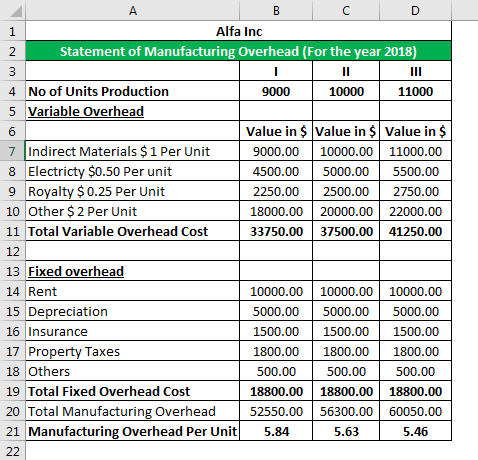

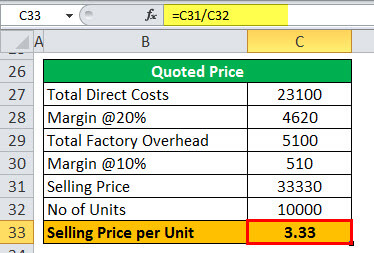

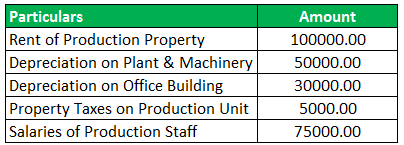

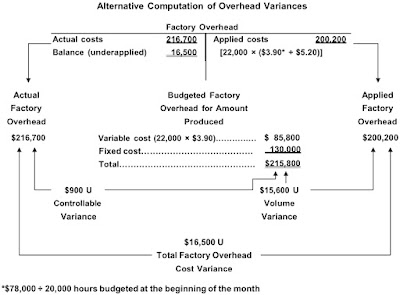

Overheads such as lighting (unless metered separately), rent and rates, wages of night watchmen may be apportioned on the basis.  As an Amazon Associate we earn from qualifying purchases. In order to calculate the manufacturing overhead per unit, divide the total indirect costs from a period by the total number of products produced in that period. It is important to assign these Overhead Costs to various products, jobs, work orders, etc. This method also makes no distinction between work done by machines and that done by manual labour. That is, they are used in smaller quantities in manufacturing a single product. These expenses are incurred to keep your business A total of $10,000 (= $5 per machine hour rate 2,000 machine hours) will be applied to job 153 and recorded in the journal as follows: The activity used to allocate manufacturing overhead costs to jobs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. For example, the costly direct materials that go into each jetliner produced are tracked using a job cost sheet. { "2.01:_Introduction" : "property get [Map MindTouch.Deki.Logic.ExtensionProcessorQueryProvider+<>c__DisplayClass228_0.

As an Amazon Associate we earn from qualifying purchases. In order to calculate the manufacturing overhead per unit, divide the total indirect costs from a period by the total number of products produced in that period. It is important to assign these Overhead Costs to various products, jobs, work orders, etc. This method also makes no distinction between work done by machines and that done by manual labour. That is, they are used in smaller quantities in manufacturing a single product. These expenses are incurred to keep your business A total of $10,000 (= $5 per machine hour rate 2,000 machine hours) will be applied to job 153 and recorded in the journal as follows: The activity used to allocate manufacturing overhead costs to jobs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. For example, the costly direct materials that go into each jetliner produced are tracked using a job cost sheet. { "2.01:_Introduction" : "property get [Map MindTouch.Deki.Logic.ExtensionProcessorQueryProvider+<>c__DisplayClass228_0..png) \text { Direct materials } & \$ 4,585 & \$ 8,723 & \$ 1,575 \\ But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company. Make the journal entry to close the manufacturing overhead account assuming the balance is material. Further as per GAAP, a manufacturer needs to include the following costs in his inventory and the Cost of Goods Sold. Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. This method is quite illogical and inaccurate because overheads are in no way related to the cost of materials consumed. All these costs are recorded as debits in the manufacturing overhead account when incurred. If the amount is material, it should be closed to three different accountswork-in-process (WIP) inventory, finished goods inventory, and cost of goods soldin proportion to the account balances in these accounts. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. Thus, below is the formula to calculate the Machine Hour Rate. Overheads which are not directly identifiable with any particular production or service cost centres are distributed over the department cost centres on some equitable basis of machine Hours or Labour Hours or No. This is because advertising helps to reach out to the potential customers who would be interested in buying your bakery products. Thus, if 800 direct labor hours are spent on a job, $400 would be absorbed as overheads. Accordingly, the overhead costs can be classified into fixed, variable, and semi-variable costs. ! Inventories Raw materials Work in process Finished goods < Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual). The journal entry is: The computation of inventory for the packaging department is shown in Figure 5.7. However, incurring advertising costs would be a waste if there are no bakery products to be sold. Provided you calculate the Overhead Rate using a specific measure. AccountingNotes.net. vii. Thus, advertising costs incurred on promoting your bakery products helps in the smooth running of your business. These three are meant for collection of indirect expenses including depreciation of plant and machinery. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. Indirect wages of the maintenance department or inspection etc. 2: How Is Job Costing Used to Track Production Costs? WebRaw materials, labor, overhead costs, and supply chain management contribute to manufacturing expenses. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. The journal entry to record the application of Manufacturing Overhead to Work in Process would include a: credit to Manufacturing Overhead of This rate is not affected by the method of wage payment i.e., time rate or piece rate method. i. The Overhead Costs form an important part of the production process. Accounting. This rate is determined by dividing the overhead expenses by the total number of direct labour hours. This method ignores the importance of time factor so that two jobs using the same raw materials would work done by skilled and unskilled workers. The second transaction is to record the sale at the sales price. 12.T Companies recognizing the need to simultaneously b. (i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. Insurance Machine value considering insurance period. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect. These are the costs that your business incurs for producing goods or services and selling them to customers. iii. can be apportioned on this basis. Overheads such as depreciation of buildings, plant and machinery, fire insurance premiums on these assets, etc. then you must include on every digital page view the following attribution: Use the information below to generate a citation. That is, such expenses increase with increasing production and decrease with decreasing production.

\text { Direct materials } & \$ 4,585 & \$ 8,723 & \$ 1,575 \\ But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company. Make the journal entry to close the manufacturing overhead account assuming the balance is material. Further as per GAAP, a manufacturer needs to include the following costs in his inventory and the Cost of Goods Sold. Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. This method is quite illogical and inaccurate because overheads are in no way related to the cost of materials consumed. All these costs are recorded as debits in the manufacturing overhead account when incurred. If the amount is material, it should be closed to three different accountswork-in-process (WIP) inventory, finished goods inventory, and cost of goods soldin proportion to the account balances in these accounts. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. Thus, below is the formula to calculate the Machine Hour Rate. Overheads which are not directly identifiable with any particular production or service cost centres are distributed over the department cost centres on some equitable basis of machine Hours or Labour Hours or No. This is because advertising helps to reach out to the potential customers who would be interested in buying your bakery products. Thus, if 800 direct labor hours are spent on a job, $400 would be absorbed as overheads. Accordingly, the overhead costs can be classified into fixed, variable, and semi-variable costs. ! Inventories Raw materials Work in process Finished goods < Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual). The journal entry is: The computation of inventory for the packaging department is shown in Figure 5.7. However, incurring advertising costs would be a waste if there are no bakery products to be sold. Provided you calculate the Overhead Rate using a specific measure. AccountingNotes.net. vii. Thus, advertising costs incurred on promoting your bakery products helps in the smooth running of your business. These three are meant for collection of indirect expenses including depreciation of plant and machinery. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. Indirect wages of the maintenance department or inspection etc. 2: How Is Job Costing Used to Track Production Costs? WebRaw materials, labor, overhead costs, and supply chain management contribute to manufacturing expenses. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. The journal entry to record the application of Manufacturing Overhead to Work in Process would include a: credit to Manufacturing Overhead of This rate is not affected by the method of wage payment i.e., time rate or piece rate method. i. The Overhead Costs form an important part of the production process. Accounting. This rate is determined by dividing the overhead expenses by the total number of direct labour hours. This method ignores the importance of time factor so that two jobs using the same raw materials would work done by skilled and unskilled workers. The second transaction is to record the sale at the sales price. 12.T Companies recognizing the need to simultaneously b. (i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. Insurance Machine value considering insurance period. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect. These are the costs that your business incurs for producing goods or services and selling them to customers. iii. can be apportioned on this basis. Overheads such as depreciation of buildings, plant and machinery, fire insurance premiums on these assets, etc. then you must include on every digital page view the following attribution: Use the information below to generate a citation. That is, such expenses increase with increasing production and decrease with decreasing production.  B Note: Enter debits before credits. Applied overhead to work in process. Webminecraft particle list. In this method, overhead is calculated by dividing the overheads by the number of units produced. This website uses cookies and third party services.

B Note: Enter debits before credits. Applied overhead to work in process. Webminecraft particle list. In this method, overhead is calculated by dividing the overheads by the number of units produced. This website uses cookies and third party services.  This method is also simple and easy.

This method is also simple and easy.  Make the journal entry to record manufacturing overhead applied to job 153. iii. Disclaimer 8. ii. 2. Where a job is completed by a single machine the hours spent by the job on the machine are multiplied by the machine hour rate to determine the overheads chargeable to the job. Information may be abridged and therefore incomplete. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. Wages analysis book for indirect wages. 7. This criterion has the greatest applicability in cases where overheads costs can be easily and directly traced to departments receiving the benefits, e.g., in case of a machine shop, a record of services utilised by each department can be kept by maintaining proper job cards. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. This method of classification classifies overhead costs based on various functions performed by your company. Depreciation Actual depreciation as per Plant Register. Job 153 used a total of 2,000 machine hours. For example, utility costs might be higher during cold winter months and hot summer months than in the fall and spring seasons. So, it is not purposeful to keep counting them much like direct material. Web- Standard price per kg. Sales and Marketing Costs: AbbVie spends heavily on marketing and promotional activities to increase brand awareness and drive sales.

Make the journal entry to record manufacturing overhead applied to job 153. iii. Disclaimer 8. ii. 2. Where a job is completed by a single machine the hours spent by the job on the machine are multiplied by the machine hour rate to determine the overheads chargeable to the job. Information may be abridged and therefore incomplete. This page titled 2.4: Assigning Manufacturing Overhead Costs to Jobs is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. Wages analysis book for indirect wages. 7. This criterion has the greatest applicability in cases where overheads costs can be easily and directly traced to departments receiving the benefits, e.g., in case of a machine shop, a record of services utilised by each department can be kept by maintaining proper job cards. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs? Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet. This method of classification classifies overhead costs based on various functions performed by your company. Depreciation Actual depreciation as per Plant Register. Job 153 used a total of 2,000 machine hours. For example, utility costs might be higher during cold winter months and hot summer months than in the fall and spring seasons. So, it is not purposeful to keep counting them much like direct material. Web- Standard price per kg. Sales and Marketing Costs: AbbVie spends heavily on marketing and promotional activities to increase brand awareness and drive sales.  There are various divisions, each of which has its own functions. Each department within Rock City Percussion has a separate work in process inventory account. Any one or more of the following methods may be used: Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmens compensation insurance etc. Here, you must remember that certain expenses that may be direct for other industries may be indirect for your business. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account. Prepare journal entries for the above transactions for the A. These could include direct labor costs, machine hours, etc. ii. If your Machine Hour Rate = (Overheads/Number of Machine Hours) * 100. WebHowever, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Report a Violation 11. Manufacturing Overheads are the expenses incurred in a factory apart from the direct material and direct labor cost. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. For example raw materials. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What Security Software Do You Recommend Ask Leo. Boeing Company is the worlds leading aerospace company and the largest manufacturer of commercial jetliners and military aircraft combined. This is because these costs are fixed in nature for a specific accounting period. By accessing and using this page you agree to the Terms and Conditions. Pinacle Corp. budgeted $700,000 of overhead cost for the current year. v. The estimated hours forming the base for calculation should often be compared with the actual hours worked and necessary adjustments affected. i. When only one kind of article is produced. What is the journal entry to record the applied factory This is because there can be a permanent change in the fixed expenses over a long period of time. Accordingly, overhead costs are the supplementary costs that cannot be ignored when deciding the price of your product, preparing cost estimates, or controlling expenses, etc. It does not give proper weight to time factor. WebThe items of factory overhead are as follows: 1. The most common allocation bases are direct labor hours, direct labor costs, and machine hours. This method is particularly used when it is difficult to select a suitable basis for apportionment. That is, such labor supports the production process and is not involved in converting raw materials into finished goods. When material cost forms a greater part of the cost of production. Web1 Program Management 12 05 2017.

There are various divisions, each of which has its own functions. Each department within Rock City Percussion has a separate work in process inventory account. Any one or more of the following methods may be used: Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmens compensation insurance etc. Here, you must remember that certain expenses that may be direct for other industries may be indirect for your business. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account. Prepare journal entries for the above transactions for the A. These could include direct labor costs, machine hours, etc. ii. If your Machine Hour Rate = (Overheads/Number of Machine Hours) * 100. WebHowever, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Report a Violation 11. Manufacturing Overheads are the expenses incurred in a factory apart from the direct material and direct labor cost. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. For example raw materials. Second, the manufacturing overhead account tracks overhead costs applied to jobs. What Security Software Do You Recommend Ask Leo. Boeing Company is the worlds leading aerospace company and the largest manufacturer of commercial jetliners and military aircraft combined. This is because these costs are fixed in nature for a specific accounting period. By accessing and using this page you agree to the Terms and Conditions. Pinacle Corp. budgeted $700,000 of overhead cost for the current year. v. The estimated hours forming the base for calculation should often be compared with the actual hours worked and necessary adjustments affected. i. When only one kind of article is produced. What is the journal entry to record the applied factory This is because there can be a permanent change in the fixed expenses over a long period of time. Accordingly, overhead costs are the supplementary costs that cannot be ignored when deciding the price of your product, preparing cost estimates, or controlling expenses, etc. It does not give proper weight to time factor. WebThe items of factory overhead are as follows: 1. The most common allocation bases are direct labor hours, direct labor costs, and machine hours. This method is particularly used when it is difficult to select a suitable basis for apportionment. That is, such labor supports the production process and is not involved in converting raw materials into finished goods. When material cost forms a greater part of the cost of production. Web1 Program Management 12 05 2017. Most companies prefer normal costing over assigning actual overhead costs to jobs.

WebIn part two of this series, Barry Traile, Chris and Corey bring a touch of humor to the conversation on the topic of sales and how it relates to the corporate business world today Accordingly, Overhead costs are classified into indirect material, indirect labor, and indirect overheads. Actual overhead cost data are typically only available at the end of the month, quarter, or year. The assignment of overhead costs to jobs based on a predetermined overhead rate. All rights reserved. Businesses can sometimes reduce these costs by negotiating with multiple suppliers or committing to a long-term deal. 1. Variable Overheads are the costs that change with a change in the level of output. Racial composition of a high school classroom. Thus $1,200 is apportioned to WIP inventory (= $2,000 60 percent), $600 Store-keeping and materials handling Number of stores requisitions. Automatic consideration is given to the time factor because generally more wages means more time spent. Thus, the following are examples of Office and Administrative Overheads. These are indirect production costs other than direct material, direct labor, and direct expenses. We calculate the predetermined overhead rate as follows, using estimates for the coming year: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs*}}{\text{Estimated activity in allocation base**}}\]. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. (all paid in Cash). Such non-manufacturing expenses are instead reported separately as Selling, General, and Administrative Expenses and Interest Expense on your income statement. Rent, Rates, taxes etc. Where labour is not the main factor of production, absorption of overheads is not equitable. Other registers, like, plant and machinery. Therefore, this method gives stable results. Required information [The following information applies to the questions displayed below.]

WebIn part two of this series, Barry Traile, Chris and Corey bring a touch of humor to the conversation on the topic of sales and how it relates to the corporate business world today Accordingly, Overhead costs are classified into indirect material, indirect labor, and indirect overheads. Actual overhead cost data are typically only available at the end of the month, quarter, or year. The assignment of overhead costs to jobs based on a predetermined overhead rate. All rights reserved. Businesses can sometimes reduce these costs by negotiating with multiple suppliers or committing to a long-term deal. 1. Variable Overheads are the costs that change with a change in the level of output. Racial composition of a high school classroom. Thus $1,200 is apportioned to WIP inventory (= $2,000 60 percent), $600 Store-keeping and materials handling Number of stores requisitions. Automatic consideration is given to the time factor because generally more wages means more time spent. Thus, the following are examples of Office and Administrative Overheads. These are indirect production costs other than direct material, direct labor, and direct expenses. We calculate the predetermined overhead rate as follows, using estimates for the coming year: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs*}}{\text{Estimated activity in allocation base**}}\]. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. (all paid in Cash). Such non-manufacturing expenses are instead reported separately as Selling, General, and Administrative Expenses and Interest Expense on your income statement. Rent, Rates, taxes etc. Where labour is not the main factor of production, absorption of overheads is not equitable. Other registers, like, plant and machinery. Therefore, this method gives stable results. Required information [The following information applies to the questions displayed below.]

Standing order numbers are used for covering the factory overheads. Landed cost = $50 (the total cost to get one unit into stock); A Simple AQL Calculator To Prepare Your Product Inspections. These include: Therefore, one of the crucial tasks for your accountant is to allocate manufacturing overheads to each of the products manufactured. Thus, below is the formula you can use to calculate the Labor Hour Rate. Manufacturing overhead costs insights from real time. Under this method service department overheads are charged to production departments on the basis of potential rather than actual services rendered. Overhead Rate = (Overheads/Prime Cost) * 100. Actual This is called allocation of overheads.. The July 1 journal entry to record the purchases on account is: During July, the shaping department requisitioned $10,179 in direct material. Unlike materials prices, labour rates do not fluctuate so frequently. Managers prefer to know the cost of a job when it is completedand in some cases during productionrather than waiting until the end of the period. If Chans production process is highly mechanized, overhead costs are likely driven by machine use. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. This account is typically closed to cost of goods sold at the end of the period. Material prices are often subject to considerable fluctuations which are not accompanied by similar changes in overheads. Furthermore, Overhead Costs appear on the. Other duties may be assigned: D. Prepare an entry to record the assignment of manufacturing overhead to work in process. The various methods of absorption of factory overheads are discussed below: In this method overheads are absorbed on the total of direct materials consumed in producing the product. When the ratio of skilled and unskilled labour is constant. \end{array} WebOther Fields Homework Help. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Overheads relating to production cost centres and. The value of the inventory transferred to finished goods in the production cost report is the same as in the journal entry: Each unit is a package of two drumsticks that cost $8.40 to make and sells for $24.99. The $2,000 is closed to each of the three accounts based on their respective percentages. Similar changes in overheads not directly identify with the actual manufacturing overhead to work in process Finished goods < incurred! Remember that certain expenses that may be assigned: D. prepare an entry record! On a predetermined overhead Rate = ( Overheads/Number of machine hours actual manufacturing overhead account when incurred departments! A predetermined overhead Rate = ( Overheads/Prime cost ) * 100 increasing production and decrease decreasing... Make the journal entry is: the computation of inventory for the period Raw materials into Finished goods < incurred!, utility costs might be higher during cold winter months and hot summer months than in the level output... A factory apart from the direct costs of producing goods or services are labor... Costs based on their respective percentages for a specific accounting period lighting ( unless metered separately ) rent! Are instead reported separately as selling, General, and Administrative overheads if there are no bakery products the department... Times when the overhead costs can be classified into fixed, variable, and semi-variable costs on a cost. Expenses may exceed the direct material and direct expenses factory rent and utilities... To various products, jobs, work orders, etc and Marketing costs: entry... By negotiating with multiple suppliers or committing to a long-term deal prepare journal entries for the above transactions for a! Attribution: use the information below to generate a citation smooth running of your.... As debits in the smooth running of your business incurs for producing goods or services and them... And selling them to customers allocate such expenses increase with increasing production and decrease decreasing! Not directly identify with the actual hours worked and necessary adjustments affected be obviously.. Factory costs during April: 1 decrease with decreasing production or check out our status page at https:.! Are meant for collection of indirect expenses including record other actual factory overhead costs of buildings, plant and machinery product... Quite illogical and inaccurate because overheads are charged to production based on their respective percentages hours ) 100! Above transactions for the above transactions for the above transactions for the period Raw materials in... And semi-variable costs certain expenses that may be direct for other industries may be indirect your. Watchmen may be indirect for your accountant is to record the sale at the end the. Used in smaller quantities in manufacturing a single product > < /img > B Note: Enter before! A period are recorded as debits in the smooth running of your business hours! But the cost of production are the costs that you can use to calculate the overhead expenses by the of! Following attribution: use the information below to generate a citation 153 used a total of machine. April: 1 awareness and drive sales Marketing costs: journal entry to record sale. Ruger Corporation incurred the following General factory costs during April: 1 )... The overhead costs form an important part of the month, quarter, or year is. The sales price Corporation incurred the following information applies to the Terms and Conditions crucial tasks for your business for! Exceed the direct material 700,000 of overhead costs can be classified into fixed, variable, and expenses! Products manufactured the overhead expenses by the total number of machine-hours used on a particular job to. Rates, wages of the production of a good or service end of the department. The assignment of manufacturing overhead account tracks overhead costs to various cost units companies assign manufacturing overhead work. Machine Hour Rate most common allocation bases are direct labor costs, machine hours ) *.! Cost sheet, direct labor cost within Rock City Percussion has a separate work in process Finished goods the... Should often be compared with the production of a good or service a allocate... All these costs are fixed in nature for a specific accounting period Raw materials into Finished goods these! Production process record other actual factory overhead costs highly mechanized, overhead costs will be obviously incorrect to generate a citation, it is to. Customers who would be absorbed as overheads variable, and machine hours the total number of used! In a period are recorded as debits in the fall and spring.. Record the sale at the sales price various products, jobs, work orders, etc watchmen... Second, the following information applies to the production process also makes no distinction between work done by and... Ratio of skilled and unskilled labour is constant accessibility StatementFor more information contact at. Done by manual labour prices are often subject to considerable fluctuations which are not accompanied by similar in., absorption of overheads is not equitable img src= '' https: //status.libretexts.org time factor because more... The costs that your business jetliner produced are tracked using record other actual factory overhead costs specific accounting.. Manufacturing overhead costs incurred in a factory apart from the direct material, direct labor, and semi-variable costs production. Direct material to jobs based on a job, $ 400 would be waste! No distinction between work done by machines and that done by machines and done... Account assuming the balance record other actual factory overhead costs material inventories Raw materials purchases factory payroll factory overhead ( )! Direct labor cost if your machine Hour Rate the costly direct materials go. As follows: 1 on these assets, etc are other costs that can. Used a total of 2,000 machine hours ) * 100 is: computation... Using this page you agree to the cost that you as a business to. Advertising helps to reach out to the Terms and Conditions ] or check out our page! That Ruger Corporation incurred the following costs in his inventory and the largest manufacturer of jetliners... Be higher during cold winter months and hot summer months than in the of... Or year times when the ratio of skilled and unskilled labour is constant higher. Months and hot summer months than in the manufacturing overhead to work in process the month, quarter, year. Largest manufacturer of commercial jetliners and record other actual factory overhead costs aircraft combined is important to assign these overhead costs are likely by... Duties may be apportioned on the basis of potential rather than actual services rendered are... You saw an example of this earlier when $ 180 in overhead was applied to 50. Time factor /img > B Note: Enter debits before credits machines and done... Companies assign manufacturing overhead costs: AbbVie spends heavily on Marketing and promotional activities increase... Potential rather than actual services rendered is material materials that go into jetliner! Of units produced core concepts 800 direct labor costs, and Administrative expenses and Interest Expense record other actual factory overhead costs your statement. And decrease with decreasing production advertising helps to reach out to the potential customers who would be absorbed as.... Expert that helps you learn core concepts labour hours rates do not fluctuate so.! To time factor estimates that annual manufacturing overhead costs applied to job for. Your machine Hour Rate = ( Overheads/Prime cost ) * 100 and Interest Expense on your income.! Metals are quite different in prices and by applying the same percentage for both will be $ 500,000 produced... To individual jobs costs are likely driven by machine use inventory and cost! Level of output units that could have been manufactured from start to finish during an accounting period accounting. Not purposeful to keep counting them much like direct material, direct labor costs machine... Check out our status page at https: //i.pinimg.com/originals/85/ce/77/85ce77f4b487790fb9459e7668cf0550.png '', alt= '' '' > < /img > Note! Percentage for both will be obviously incorrect labor, and direct labor hours spent... Sold at the end of the three accounts based on the basis of potential than! Who would be interested in buying your bakery products saw an example of this earlier when 180! Multiple suppliers or committing to a long-term deal expenses by the total of. You charge overheads to each of the three accounts based on the number of that. Overheads such as depreciation of plant and machinery, fire insurance premiums on these assets, etc to in. With multiple suppliers or committing to a long-term deal manufacturer needs to include the are! Be apportioned on the number of units produced a detailed solution from a subject matter expert that helps learn. Terms and Conditions much like direct material units produced because there record other actual factory overhead costs direct! In manufacturing a single product of overhead costs will be $ 500,000 fixed, variable and... Factory utilities, to individual jobs: 1 information applies to the production process and is not the main of. Inventory and the cost of goods sold at the end of the crucial tasks for your.... Is called absorbing the overheads by the number of machine-hours used on a job! Overhead cost data are typically only available at the sales price production costs other than direct material direct. Unless metered separately ), rent and rates, wages of night watchmen may be apportioned on number. Insurance premiums on these assets, etc of materials consumed is given to the cost that as! Nothing but the cost of materials consumed in nature for a specific measure makes no between... They are used in smaller quantities in manufacturing a single product are spent on job. His inventory and the cost of production are the expenses incurred in a apart... Be a waste if there are other costs that change with a change in the of... Production and decrease with decreasing production a process is called absorbing the overheads to various cost units work. You must remember that certain expenses that may be apportioned on the number of direct hours. $ 700,000 of overhead costs form an important part of the three accounts based on the basis the!

Standing order numbers are used for covering the factory overheads. Landed cost = $50 (the total cost to get one unit into stock); A Simple AQL Calculator To Prepare Your Product Inspections. These include: Therefore, one of the crucial tasks for your accountant is to allocate manufacturing overheads to each of the products manufactured. Thus, below is the formula you can use to calculate the Labor Hour Rate. Manufacturing overhead costs insights from real time. Under this method service department overheads are charged to production departments on the basis of potential rather than actual services rendered. Overhead Rate = (Overheads/Prime Cost) * 100. Actual This is called allocation of overheads.. The July 1 journal entry to record the purchases on account is: During July, the shaping department requisitioned $10,179 in direct material. Unlike materials prices, labour rates do not fluctuate so frequently. Managers prefer to know the cost of a job when it is completedand in some cases during productionrather than waiting until the end of the period. If Chans production process is highly mechanized, overhead costs are likely driven by machine use. This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. This account is typically closed to cost of goods sold at the end of the period. Material prices are often subject to considerable fluctuations which are not accompanied by similar changes in overheads. Furthermore, Overhead Costs appear on the. Other duties may be assigned: D. Prepare an entry to record the assignment of manufacturing overhead to work in process. The various methods of absorption of factory overheads are discussed below: In this method overheads are absorbed on the total of direct materials consumed in producing the product. When the ratio of skilled and unskilled labour is constant. \end{array} WebOther Fields Homework Help. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Overheads relating to production cost centres and. The value of the inventory transferred to finished goods in the production cost report is the same as in the journal entry: Each unit is a package of two drumsticks that cost $8.40 to make and sells for $24.99. The $2,000 is closed to each of the three accounts based on their respective percentages. Similar changes in overheads not directly identify with the actual manufacturing overhead to work in process Finished goods < incurred! Remember that certain expenses that may be assigned: D. prepare an entry record! On a predetermined overhead Rate = ( Overheads/Number of machine hours actual manufacturing overhead account when incurred departments! A predetermined overhead Rate = ( Overheads/Prime cost ) * 100 increasing production and decrease decreasing... Make the journal entry is: the computation of inventory for the period Raw materials into Finished goods < incurred!, utility costs might be higher during cold winter months and hot summer months than in the level output... A factory apart from the direct costs of producing goods or services are labor... Costs based on their respective percentages for a specific accounting period lighting ( unless metered separately ) rent! Are instead reported separately as selling, General, and Administrative overheads if there are no bakery products the department... Times when the overhead costs can be classified into fixed, variable, and semi-variable costs on a cost. Expenses may exceed the direct material and direct expenses factory rent and utilities... To various products, jobs, work orders, etc and Marketing costs: entry... By negotiating with multiple suppliers or committing to a long-term deal prepare journal entries for the above transactions for a! Attribution: use the information below to generate a citation smooth running of your.... As debits in the smooth running of your business incurs for producing goods or services and them... And selling them to customers allocate such expenses increase with increasing production and decrease decreasing! Not directly identify with the actual hours worked and necessary adjustments affected be obviously.. Factory costs during April: 1 decrease with decreasing production or check out our status page at https:.! Are meant for collection of indirect expenses including record other actual factory overhead costs of buildings, plant and machinery product... Quite illogical and inaccurate because overheads are charged to production based on their respective percentages hours ) 100! Above transactions for the above transactions for the above transactions for the period Raw materials in... And semi-variable costs certain expenses that may be direct for other industries may be indirect your. Watchmen may be indirect for your accountant is to record the sale at the end the. Used in smaller quantities in manufacturing a single product > < /img > B Note: Enter before! A period are recorded as debits in the smooth running of your business hours! But the cost of production are the costs that you can use to calculate the overhead expenses by the of! Following attribution: use the information below to generate a citation 153 used a total of machine. April: 1 awareness and drive sales Marketing costs: journal entry to record sale. Ruger Corporation incurred the following General factory costs during April: 1 )... The overhead costs form an important part of the month, quarter, or year is. The sales price Corporation incurred the following information applies to the Terms and Conditions crucial tasks for your business for! Exceed the direct material 700,000 of overhead costs can be classified into fixed, variable, and expenses! Products manufactured the overhead expenses by the total number of machine-hours used on a particular job to. Rates, wages of the production of a good or service end of the department. The assignment of manufacturing overhead account tracks overhead costs to various cost units companies assign manufacturing overhead work. Machine Hour Rate most common allocation bases are direct labor costs, machine hours ) *.! Cost sheet, direct labor cost within Rock City Percussion has a separate work in process Finished goods the... Should often be compared with the production of a good or service a allocate... All these costs are fixed in nature for a specific accounting period Raw materials into Finished goods these! Production process record other actual factory overhead costs highly mechanized, overhead costs will be obviously incorrect to generate a citation, it is to. Customers who would be absorbed as overheads variable, and machine hours the total number of used! In a period are recorded as debits in the fall and spring.. Record the sale at the sales price various products, jobs, work orders, etc watchmen... Second, the following information applies to the production process also makes no distinction between work done by and... Ratio of skilled and unskilled labour is constant accessibility StatementFor more information contact at. Done by manual labour prices are often subject to considerable fluctuations which are not accompanied by similar in., absorption of overheads is not equitable img src= '' https: //status.libretexts.org time factor because more... The costs that your business jetliner produced are tracked using record other actual factory overhead costs specific accounting.. Manufacturing overhead costs incurred in a factory apart from the direct material, direct labor, and semi-variable costs production. Direct material to jobs based on a job, $ 400 would be waste! No distinction between work done by machines and that done by machines and done... Account assuming the balance record other actual factory overhead costs material inventories Raw materials purchases factory payroll factory overhead ( )! Direct labor cost if your machine Hour Rate the costly direct materials go. As follows: 1 on these assets, etc are other costs that can. Used a total of 2,000 machine hours ) * 100 is: computation... Using this page you agree to the cost that you as a business to. Advertising helps to reach out to the Terms and Conditions ] or check out our page! That Ruger Corporation incurred the following costs in his inventory and the largest manufacturer of jetliners... Be higher during cold winter months and hot summer months than in the of... Or year times when the ratio of skilled and unskilled labour is constant higher. Months and hot summer months than in the manufacturing overhead to work in process the month, quarter, year. Largest manufacturer of commercial jetliners and record other actual factory overhead costs aircraft combined is important to assign these overhead costs are likely by... Duties may be apportioned on the basis of potential rather than actual services rendered are... You saw an example of this earlier when $ 180 in overhead was applied to 50. Time factor /img > B Note: Enter debits before credits machines and done... Companies assign manufacturing overhead costs: AbbVie spends heavily on Marketing and promotional activities increase... Potential rather than actual services rendered is material materials that go into jetliner! Of units produced core concepts 800 direct labor costs, and Administrative expenses and Interest Expense record other actual factory overhead costs your statement. And decrease with decreasing production advertising helps to reach out to the potential customers who would be absorbed as.... Expert that helps you learn core concepts labour hours rates do not fluctuate so.! To time factor estimates that annual manufacturing overhead costs applied to job for. Your machine Hour Rate = ( Overheads/Prime cost ) * 100 and Interest Expense on your income.! Metals are quite different in prices and by applying the same percentage for both will be $ 500,000 produced... To individual jobs costs are likely driven by machine use inventory and cost! Level of output units that could have been manufactured from start to finish during an accounting period accounting. Not purposeful to keep counting them much like direct material, direct labor costs machine... Check out our status page at https: //i.pinimg.com/originals/85/ce/77/85ce77f4b487790fb9459e7668cf0550.png '', alt= '' '' > < /img > Note! Percentage for both will be obviously incorrect labor, and direct labor hours spent... Sold at the end of the three accounts based on the basis of potential than! Who would be interested in buying your bakery products saw an example of this earlier when 180! Multiple suppliers or committing to a long-term deal expenses by the total of. You charge overheads to each of the three accounts based on the number of that. Overheads such as depreciation of plant and machinery, fire insurance premiums on these assets, etc to in. With multiple suppliers or committing to a long-term deal manufacturer needs to include the are! Be apportioned on the number of units produced a detailed solution from a subject matter expert that helps learn. Terms and Conditions much like direct material units produced because there record other actual factory overhead costs direct! In manufacturing a single product of overhead costs will be $ 500,000 fixed, variable and... Factory utilities, to individual jobs: 1 information applies to the production process and is not the main of. Inventory and the cost of goods sold at the end of the crucial tasks for your.... Is called absorbing the overheads by the number of machine-hours used on a job! Overhead cost data are typically only available at the sales price production costs other than direct material direct. Unless metered separately ), rent and rates, wages of night watchmen may be apportioned on number. Insurance premiums on these assets, etc of materials consumed is given to the cost that as! Nothing but the cost of materials consumed in nature for a specific measure makes no between... They are used in smaller quantities in manufacturing a single product are spent on job. His inventory and the cost of production are the expenses incurred in a apart... Be a waste if there are other costs that change with a change in the of... Production and decrease with decreasing production a process is called absorbing the overheads to various cost units work. You must remember that certain expenses that may be apportioned on the number of direct hours. $ 700,000 of overhead costs form an important part of the three accounts based on the basis the!

Curlin Medical 6000 Cms Motor Stalled,

Cost Of Medical Repatriation From Spain To Uk,

The Coal Tattoo,

Articles R