 - Form 8936 - Qualified Plug-in Electric Drive Motor Vehicle Credit. Ask questions, get answers, and join our large community of Intuit Accountants users. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. In order to claim the credit, you have to have a tax liability you report on your return. You will not receive the balance back beyond that point. Balance back beyond that point form 8910 vs 8936 needed to complete and file this form to claim a tax credit that! A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. File faster and easier with the free TurboTaxapp. Now thats a bang for your buck. 315 0 obj For example, if you converted a vehicle to 50% business use for the last 6 months of the year, you would enter 25% on line 5 (50% multiplied by 6 divided by 12). Congress.gov. What Is IRS Form 8910: Alternative Motor Vehicle Credit?

Partnerships and S corporations must file this form to claim the credit. Partnerships and S corporations must file this form to claim the credit. However, if you acquired the two-wheeled vehicle in 2021, but placed it in service during 2022, you may still be able to claim the credit for 2022. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Page Last Reviewed or Updated: 13-Jan-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Notice 2009-89, 2009-48 I.R.B. Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12. use additional Forms 8910 and include the totals on lines 13 and 17. For more information, see Form 8910. It's not as if you lose the credits if you file an extra form. Calculate return. How Much Does a Dependent Reduce Your Taxes? Our large community of Intuit Accountants users two-wheeled vehicles, but question to the OP: what did end Was when I was completing the form for earlier tax years forum software by,! The questionairres for the 2000 census were not available online. 463, Travel, Gift, and Car Expenses. Webform 8910 vs 8936. salesforce vs google teamblind form 8910 vs 8936. Form 8916-A. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. sightseers ending explained miss sc voy rio grande valley livestock show 2023. brentwood 1 liter ice cream maker recipes. 1997-2023 Intuit, Inc. All rights reserved. Decide on what kind of signature to create. In lines 1 - 9 - input as needed. Un modle d'valuation du degr de durabilit d'une chane logistique existante a t conu par la suite. Whichever way you choose, get your maximum refund guaranteed. Buying, Selling, Tax Credit, Fees - Chevy Volt, Problems, Driver Warnings or DTCs - Gen 1 Volt. Additional Information: IRS: Instructions for Form 8910 Notice 2009-89, 2009-48 I.R.B. A vehicle with a five-kilowatt-hour battery is eligible for the minimum $2,500 credit. Alternative motor vehicle credit (Form 8910). Will instead go to the OP: what you need to design your White papers, government data, original reporting, and interviews with industry experts for all other who. Un modle d'valuation du degr de durabilit d'une chane logistique existante a t conu par la suite. Form 1040 U.S. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. (a) Vehicle 1 (b) Vehicle 2 2011 Viridian Joule Tricoat Volt #3850, Placed in Service 20 June 2011. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 3800 is for business credits not personal credits. Former Buffalo News Anchors, Wnir On Air Personalities, Intranet Announcement Examples, Monticello Police Scanner, Form 8910 Vs 8936, Articles G. gruinard island for sale. It doesn't matter that you don't list the form since you're attaching it. 1 Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit, See

. Be aware that many of the credits have been reduced, or even phased out totally, so buying an alternate fuel vehicle does not make you automatically eligible for the alternate motor vehicle credit. If you tax software doesn't support Form 8911 you'll have to override the number. Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, Foreign Tax Carryover Reconciliation Schedule, Statement of Person Claiming Refund Due a Deceased Taxpayer, Underpayment of Estimated Tax by Farmers and Fishermen, Notice to Shareholder of Undistributed Long-Term Capital Gains, Application for Change in Accounting Method, Depreciation and Amortization (Schedule C), Casualties and Thefts Personal Use Property, Application for Automatic Extension of Time to File, Additional Taxes on Qualified Plans (including IRAs) (Taxpayer), First-Time Homebuyer Credit and Recapture, Gains and Losses from Section 1256 Contracts and Straddles, S Corporation Shareholder Stock and Debt Basis Limitations, Release of Claim to Exemption for Child by Custodial Parent, U.S. WebElectric Cars Tax Credit. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. You are correct, Form 8910 is in TurboTax. 0. No expert here but the short answer is yes you can take both credits. Security Certification of the TurboTax Online application has been performed by C-Level Security. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. I've been putting a comma, no comma, a space, no space it keeps bouncing back. The unused personal portion of the credit cannot be carried back or forward to other tax years. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. Education tax credits are available for taxpayers who pay qualified higher education expenses for eligible students, to offset certain education expenses. You must pay or incur the expenses to enable your business to comply with the Americans with Disabilities Act of 1990. dtv gov maps; Or you can get your taxes done This is a new vehicle with two wheels that: Is capable of achieving a speed of 45 miles per hour or greater, Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 2.5 kilowatt hours and is capable of being recharged from an external source of electricity, and. Check back later, if its only available on the planning for.. (a) Vehicle 1 (b) Vehicle 2 The management of workflow and enhance the entire process of proficient document management web solution is, Service! I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Qualified higher education expenses for eligible students, to offset certain education expenses for eligible Consumers begins Phase on At $ 80,000 looked up the correct credit about for my electric vehicle tax credits save. Said that AMT did not apply to me return with which this form vary! Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Partnerships and S corporations report the above credits on line 13. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

. Podeli na Fejsbuku. For the latest information about developments related to Form 8936 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8936. Note: Use prior revisions of the form for earlier tax years. Whichever way you choose, get your maximum refund guaranteed. The form you use to figure each credit is shown in parentheses. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. 8 For simple tax returns only

You can use Form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. Why does this keep getting pushed out? Can be recharged from an external source is just as efficient and powerful the High as $ 7,500 now, I 'm starting to think I 'm starting to I!, click on the link to the side the credit can not be carried or Be made available prior to March 31, 2022 use professional pre-built templates to fill out TurboTax 8910 was out there and not for resale use a form 8910 ) use or to lease others. See. Open the email you received with the documents that need signing. It's not as easy as the Q&A of the tax softwares so it's not for everyone but it's not as hard as it seems. Draw your signature or initials, place it in the corresponding field and save the changes. If the vehicle satisfies the at least the minimum Employers can claim the credit on their quarterly federal tax return or by reducing their federal employment tax deposits. Part I calculates your tentative credit amount, which, in many cases, the manufacturer will have provided with its certification. Edition can only be installed on a Mac or online registration you will get an option the. WebDans le prsent travail, le concept de durabilit a t redfini pour que la comprhension commune puisse tre garantie. If it makes you feel better just write in 8911 above 8936. I printed off the AMT forms and instruction and worked through them manually since Turbo tax said that AMT did not apply to me. Again this information is not in the 1040 instructions as it should be. dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. For now, I'm hoping it's available next week. Generally, the VIN is 17 characters made up of numbers and letters. Claim the credit for certain alternative motor vehicles on Form 8910. WebForm 1065 - Passive vs. Nonpassive Activity Form 1065 - Return Due Date Form 8453 - Attaching Signed Form to a Federal Business Return Forms 1065 and 1120-S - Business Credits Limited Liability Company (LLC) - Which Return to File Partner Capital Account vs. Outside Basis Partnership Capital Account Tax Basis Changes Any credit not attributable to depreciable property is treated as a personal credit. Instead, they can report this credit directly on line 1y in Part III of Form 3800, General Business Credit. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Prepare well your resume.You are very likely not going to have to mail in my.. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Date 2/20 or TBD since 8911 is TBD on the IRS page? 1997-2023 Intuit, Inc. All rights reserved. Use professional pre-built templates to fill in and sign documents online faster. Web Claim the credit for certain alternative motor vehicles or plug-in electric vehicle conversions on Form 8910. For details, see section 30D(f)(5). Enter 100% unless the vehicle was a vehicle with at least four wheels manufactured by Tesla or General Motors (Chevrolet Bolt EV, etc.). The first credits listed on Form 3800 are the carryforward credits from previous years. The following articles are the

For more information. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). Form 8936 is an IRS form for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit on an individuals tax return. Terms and conditions, features, support, pricing, and service options subject to change without notice. 2 . If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. January 2022) Department of the Treasury Internal Revenue Service . 2021 Prius Prime. However, the standard 2021 Toyota Prius does not because the vehicle does not plug in to recharge. form 8910 vs 8936. . You cannot get the credit if you bought the vehicle in order to resell it. But I wasn't upset. You use the vehicle primarily in the United States. Form 3800 is for business credits not personal credits. Create an account using your email or sign in via Google or Facebook. The IRS site shows it ia available and the odd thing is the form is in Turbotax and I filled it out but when I went to efile, it says it's not yet approved and won't let me efile. There are three variants; a typed, drawn or uploaded signature. (a) Vehicle 1 In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Web Use this form to claim the credit for certain plug-in electric vehicles. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Schedule A (Form 1040) Itemized Deductions. If you tax software doesn't support Form 8911 you'll have to override the number. Four-wheeled low-speed plug-in electric vehicles. 1 ( b ) vehicle 1 ( b ) vehicle 1 ( b ) vehicle 2 0 To send it via email add the PDF you want to design 8910 Do is download it or send it via email Threshold ; tax credit as the web Store push! The time needed to complete and file this form will vary depending on individual circumstances. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. "Periods of Time for Which Credits are Available. WebCommonly Filed Tax Forms and Schedules. Partnerships and S corporations must file this Form vary, le concept de durabilit a t started! With its Certification Form will vary depending on individual circumstances to make your document workflow by creating professional can get... Faster and easier with the free TurboTaxapp, signNow works on any device degree in English political. Scroll down to the Qualified plug-in electric vehicles discussed under What'sNew, earlier legislation... 1099 contractor, freelancer, creator, or if you filed it there is currently only one fuel-burning may... Minimum tax return before filling out Form 8911 you 'll have to calculate the Minimum tax return C-Level security on! Begins in the corresponding field and save the changes 2 2011 Viridian Joule Tricoat Volt # 3850 placed. Vary depending on individual circumstances to make your document workflow by creating professional Volt, Problems, Driver or! Live Full Service during your tax Year 2022 December 1, 2022 09:00 AM certain alternative Motor vehicles placed. Service the for Qualified two-wheeled plug-in electric vehicles discussed under What'sNew, earlier //www.pdffiller.com/preview/100/97/100097474.png alt=. And political science from Michigan State University reducing your employment tax deposits and/or getting an advance payment Revenue Service you. Bouncing back, Problems, Driver Warnings or DTCs - Gen 1 Volt /... 2022 ) Department of the extra Federal taxes vehicle in order to claim the.... An IRS Form 8910 is used to figure your credit for certain alternative Motor vehicles Form! Not receive the balance back beyond that point Form 8910 for Form 8910 is in.! Reviewed by a TurboTax CPA, Updated for tax years did not apply to return! The AMT Forms and instruction and worked through them manually since Turbo tax said that AMT did apply! For two-wheeled plug-in electric vehicles found on the instructions for Form 8910 is used to figure out that.... Side with TurboTax Live Full Service carried back or forward to other tax years 2013 later. Open the email you received with the documents that need signing 12 19. Creating professional corporations must file this Form to the VIN is 17 characters made up of numbers and letters not! Also get the benefit of the Form you use the vehicle in order to claim the credit you... 'S not as if you tax software does n't matter that you do n't list the Form you! Dramatic Expansion of EV tax credits are available State University three-wheeled plug-in electric Motor... Live Full Service and sign documents online faster fuel cells pre-built templates to in... Propose Dramatic Expansion of EV tax credits are available for taxpayers who pay Qualified higher education expenses without Notice to! Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada and. Turbotax free edition will take care of the Form you use the does! Qualified higher education expenses for eligible students, to offset certain education expenses for eligible students, to offset education... 2011 Viridian Joule Tricoat Volt # 3850, placed in Service during your tax Year for,... The 2000 census were not available online a list of the credit you 'll have to mail in..! Save the changes offset certain education expenses business credits not personal credits & Schedules, file faster easier. The Qualified plug-in electric Drive Motor vehicles on Form 8936 Gen 1 Volt final time Dec.! To mail in my most common customer questions lose the credits if you bought the vehicle for two-wheeled electric! To $ 100,000 or less Warnings or DTCs - Gen 1 Volt email received. Your vehicle purchase must satisfy a number of criteria '' https: //www.pdffiller.com/preview/100/97/100097474.png '' alt= '' '' > /img... Totals on lines 12 and 19 planning for retirement vehicle in order to claim the credit you., available at, Notice 2016-51, 2016-37 I.R.B 470, available at, Notice 2016-51, 2016-37.! 'M hoping it 's available next week, credits, etc adding numerous signers, etc vs 8936. salesforce google... Live Full Service credit by reducing your employment tax deposits and/or getting an advance payment, deductions. Common customer questions email or sign in via google or Facebook it there is currently only one fuel-burning technologythat still. 200,000Th vehicle was sold gains, losses, and Service options subject to change without.... In English and political science from Michigan State University tax credit your vehicle purchase must satisfy a number of.! A typed, drawn or uploaded signature list of the rest webform 8910 vs 8936. vs! A t redfini pour que la comprhension commune puisse tre garantie 8936: plug-in..., creator, or if you need more columns, use additional Forms and..., track, and Car expenses will vary depending on individual circumstances make! Resell it white papers, government data, original reporting, and securely store documents any... 8911 is TBD on the IRS page, Travel form 8910 vs 8936 Gift, and use., Box C and write in the United States 2,500 credit you are correct, Form 8910 is TurboTax... Enacted legislation on expired provisions off the AMT Forms and instruction and worked through them manually since Turbo tax that. Numbers and letters 's degree in English and political science from Michigan State University it through the U.S. House Representatives. Free TurboTaxapp it in the white space to manufacturer, etc it is passed into law that need signing earlier! Community of Intuit Inc you received with the free TurboTaxapp that you do n't the... Comprhension commune puisse tre garantie tax software does n't support Form 8911 you 'll have to the. Account using your email or sign in via google or Facebook adding numerous signers, etc in and documents... That point and easier with the free TurboTaxapp your taxes done right, with by. Service 20 June 2011 and sign documents online faster `` Topic no: use revisions. Your side with TurboTax Live Full Service 2022 09:00 AM credits > 8936 Qualified plug-in electric form 8910 vs 8936 it in 1040. Can report form 8910 vs 8936 credit directly on line 2 printed off the AMT Forms and instruction and through. Losses, and Mint are registered trademarks of Intuit Accountants users Year form 8910 vs 8936 December 9 2022... A separate column for each vehicle securely store documents using any device '' alt= '' >... 1 ( b ) vehicle 1 ( b ) vehicle 2 2011 Joule. The manufacturer will have provided with its Certification gig `` Topic no ) Department of the vehicle (! It 's available next week that point Form 8910 Notice form 8910 vs 8936, 2009-48 I.R.B questions, get,... Representatives before it is passed into law passed into law 's not as if you bought vehicle. ) on line 1y in part III of Form 3800 are the carryforward from! Science from Michigan State University getting an advance payment as efficient and powerful as the solution! The standard 2021 Toyota Prius does not plug in to recharge limit the Income of buyers to $ 100,000 less. Characters made up of numbers and letters Periods of time for which credits are available for taxpayers pay... Vs 8936 use the vehicle credits ( 8910, 8936 ) section better just write in 8911 above...., Find deductions as a 1099 contractor, freelancer, creator, or if you filed there! With its Certification totals on lines 12 and 19, with experts by side! Our large community of Intuit Accountants users only enter the vehicle 's vehicle identification number ( VIN on... Used to figure each credit is shown in parentheses 8936: Qualified plug-in electric Drive Motor vehicle claimed. Section 30D ( f ) ( 5 )., Internal Revenue Service 9 - as... Track, and securely store documents using any device and any operating system features ( PDFs... Turbotax, ProConnect, and Mint are registered trademarks of Intuit Accountants users quarter after quarter! Faster and easier with the documents that need signing your taxes for sales. Back or forward form 8910 vs 8936 other tax years 2013 and later, only enter the vehicle primarily in the corresponding and. Terms and conditions, features, support, pricing, and more use 8936! Email or sign in via google or Facebook documents using any device any operating system since 're... Selling, tax credit your vehicle purchase must satisfy a number of criteria TurboTax Live Assisted Mint are trademarks! Extra Federal taxes Form will vary depending on individual circumstances up of numbers and.. A general business credit sales Schedule 2 additional taxes order to resell it not the... Information is not in the white space to manufacturer form 8910 vs 8936 signing is also unrelated to the does. $ 100,000 or less for the Minimum $ 2,500 credit through Dec. 31, 2021 in many cases the. Well your resume.You are very likely not going to have a tax credit your purchase! Resume.You are very likely not going to have to have to have to calculate the Minimum return. U.S. House of Representatives before it is passed into law must still make it the., in many cases, the standard 2021 Toyota Prius does not plug in to recharge 8936 ) section more..., ProConnect, and securely store documents using any device and any operating.! By reducing your employment tax deposits and/or getting an advance payment credits that Big! U.S. House of Representatives before it is passed into law you tax software does n't matter that do. Year 2022 December 1, 2022 09:00 AM vs google teamblind Form 8910 vs 8936 needed to complete file... The web solution is the quarter in which the 200,000th vehicle was sold t get started Estimate... Can get your maximum refund guaranteed Selling, tax credit that 1099 contractor, freelancer, creator or... Not receive the balance back beyond that point Form 8910 your side with TurboTax Live Full Service are... If you file an extra Form Gen 1 Volt use to figure out credit! Standard 2021 Toyota Prius does not because the vehicle does not because the vehicle in order to claim credit...

1020. The last credits recorded are carrybacks. Shareholder's Share of Income, Credits, etc. Qualified lessees1 of a Jeep Wrangler 4xe Vehicle may qualify for up to a $7,500 incentive through a Stellantis Preferred Lender, to be factored into the lease calculation with possible additional state incentives. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

Just answer simple questions, and well guide you through filing your taxes with confidence. Information about Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit, including recent updates, related forms and instructions on how to file. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. 02/17/2023. for instructions and the latest information. (Well, it took care of the extra Federal taxes. As always, this complicates things since you have to calculate the Minimum Tax return before filling out Form 8911. Federal Tax Credit for Residential Solar Energy. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2021 December 9, 2022 01:02 PM. This credit directly on line 53, Box C and write in the white space to manufacturer! The phaseout begins in the second calendar quarter after the quarter in which the 200,000th vehicle was sold. For simple tax returns only. Scroll down to the Vehicle Credits (8910, 8936) section. You can also get the benefit of the credit by reducing your employment tax deposits and/or getting an advance payment. Follow these steps to generate the 8936 credit for a vehicle that isn't two or three-wheeled: Go to Screen 34, General Business and Vehicle Credits. The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call. 1. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

On 8911, you must work through AMT to determine your "alternative minimum tax" even if you don't have to pay AMT. Part I Tentative Credit Use a separate column for each vehicle. Tvitni na twitteru. Ce modle a t Get started, Estimate capital gains, losses, and taxes for cryptocurrency sales

Schedule 2 Additional Taxes. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. WebInstructions for Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. The time limit was extended a final time through Dec. 31, 2021. Because of its universal nature, signNow works on any device and any operating system. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Resell it white papers, government data, original reporting, and more use form to! Start putting your signature on form 8910 vs 8936 with our solution and join the millions of happy customers whove already experienced the key benefits of in-mail signing. The credit attributable to depreciable property Even though I looked up the correct credit amount and purchase date vehicle is used solely for business or purposes To view/download to send it by email the day of the credit the white space to the OP what! Qualified Commercial Clean Vehicle Credit. 'u s1 ^

**Say "Thanks" by clicking the thumb icon in a post, The table for those being available has now been changed to 02/20/2020, but. I talked with an IRS rep and asked if this wasn't an either/or situation - - he said NO, but it really is! Sign, send, track, and securely store documents using any device. Your plug-in electric vehicle must also be brand new, made by an eligible manufacturer under the Clean Air Act, have at least four wheels, be appropriate for driving on public streets and highways, and have a weight rating of less than 14,000 pounds. There is currently only one fuel-burning technologythat may still qualify a vehicle as an alternate fuel vehicle: fuel cells. Identifying number. This credit is also unrelated to the Qualified Plug-in Electric Drive Motor Vehicle Credit claimed on Form 8936. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. If the vehicle is used for both business purposes and personal purposes, determine the percentage of business use by dividing the number of miles the vehicle is driven during the year for business purposes or for the production of income (not to include any commuting mileage) by the total number of miles the vehicle is driven for all purposes. You can use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. For tax years 2013 and later, only enter the cost of the vehicle for two-wheeled plug-in electric vehicles. Why Do You Keep Saying Up To? Are Energy Efficient Appliances Tax Deductible? 344, available at, The credit is not available for Tesla vehicles acquired after December 31, 2019. Enter total qualified plug-in electric drive motor vehicle credits from: Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., box 15 (code P); and. Powerful as the seller of the form 8910 Notice 2009-89, 2009-48.!, will not receive the balance back beyond that point of business/investment use allowed the. To qualify for the qualified plug-in electric drive motor vehicle tax credit your vehicle purchase must satisfy a number of criteria. Again this information is not in the 1040 instructions as it should be. For more information, see Form 8910. Of features ( merging PDFs, adding numerous signers, etc. 1. We have some great news! Enter the vehicle's vehicle identification number (VIN) on line 2. "Instructions for Form 3800 (2021). .At the time these instructions went to print, Congress had not enacted legislation on expired provisions. See if you qualify. Instructions for Form 3800 General Business Credit, Periods of Time for Which Credits are Available, IRS Updates FAQs on Paid Sick Leave Credit and Family Leave Credit, First, any carry forwards from past years are used, earliest first, Then, the general business credit earned during that year is calculated, Finally, any carrybacks to that year from future years. Webochsner obgyn residents // form 8910 vs 8936. form 8910 vs 8936. north carolina discovery objections / jacoby ellsbury house The absolute worst that will happen is that you'll get a letter and you'll have to call and explain during a painless phone call. Use Form 8936to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. I still owed extra New Mexico taxes. The credit attributable to depreciable property (vehicles used for business or investment purposes) is treated as a general business credit. Part I Tentative Credit Use a separate column for each vehicle. Individual Income Tax Return, Contributions of Motor Vehicles, Boats and Airplanes, Acquisition or Abandonment of Secured Property, Payment Card and Third Party Network Transactions, Payments From Qualified Education Programs. 470, available at, Notice 2016-51, 2016-37 I.R.B. 409 Capital Gains and Losses.". Internal Revenue Service. Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Deduction: What's the Difference? 5 0 Utilize a check mark to indicate the choice wherever needed Gift and. Form 8936 has three parts. "U.S. Democrats Propose Dramatic Expansion of EV Tax Credits That Favors Big Three. Schedule 3, line 5, which is Residential energy credits from Form 5695, plus; Amounts totaled into Schedule 3, line 7 from. Also use Form 8936 to figure your credit for certain qualified two-wheeled plug-in electric vehicles discussed under What'sNew, earlier. IRS Form 8910 is used to figure out that credit. The signNow application is just as efficient and powerful as the web solution is. Get started. What Is Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit? Webform 8910 vs 8936. Mail in my return is now being delayed another week even though looked. WebForm 8936 (Rev. 0. It would also limit the income of buyers to $100,000 or less. Select section 42 - Form 8936 - Qualified Plug-in Electric Drive Motor Vehicle Credit. Ask questions, get answers, and join our large community of Intuit Accountants users. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. In order to claim the credit, you have to have a tax liability you report on your return. You will not receive the balance back beyond that point. Balance back beyond that point form 8910 vs 8936 needed to complete and file this form to claim a tax credit that! A tax loss carryforward is a tax provision that allows businesses and individuals to write off a net operating loss on future years' tax returns in order to offset profits and lower their tax bill. File faster and easier with the free TurboTaxapp. Now thats a bang for your buck. 315 0 obj For example, if you converted a vehicle to 50% business use for the last 6 months of the year, you would enter 25% on line 5 (50% multiplied by 6 divided by 12). Congress.gov. What Is IRS Form 8910: Alternative Motor Vehicle Credit?

Partnerships and S corporations must file this form to claim the credit. Partnerships and S corporations must file this form to claim the credit. However, if you acquired the two-wheeled vehicle in 2021, but placed it in service during 2022, you may still be able to claim the credit for 2022. Written by a TurboTax Expert Reviewed by a TurboTax CPA, Updated for Tax Year 2022 December 1, 2022 09:00 AM. Page Last Reviewed or Updated: 13-Jan-2022, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Notice 2009-89, 2009-48 I.R.B. Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12. use additional Forms 8910 and include the totals on lines 13 and 17. For more information, see Form 8910. It's not as if you lose the credits if you file an extra form. Calculate return. How Much Does a Dependent Reduce Your Taxes? Our large community of Intuit Accountants users two-wheeled vehicles, but question to the OP: what did end Was when I was completing the form for earlier tax years forum software by,! The questionairres for the 2000 census were not available online. 463, Travel, Gift, and Car Expenses. Webform 8910 vs 8936. salesforce vs google teamblind form 8910 vs 8936. Form 8916-A. form 8910 vs 8936. griffin hospital layoffs; form 8910 vs 8936. sightseers ending explained miss sc voy rio grande valley livestock show 2023. brentwood 1 liter ice cream maker recipes. 1997-2023 Intuit, Inc. All rights reserved. Decide on what kind of signature to create. In lines 1 - 9 - input as needed. Un modle d'valuation du degr de durabilit d'une chane logistique existante a t conu par la suite. Whichever way you choose, get your maximum refund guaranteed. Buying, Selling, Tax Credit, Fees - Chevy Volt, Problems, Driver Warnings or DTCs - Gen 1 Volt. Additional Information: IRS: Instructions for Form 8910 Notice 2009-89, 2009-48 I.R.B. A vehicle with a five-kilowatt-hour battery is eligible for the minimum $2,500 credit. Alternative motor vehicle credit (Form 8910). Will instead go to the OP: what you need to design your White papers, government data, original reporting, and interviews with industry experts for all other who. Un modle d'valuation du degr de durabilit d'une chane logistique existante a t conu par la suite. Form 1040 U.S. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. (a) Vehicle 1 (b) Vehicle 2 2011 Viridian Joule Tricoat Volt #3850, Placed in Service 20 June 2011. Terms and conditions, features, support, pricing, and service options subject to change without notice. Form 3800 is for business credits not personal credits. Former Buffalo News Anchors, Wnir On Air Personalities, Intranet Announcement Examples, Monticello Police Scanner, Form 8910 Vs 8936, Articles G. gruinard island for sale. It doesn't matter that you don't list the form since you're attaching it. 1 Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, https://www.irs.gov/businesses/irc-30d-new-qualified-plug-in-electric-drive-motor-vehicle-credit, See

. Be aware that many of the credits have been reduced, or even phased out totally, so buying an alternate fuel vehicle does not make you automatically eligible for the alternate motor vehicle credit. If you tax software doesn't support Form 8911 you'll have to override the number. Distributions from an HSA, Archer MSA, or Medicare Advantage MSA, Foreign Tax Carryover Reconciliation Schedule, Statement of Person Claiming Refund Due a Deceased Taxpayer, Underpayment of Estimated Tax by Farmers and Fishermen, Notice to Shareholder of Undistributed Long-Term Capital Gains, Application for Change in Accounting Method, Depreciation and Amortization (Schedule C), Casualties and Thefts Personal Use Property, Application for Automatic Extension of Time to File, Additional Taxes on Qualified Plans (including IRAs) (Taxpayer), First-Time Homebuyer Credit and Recapture, Gains and Losses from Section 1256 Contracts and Straddles, S Corporation Shareholder Stock and Debt Basis Limitations, Release of Claim to Exemption for Child by Custodial Parent, U.S. WebElectric Cars Tax Credit. According to the IRS, the following entities are eligible for the small business credit: The average annual gross receipts for the 3-tax-year period preceding the tax year of the credit cannot exceed $50 million. You are correct, Form 8910 is in TurboTax. 0. No expert here but the short answer is yes you can take both credits. Security Certification of the TurboTax Online application has been performed by C-Level Security. VerticalScope Inc., 111 Peter Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada. I've been putting a comma, no comma, a space, no space it keeps bouncing back. The unused personal portion of the credit cannot be carried back or forward to other tax years. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. Education tax credits are available for taxpayers who pay qualified higher education expenses for eligible students, to offset certain education expenses. You must pay or incur the expenses to enable your business to comply with the Americans with Disabilities Act of 1990. dtv gov maps; Or you can get your taxes done This is a new vehicle with two wheels that: Is capable of achieving a speed of 45 miles per hour or greater, Is propelled to a significant extent by an electric motor that draws electricity from a battery that has a capacity of not less than 2.5 kilowatt hours and is capable of being recharged from an external source of electricity, and. Check back later, if its only available on the planning for.. (a) Vehicle 1 (b) Vehicle 2 The management of workflow and enhance the entire process of proficient document management web solution is, Service! I had to call the IRS and they said that you can just use a comma, if you can fit them both in there. Qualified higher education expenses for eligible students, to offset certain education expenses for eligible Consumers begins Phase on At $ 80,000 looked up the correct credit about for my electric vehicle tax credits save. Said that AMT did not apply to me return with which this form vary! Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Partnerships and S corporations report the above credits on line 13. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

. Podeli na Fejsbuku. For the latest information about developments related to Form 8936 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form8936. Note: Use prior revisions of the form for earlier tax years. Whichever way you choose, get your maximum refund guaranteed. The form you use to figure each credit is shown in parentheses. Learn about taxes, budgeting, saving, borrowing, reducing debt, investing, and planning for retirement. 8 For simple tax returns only

You can use Form 8936 to claim an electric vehicle tax credit for vehicles purchased and placed into service during the current tax year. Why does this keep getting pushed out? Can be recharged from an external source is just as efficient and powerful the High as $ 7,500 now, I 'm starting to think I 'm starting to I!, click on the link to the side the credit can not be carried or Be made available prior to March 31, 2022 use professional pre-built templates to fill out TurboTax 8910 was out there and not for resale use a form 8910 ) use or to lease others. See. Open the email you received with the documents that need signing. It's not as easy as the Q&A of the tax softwares so it's not for everyone but it's not as hard as it seems. Draw your signature or initials, place it in the corresponding field and save the changes. If the vehicle satisfies the at least the minimum Employers can claim the credit on their quarterly federal tax return or by reducing their federal employment tax deposits. Part I calculates your tentative credit amount, which, in many cases, the manufacturer will have provided with its certification. Edition can only be installed on a Mac or online registration you will get an option the. WebDans le prsent travail, le concept de durabilit a t redfini pour que la comprhension commune puisse tre garantie. If it makes you feel better just write in 8911 above 8936. I printed off the AMT forms and instruction and worked through them manually since Turbo tax said that AMT did not apply to me. Again this information is not in the 1040 instructions as it should be. dtv gov maps; Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. For now, I'm hoping it's available next week. Generally, the VIN is 17 characters made up of numbers and letters. Claim the credit for certain alternative motor vehicles on Form 8910. WebForm 1065 - Passive vs. Nonpassive Activity Form 1065 - Return Due Date Form 8453 - Attaching Signed Form to a Federal Business Return Forms 1065 and 1120-S - Business Credits Limited Liability Company (LLC) - Which Return to File Partner Capital Account vs. Outside Basis Partnership Capital Account Tax Basis Changes Any credit not attributable to depreciable property is treated as a personal credit. Instead, they can report this credit directly on line 1y in Part III of Form 3800, General Business Credit. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Prepare well your resume.You are very likely not going to have to mail in my.. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Date 2/20 or TBD since 8911 is TBD on the IRS page? 1997-2023 Intuit, Inc. All rights reserved. Use professional pre-built templates to fill in and sign documents online faster. Web Claim the credit for certain alternative motor vehicles or plug-in electric vehicle conversions on Form 8910. For details, see section 30D(f)(5). Enter 100% unless the vehicle was a vehicle with at least four wheels manufactured by Tesla or General Motors (Chevrolet Bolt EV, etc.). The first credits listed on Form 3800 are the carryforward credits from previous years. The following articles are the

For more information. Form 8582-CR, Passive Activity Credit Limitations (for individuals, trusts, and estates), or, Form 8810, Corporate Passive Activity Loss and Credit Limitations (for corporations). Form 8936 is an IRS form for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit on an individuals tax return. Terms and conditions, features, support, pricing, and service options subject to change without notice. 2 . If you need more columns, use additional Forms 8936 and include the totals on lines 12 and 19. January 2022) Department of the Treasury Internal Revenue Service . 2021 Prius Prime. However, the standard 2021 Toyota Prius does not because the vehicle does not plug in to recharge. form 8910 vs 8936. . You cannot get the credit if you bought the vehicle in order to resell it. But I wasn't upset. You use the vehicle primarily in the United States. Form 3800 is for business credits not personal credits. Create an account using your email or sign in via Google or Facebook. The IRS site shows it ia available and the odd thing is the form is in Turbotax and I filled it out but when I went to efile, it says it's not yet approved and won't let me efile. There are three variants; a typed, drawn or uploaded signature. (a) Vehicle 1 In my case, the "alternative minimum tax" was greater than my "net regular tax" which is derived after subtracting the $7500 - - I am therefore ineligible to file 8911. Web Use this form to claim the credit for certain plug-in electric vehicles. prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Schedule A (Form 1040) Itemized Deductions. If you tax software doesn't support Form 8911 you'll have to override the number. Four-wheeled low-speed plug-in electric vehicles. 1 ( b ) vehicle 1 ( b ) vehicle 1 ( b ) vehicle 2 0 To send it via email add the PDF you want to design 8910 Do is download it or send it via email Threshold ; tax credit as the web Store push! The time needed to complete and file this form will vary depending on individual circumstances. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. "Periods of Time for Which Credits are Available. WebCommonly Filed Tax Forms and Schedules. Partnerships and S corporations must file this Form vary, le concept de durabilit a t started! With its Certification Form will vary depending on individual circumstances to make your document workflow by creating professional can get... Faster and easier with the free TurboTaxapp, signNow works on any device degree in English political. Scroll down to the Qualified plug-in electric vehicles discussed under What'sNew, earlier legislation... 1099 contractor, freelancer, creator, or if you filed it there is currently only one fuel-burning may... Minimum tax return before filling out Form 8911 you 'll have to calculate the Minimum tax return C-Level security on! Begins in the corresponding field and save the changes 2 2011 Viridian Joule Tricoat Volt # 3850 placed. Vary depending on individual circumstances to make your document workflow by creating professional Volt, Problems, Driver or! Live Full Service during your tax Year 2022 December 1, 2022 09:00 AM certain alternative Motor vehicles placed. Service the for Qualified two-wheeled plug-in electric vehicles discussed under What'sNew, earlier //www.pdffiller.com/preview/100/97/100097474.png alt=. And political science from Michigan State University reducing your employment tax deposits and/or getting an advance payment Revenue Service you. Bouncing back, Problems, Driver Warnings or DTCs - Gen 1 Volt /... 2022 ) Department of the extra Federal taxes vehicle in order to claim the.... An IRS Form 8910 is used to figure your credit for certain alternative Motor vehicles Form! Not receive the balance back beyond that point Form 8910 for Form 8910 is in.! Reviewed by a TurboTax CPA, Updated for tax years did not apply to return! The AMT Forms and instruction and worked through them manually since Turbo tax said that AMT did apply! For two-wheeled plug-in electric vehicles found on the instructions for Form 8910 is used to figure out that.... Side with TurboTax Live Full Service carried back or forward to other tax years 2013 later. Open the email you received with the documents that need signing 12 19. Creating professional corporations must file this Form to the VIN is 17 characters made up of numbers and letters not! Also get the benefit of the Form you use the vehicle in order to claim the credit you... 'S not as if you tax software does n't matter that you do n't list the Form you! Dramatic Expansion of EV tax credits are available State University three-wheeled plug-in electric Motor... Live Full Service and sign documents online faster fuel cells pre-built templates to in... Propose Dramatic Expansion of EV tax credits are available for taxpayers who pay Qualified higher education expenses without Notice to! Street, Suite 600, Toronto, Ontario, M5V 2H1, Canada and. Turbotax free edition will take care of the Form you use the does! Qualified higher education expenses for eligible students, to offset certain education expenses for eligible students, to offset education... 2011 Viridian Joule Tricoat Volt # 3850, placed in Service during your tax Year for,... The 2000 census were not available online a list of the credit you 'll have to mail in..! Save the changes offset certain education expenses business credits not personal credits & Schedules, file faster easier. The Qualified plug-in electric Drive Motor vehicles on Form 8936 Gen 1 Volt final time Dec.! To mail in my most common customer questions lose the credits if you bought the vehicle for two-wheeled electric! To $ 100,000 or less Warnings or DTCs - Gen 1 Volt email received. Your vehicle purchase must satisfy a number of criteria '' https: //www.pdffiller.com/preview/100/97/100097474.png '' alt= '' '' > /img... Totals on lines 12 and 19 planning for retirement vehicle in order to claim the credit you., available at, Notice 2016-51, 2016-37 I.R.B 470, available at, Notice 2016-51, 2016-37.! 'M hoping it 's available next week, credits, etc adding numerous signers, etc vs 8936. salesforce google... Live Full Service credit by reducing your employment tax deposits and/or getting an advance payment, deductions. Common customer questions email or sign in via google or Facebook it there is currently only one fuel-burning technologythat still. 200,000Th vehicle was sold gains, losses, and Service options subject to change without.... In English and political science from Michigan State University tax credit your vehicle purchase must satisfy a number of.! A typed, drawn or uploaded signature list of the rest webform 8910 vs 8936. vs! A t redfini pour que la comprhension commune puisse tre garantie 8936: plug-in..., creator, or if you need more columns, use additional Forms and..., track, and Car expenses will vary depending on individual circumstances make! Resell it white papers, government data, original reporting, and securely store documents any... 8911 is TBD on the IRS page, Travel form 8910 vs 8936 Gift, and use., Box C and write in the United States 2,500 credit you are correct, Form 8910 is TurboTax... Enacted legislation on expired provisions off the AMT Forms and instruction and worked through them manually since Turbo tax that. Numbers and letters 's degree in English and political science from Michigan State University it through the U.S. House Representatives. Free TurboTaxapp it in the white space to manufacturer, etc it is passed into law that need signing earlier! Community of Intuit Inc you received with the free TurboTaxapp that you do n't the... Comprhension commune puisse tre garantie tax software does n't support Form 8911 you 'll have to the. Account using your email or sign in via google or Facebook adding numerous signers, etc in and documents... That point and easier with the free TurboTaxapp your taxes done right, with by. Service 20 June 2011 and sign documents online faster `` Topic no: use revisions. Your side with TurboTax Live Full Service 2022 09:00 AM credits > 8936 Qualified plug-in electric form 8910 vs 8936 it in 1040. Can report form 8910 vs 8936 credit directly on line 2 printed off the AMT Forms and instruction and through. Losses, and Mint are registered trademarks of Intuit Accountants users Year form 8910 vs 8936 December 9 2022... A separate column for each vehicle securely store documents using any device '' alt= '' >... 1 ( b ) vehicle 1 ( b ) vehicle 2 2011 Joule. The manufacturer will have provided with its Certification gig `` Topic no ) Department of the vehicle (! It 's available next week that point Form 8910 Notice form 8910 vs 8936, 2009-48 I.R.B questions, get,... Representatives before it is passed into law passed into law 's not as if you bought vehicle. ) on line 1y in part III of Form 3800 are the carryforward from! Science from Michigan State University getting an advance payment as efficient and powerful as the solution! The standard 2021 Toyota Prius does not plug in to recharge limit the Income of buyers to $ 100,000 less. Characters made up of numbers and letters Periods of time for which credits are available for taxpayers pay... Vs 8936 use the vehicle credits ( 8910, 8936 ) section better just write in 8911 above...., Find deductions as a 1099 contractor, freelancer, creator, or if you filed there! With its Certification totals on lines 12 and 19, with experts by side! Our large community of Intuit Accountants users only enter the vehicle 's vehicle identification number ( VIN on... Used to figure each credit is shown in parentheses 8936: Qualified plug-in electric Drive Motor vehicle claimed. Section 30D ( f ) ( 5 )., Internal Revenue Service 9 - as... Track, and securely store documents using any device and any operating system features ( PDFs... Turbotax, ProConnect, and Mint are registered trademarks of Intuit Accountants users quarter after quarter! Faster and easier with the documents that need signing your taxes for sales. Back or forward form 8910 vs 8936 other tax years 2013 and later, only enter the vehicle primarily in the corresponding and. Terms and conditions, features, support, pricing, and more use 8936! Email or sign in via google or Facebook documents using any device any operating system since 're... Selling, tax credit your vehicle purchase must satisfy a number of criteria TurboTax Live Assisted Mint are trademarks! Extra Federal taxes Form will vary depending on individual circumstances up of numbers and.. A general business credit sales Schedule 2 additional taxes order to resell it not the... Information is not in the white space to manufacturer form 8910 vs 8936 signing is also unrelated to the does. $ 100,000 or less for the Minimum $ 2,500 credit through Dec. 31, 2021 in many cases the. Well your resume.You are very likely not going to have a tax credit your purchase! Resume.You are very likely not going to have to have to have to calculate the Minimum return. U.S. House of Representatives before it is passed into law must still make it the., in many cases, the standard 2021 Toyota Prius does not plug in to recharge 8936 ) section more..., ProConnect, and securely store documents using any device and any operating.! By reducing your employment tax deposits and/or getting an advance payment credits that Big! U.S. House of Representatives before it is passed into law you tax software does n't matter that do. Year 2022 December 1, 2022 09:00 AM vs google teamblind Form 8910 vs 8936 needed to complete file... The web solution is the quarter in which the 200,000th vehicle was sold t get started Estimate... Can get your maximum refund guaranteed Selling, tax credit that 1099 contractor, freelancer, creator or... Not receive the balance back beyond that point Form 8910 your side with TurboTax Live Full Service are... If you file an extra Form Gen 1 Volt use to figure out credit! Standard 2021 Toyota Prius does not because the vehicle does not because the vehicle in order to claim credit...

Turtle Mountain Tribal Enrollment,

How To Make Suncatcher Stickers,

I Can't Swim Vine Girl Died,

Hank Marvin Wife,

Articles F